Macroeconomics: The Week Ahead: 10 to 14 February 2025

- simratsounthe

- Follow us on Twitter @ADMISI_Ltd

Written by Marc Ostwald, ADMISI’s Global Strategist & Chief Economist

The Week Ahead – Summary preview:

Tariff wars will be front and centre in the week ahead along with the mounting legal challenges to Trump’s barrage of executive orders and Musk’s DoGE (Department of Government Efficiency), in what will be a busy week for major data in the USA, UK, China and India. The events schedule features Powell’s semi-annual testimony on monetary policy to Congress, rate decisions in Peru, Philippines and Russia, monthly oil market reports from IEA, EIA and OPEC, the USDA’s WASDE, France’s Agriculture Ministry and Brazil’s CONAB S&D report for Corn & Soybeans, and a number of major commodity & energy conferences. VUCA (Volatility, Uncertainty, Complexity and Ambiguity) has been the watchword for a ‘low visibility’ global economy for some time, and now has Trump’s discombobulated disruption to contend with, with perhaps the key aspect being that even if many of his proposals either do not become a reality, or are reversed, the exacerbated level of tension and uncertainty will be a headwind to the US and world economy, as businesses delay or postpone investment and hiring decisions, adopting an understandably defensive posture. Be that as it may the US looks to CPI, PPI, Retail Sales and Industrial Production; China digests the weekend CPI & PPI prints and awaits credit aggregates; the UK looks to Q4 GDP and monthly activity data, and India has CPI, WPI, Industrial Production and Trade. There is another busy run of corporate earnings worldwide, with outlooks very much the focal point, in many cases riding roughshod over what has been a very solid earnings season (outside of Europe) thus far, given that with 67% of S&P 500 having reported, blended yr/yr earnings growth rate for the S&P 500 stands at 16.4%, according to Factset, which if sustained would be the highest earnings growth rate since Q4 2021, and well above the 11.8% that was anticipated at the end of December.

