TODAY—DELIVERABLE STOCKS—

Overnight trade has SRW Wheat down roughly 9 cents, HRW down 6; HRS Wheat down 5, Corn is down 11 cents; Soybeans down 25; Soymeal down $9.00, and Soyoil unchanged.

Chinese Ag futures (May) settled down 91 yuan in soybeans, down 27 in Corn, down 106 in Soymeal, down 96 in Soyoil, and down 96 in Palm Oil.

Malaysian palm oil prices were down 42 ringgit at 3,225 (basis April) on shrinking Jan exports.

In Brazil, conditions will still be mostly good for crops, with northeastern areas too dry, especially northeastern Minas Gerais through Bahia, and a few pockets that may be a little too wet in the south such as Santa Catarina and Parana.

Warm to hot temperatures and a lack of meaningful rain in Argentina through Friday will lead to some increase of crop stress in the driest pockets of the region such as southeastern Entre Rios and some far west-central production areas. Rain will then increase this weekend and occur through next Tuesday. This rain will be important for bringing relief from this week’s dryness. The GFS model run showed no significant change with the advertised rain event; though, the model is notably wetter in central and southeastern Argentina compared to today’s midday European Model run.

The player sheet had funds net sellers of 2,000 SRW Wheat; sold 25,000 Corn; net sold 20,000 Soybeans; sold 5,000 lots of Soymeal, and; net even in Soyoil.

We estimate Managed Money net long 21,000 contracts of SRW Wheat; long 389,000 Corn; net long 144,000 Soybeans; net long 79,000 lots of Soymeal, and; long 85,000 Soyoil.

Preliminary Open Interest saw SRW Wheat futures up roughly 6,500 contracts; HRW Wheat down 2,800; Corn down 8,400; Soybeans down 4,500 contracts; Soymeal down 4,500 lots, and; Soyoil down 820.

There were no changes in registrations—Registrations total 49 contracts for SRW Wheat; ZERO Oats; Corn ZERO; Soybeans 169; Soyoil 1,289 lots; Soymeal 175; Rice 732; HRW Wheat 91, and; HRS 1,023.

Tender Activity—Philippines seen passing on 100,000t optional-origin feed wheat—Taiwan seeks 65,000t U.S. corn—

Yesterday’s U.S. weekly export inspections had (for the week ending Jan 14)

—Wheat exports running 3% behind a year ago (down 1% last week) with the USDA currently forecasting a 2% increase on the year

—Corn 82% ahead of a year ago (up 78% last week) with the USDA up 43% for the season

–Soybeans are up 78% on the year (up 78% last week) with the USDA having a 33% increase forecasted on the year

The U.S. Environmental Protection Agency (EPA) on Tuesday granted three waivers to oil refiners that exempt them from U.S. biofuel blending obligations, a last-minute move before President Donald Trump leaves office on Wednesday. The agency granted two waivers for the 2019 compliance year and one waiver for the 2018 compliance year. The announcement followed four years of controversy around the waiver program under the Trump administration, but left many questions unresolved

CME Raises Soybean Futures Margins For March 2021 – Reuters

- CME RAISES SOYBEAN FUTURES (S) MAINTENANCE MARGINS BY 7.3% TO $2,950 PER CONTRACT FROM $2,750 FOR MARCH 2021

- SAYS INITIAL MARGIN RATES ARE 110% OF THESE LEVELS

- SAYS RATES WILL BE EFFECTIVE AFTER THE CLOSE OF BUSINESS ON JAN. 20, 2021

Tyson Foods Inc agreed to settle price-fixing litigation by consumers who accused it of illegally conspiring to inflate prices in the $65 billion chicken industry.

The settlement with so-called “end-user” consumers was disclosed in a Tuesday filing in Chicago federal court. It came eight days after Tyson agreed to settle related antitrust claims by purchasers who bought chickens directly from the Springdale, Arkansas-based company.

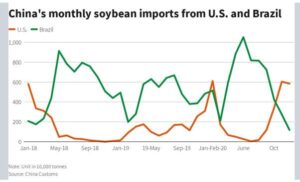

China’s soybean imports from the United States in 2020 rose by 52.8% from a year earlier, customs data showed, though the stepped up buying likely fell short of what was needed to fulfil last year’s trade deal between the countries. They last year brought in 25.89 million tonnes of the oilseed from the U.S., its second-largest supplier, up from 16.94 million tonnes in 2019. Chinese buyers stepped up U.S. farm produce purchases to meet China’s pledge to buy $36.5 million in farm goods in 2020 under the Phase 1 trade deal signed with Washington last January. Soybean purchases were expected to make up half of the monetary target and estimates showed China needed to import about 40 million tonnes to make good on the deal.

Shipments from Brazil, China’s biggest soybean supplier, were 1.18 million tonnes in December, down from 4.83 million a year earlier, as shipments dwindled after abundant arrivals in earlier months. For 2020, Brazilian shipments were 64.28 million tonnes, up 11.46% from 2019’s 57.67 million tonnes, and almost two-thirds of total annual imports.

China’s soybean imports in 2020 were a record 100.33 million tonnes. China is expected to import even more soybeans in the new year on strong demand and crush margins. Crushers in Rizhao in Shandong province, a major processing hub for the beans, can make about 237 yuan ($36.64) from every tonne of beans crushed, about two times higher than a year ago.

Agro-export companies in Argentina are concerned about independent truck owners who are blocking roads as part of a protest over what drivers say are exorbitant taxes and highway tolls, the CIARA-CEC export industry chamber said on Tuesday. Owners and drivers, grouped in the informal TUDA association (Transportistas Unidos de Argentina), began blocking highways over the weekend, making it hard for grains to reach port terminals. The protest adds uncertainty to a sector that was racked by several Argentine port workers’ strikes last month.

Ukrainian grain traders said on Tuesday they saw no grounds to restrict corn exports for the 2020/21 season, a move requested by animal feed and meat producers to avoid higher feed prices. Ukraine’s economy ministry and agricultural unions will decide on Jan. 25 whether to limit corn exports for the 2020/21 marketing season to 22 million tonnes. Domestic livestock and poultry producers’ associations last week asked the government to limit corn exports to that level to avoid a shortage of animal feed.

Euronext wheat ended little changed on Tuesday, pausing after an earlier 7-1/2 year high as traders awaited further indications on how a planned Russian export tax will affect global wheat trade. The market was also looking ahead to an import tender to be held by Algeria on Wednesday to see how the biggest buyer of European Union wheat would adjust to high prices and less availability. March milling wheat settled unchanged on the day at 235.75 euros ($285.75) a tonne. It earlier climbed to 240.25 euros, another highest front-month price since May 2013.

Japan’s usage of corn in animal feed rose to 48.9% in November, compared with 48.6% in the year-ago period, preliminary data from the Ministry of Agriculture, Forestry and Fisheries showed.

Exports of Malaysian palm oil products for Jan. 1-20 fell 43.3 percent to 572,910 tonnes from 1,010,653 tonnes shipped during Dec. 1-20, cargo surveyor Societe Generale de Surveillance said.

Exports of Malaysian palm oil products for January 1 – 20 fell 43.1 percent to 607,900 tonnes from 1,067,670 tonnes shipped during December 1 – 20, cargo surveyor Intertek Testing Services said.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.