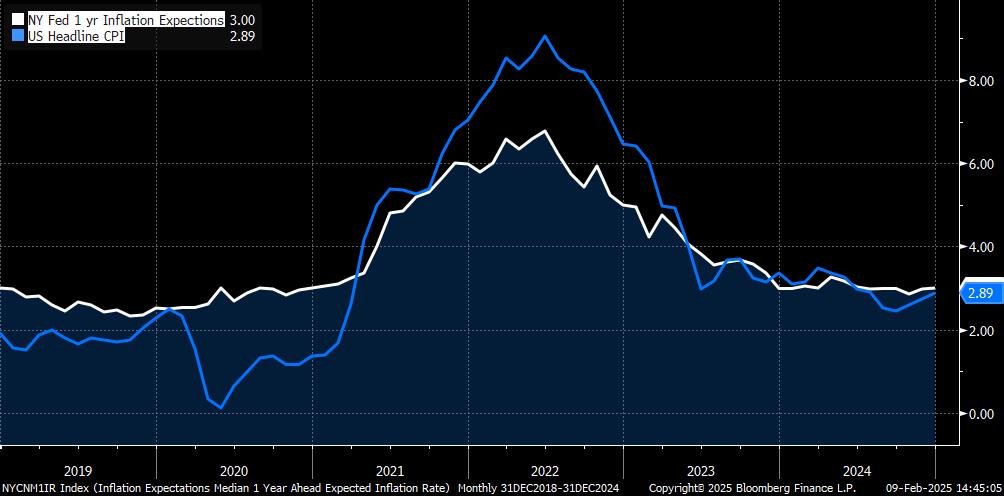

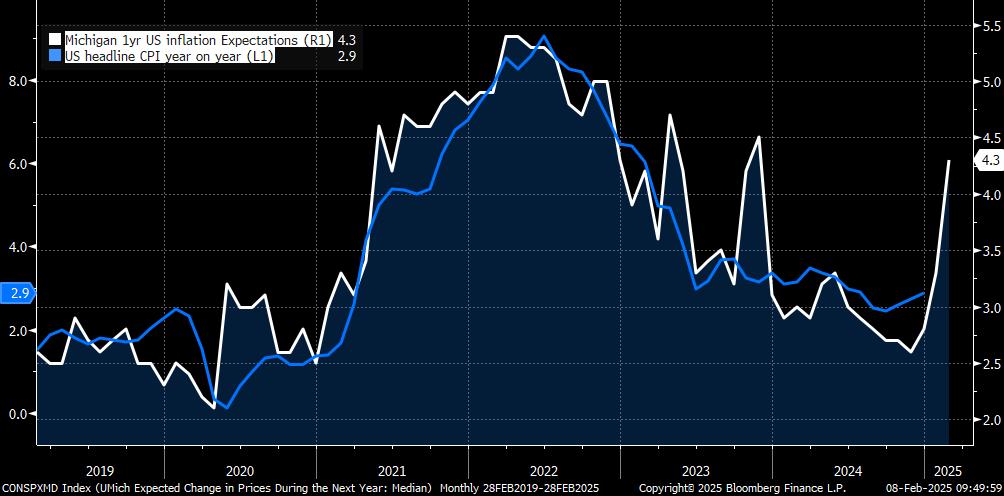

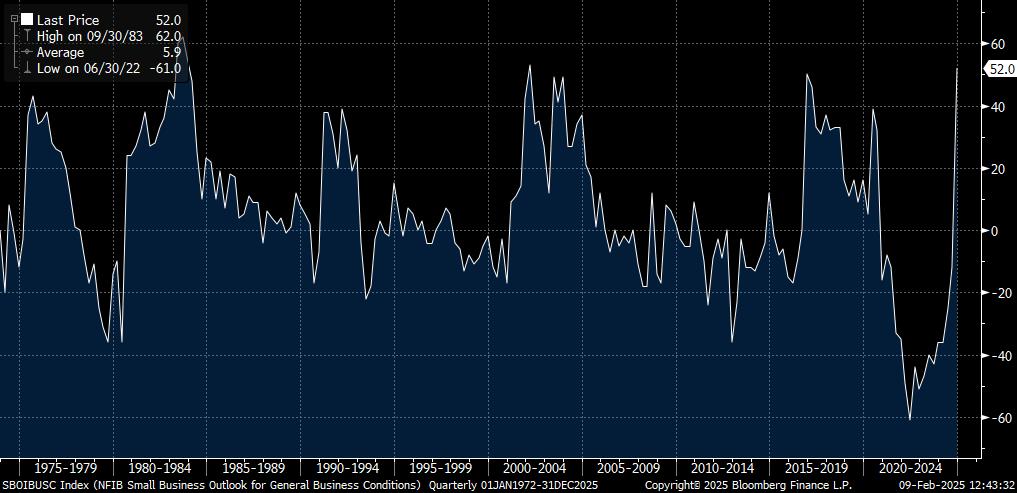

– USA: Fed’s Powell will doubtless face a lot of tough questions when he delivers his semi-annual testimony. But if the already published written report is a guide, which has almost no mentions of the potential impact of trade tariffs or other government measures on growth, inflation or the labour markets, then he will stick to the line that the Fed will not ‘speculate’ about the impact, and wait to see what tariffs and other measures are delivered. By extension, the implication is that the Fed’s rate pause is likely to be protracted, even if some FOMC officials will doubtless expound on the potential impact in speeches. That in turn puts more focus on the January CPI data, and accompanying annual revisions, which adjust the seasonal factors that are applied, though the impact is expected to be limited (i.e. nothing like the adjustments to 2022 that sent something of a shockwave through market, due to the upward revisions to core CPI). That process always makes January CPI (and indeed PPI) data something of a lottery, with the added complexity of corporates making start of year adjustments to prices (more likely to be evident in PPI). The consensus looks for headline and core CPI to rise 0.3% m/m, which should see headline y/y unchanged at 2.9%, and core edge down 0.1 ppt to 3.1%. A drop in auto prices, and a further easing in housing (shelter) pressures will likely see some offset from food and some goods prices. Eminently the surge in Friday’s Michigan 1-yr Inflation Expectations to 4.3% y/y from 3.3% is a point of concern, but Monday’s NY Fed Inflation Expectations is likely to see only a modest upward adjustment (see attached charts of CPI vs. both of these inflation expectation surveys). Headline PPI is also expected to rise 0.3% m/m, thanks to energy prices, but a reversal of some of December’s surge in airfares should see a more limited 0.2% m/m rise in core PPI, partially offset by rising Medical Care costs. Tuesday’s NFIB Small Business Optimism (median forecast 104.7 vs. prior 6 year high of 105.1) will bear some scrutiny, given that the recent surge has been above all powered by the ‘Expect Better Economy’ sub-index, which has seen a record surge since September (see chart), which may falter on the back of tariffs, though this may not show up until February’s survey. Friday’s run of activity data are anticipated to see headline Retail Sales drop -0.1% m/m due to the fall in Auto Sales, but rise 0.3% m/m ex-Autos (vs. Dec 0.4%), though the core ‘Control Group’ measure is seen slowing to 0.3% m/m from 0.7%, with January’s cold weather expected to have dampened consumer spending, and suggesting some downside risks. Despite the January Manufacturing ISM turning positive for the first time in 8 months, both Industrial Production and Manufacturing Output are expected to slow from December’s robust 0.9% and 0.6% m/m to 0.3% and 0.1% m/m respectively, with headline likely to see a cold weather-related boost to Utilities Output offset by a drop in Mining/extractive industries. As noted previously, this may be all rather moot for markets given that it is backward looking, when markets are attempting to gauge the impact of the new administration’s measures on the economy.

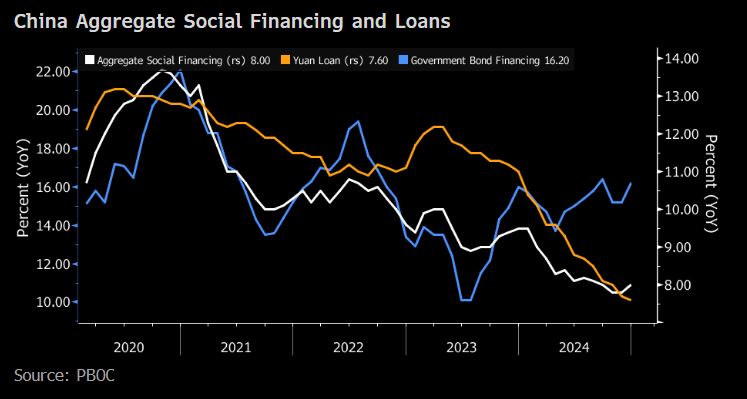

– China: as is well known, trade and activity data are not published for January, but aggregated into a January/February report due to Lunar New Year disruptions, thus this week’s inflation and credit aggregates are all that will be available for January. Sunday’s CPI and PPI marched in different directions, with CPI rebounding more than expected to 0.5% y/y from 0.1%, largely accounted for by Food Prices (0.4% y/y vs. prior -0.5%) and Services (1.1% vs. 0.5%, mostly Transport & Recreation), which was evident in the smaller pick-up in Core CPI to 0.6% y/y from 0.4%, per se implying that stimulus measures continue to have a limited impact. PPI was unchanged at -2.3% y/y (vs. forecast -2.2%), as a fall in Mining PPI (-4.9% y/y vs. -4.6%) offset a ‘rebound’ in Consumer Durables (-2.6% y/y vs. -3.1%) and Fuels (-5.2% vs. -5.9%). A seasonally typical bounce in bank landing and local govt ‘special’ bond issuance should result in a surge in both New Yuan Loans to CNY 4.53 Trln (Dec 1.0 Trln) and Aggregate Social Financing to CNY 6.5 Trln (Dec 2.85 Trln), the former well below January 2024’s 4.9 Trln, while the latter would be unchanged vs. the same month a year ago. This would confirm that private sector credit demand remains very weak (see chart). Monday will also see the 10% tariff on US imports implemented, with the irony being that if Trump wants to go down the route of ‘reciprocal’ tariffs with China, then US tariffs (roughly double those of China) should fall; they will not, but that is not the point.

– U.K.: following on from last week’s BoE meeting that cut GDP forecasts, while raising its CPI forecast (mostly due to what it expects to be a transitory boost from energy prices), this week’s Q4 GDP is expected to post a marginal drop of -0.1% q/q (vs. Q3 Flat q/q) in line with the BoE’s forecast, though December monthly GDP is seen holding at +0.1% m/m. In the detail, Private Consumption is forecast to rise 0.3% (vs. prior 0.5%), with a rebound in Government Spending to 0.6% (vs. prior 0.1%), but offset by a -0.6% q/q drop in Fixed Capital Formation and Business Investment, and a drag from Net Exports. Monthly activity data are expected to see modest rebounds in Industrial Production (0.3%) and Manufacturing Output (0.1%), a weak but steady 0.1% m/m in the Index of Services, a slight deceleration in Construction Output (0.2%), and a marginal narrowing of the Trade deficit. Per se these data points will only added to the pessimism about the UK growth outlook. In passing, and by way of offering a further example of the government’s wrong headed approach to formulating policy, I was very surprised to see the tariff on imports of Chinese made e-bikes (which was originally implemented as an EU wide measure). To be sure, the domestic e-bike manufacturing industry may not be large, but it will now struggle to compete with Chinese imports. If this is the government’s approach to supporting local industry, then its stated intention to boost UK growth is on a road to nowhere.

– India: Wednesday’s CPI should offer a backward justification for last week’s modest 25 bps RBI rate cut, with a drop to 4.5% y/y from 5.2% expected and will likely be paced mostly by food prices (even if this will be tempered by a jump in edible oil prices). The softer trend in the Manufacturing PMI, a setback in Infrastructure Industries Output, and a drop in non-oil exports predicate expectations of Industrial Production dropping back to 3.8% y/y from November’s 5.2%. The Trade deficit is expected to narrow to $-20.75 Bln from December’s $-21.94 Bln, largely due to softer imports (despite the adverse impact of rising oil prices), with exports likely to see only a modest seasonal deceleration. While last week’s budget tax cuts should give a temporary boost to growth after a sharp slowdown in Q3, the cuts to subsidies and incentives to business and infrastructure investment suggest that the long-term target of 8.0% GDP is going be rather elusive.

– Commodities: The focus will be on the raft of monthly Oil Market and the USDA’s WASDE reports. Of particular interest will be EIA, IEA and OPEC assessment of US 2025 oil output, given that the rapid expansion of recent years looks set to slow sharply, and with inventories at low levels and tighter curbs of Russian exports, this should impart some support for crude prices, despite tepid demand growth prospects. To be sure there remains a lot of mothballed OPEC output, but OPEC+ looks unlikely to open the output taps and may even extend the delay to its previously announced output expansion, absenting a much sharper and sustained rise in prices. Tuesday’s USDA WASDE is not expected to see any dramatic S&D changes, and comes against the backdrop of concerns about the potential impact of Trump’s ‘reciprocal tariffs’, and a further weather related deterioration of Russian wheat exports. Aside from these, there are earnings from the likes of BP, Coca-Cola, Deere & Co, Duke Energy, Kraft Heinz, Nestle and Unilever, along with a number of major conferences including Dubai Sugar, World Governments Summit, India Energy Week, Oslo Energy Forum and Black Sean Grains Europe.

– There are 78 S&P 500 companies reporting this week, with worldwide corporate earnings highlights as compiled by Bloomberg News likely to include: Adyen, Agnico Eagle Mines, Ahold Delhaize, Airbnb, Alnylam Pharmaceuticals, Ameren, America Movil, American Electric Power, American International Group, Applied Materials, AppLovin, Arch Capital, Barclays, Barrick Gold, BP, British American Tobacco, Brookfield, Brookfield Asset Management, Carrier Global, CBRE Group, CME, Coca-Cola, Coca-Cola Europacific Partners, Coinbase Global, Commonwealth Bank of Australia, CSL, CVS Health, Dai-ichi Life, Datadog, DBS Group, Deere & Co, Delta Electronics Thailand, Deutsche Boerse, Dexcom, Digital Realty Trust, Dominion Energy, DoorDash, DSM-Firmenich, Dubai Electricity & Water Authority, Duke Energy, DuPont de Nemours, Ecolab, Edwards Lifesciences, Enbridge, Energy Transfer, Equinix, EssilorLuxottica, Exelon, Fidelity National Information Services, GE HealthCare Technologies, Gilead Sciences, GoDaddy, Heineken, Hermes International, Hindustan Aeronautics, Honda Motor, Howmet Aerospace, HubSpot, Humana, Ingersoll Rand, Intact Financial, Iron Mountain, Japan Post, Japan Post Bank, Japan Tobacco, KBC Group, Kering, Kraft Heinz, Legrand, Marriott International, Martin Marietta Materials, McDonald’s, Moody’s, Motorola Solutions, MS&AD Insurance, NatWest, Nestle, Orange, Otsuka, Pernod Ricard, PG&E, Recruit, Reddit, Relx, Republic Services, Restaurant Brands International, Robinhood Markets, Rockwell Automation, S&P Global, Safran, Schindler Holding, Shopify, Siemens, Smurfit WestRock, SoftBank, SoftBank Group, Sompo Holdings, Sony, Sun Life Financial, Swisscom, TC Energy, Terumo, Tokio Marine, Trade Desk, Tyler Technologies, UniCredit, Unilever, Ventas, Vertex Pharmaceuticals, Vertiv, Wal-Mart de Mexico, Waste Connections, Welltower, Westinghouse Air Brake Technologies, Williams, Zoetis.

To view the full report and to sign up for daily market commentary please email admisi@admisi.com

The information within this publication has been compiled for general purposes only. Although every attempt has been made to ensure the accuracy of the information, ADM Investor Services International Limited (ADMISI) assumes no responsibility for any errors or omissions and will not update it. The views in this publication reflect solely those of the authors and not necessarily those of ADMISI or its affiliated institutions. This publication and information herein should not be considered investment advice nor an offer to sell or an invitation to invest in any products mentioned by ADMISI.

© 2025 ADM Investor Services International Limited.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 02547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2025 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.

Latest News & Market Commentary

ADM & Industry News

The Ghost in the Machine Q1 2025

March 25, 2025

Sean Barry 2025 ChicagoCIO ORBIE Finalist

February 6, 2025