TODAY—WEEKLY EXPORT SALES–

Overnight trade has SRW Wheat roughly unchanged, HRW down 2; HRS Wheat down 1, Corn is down 1 cent; Soybeans up 18; Soymeal up $3.50, and Soyoil up 55 points.

Chinese Ag futures (May) settled up 10 yuan in soybeans, up 28 in Corn, up 16 in Soymeal, up 152 in Soyoil, and up 110 in Palm Oil.

Malaysian palm oil prices were up 133 ringgit at 3,784 (basis May) following rival oils, some strength in exports.

Net drying will continue across much of Argentina through next Wednesday. Pockets of increasing crop stress will continue the next seven days as a result of the dryness. Last evening’s GFS model was notably wetter in southern Argentina Mar. 9 – 11.

In Brazil, Mato Grosso through Minas Gerais will still be notably wet through Saturday leading to some more fieldwork delays; though, the zone of heaviest rain next week will shift to an area from Mato Grosso through Parana.

The player sheet had funds net buyers of 9,000 SRW Wheat; net bought 12,000 contracts of Corn; bought 10,000 Soybeans; bought 1,000 lots of Soymeal, and; bought 9,000 Soyoil.

We estimate Managed Money net long 40,000 contracts of SRW Wheat; long 393,000 Corn; net long 196,000 Soybeans; net long 71,000 lots of Soymeal, and; long 133,000 Soyoil.

Preliminary Open Interest saw SRW Wheat futures down roughly 565 contracts; HRW Wheat up 945; Corn down 49,700; Soybeans down 22,900 contracts; Soymeal down 1,800 lots, and; Soyoil down 8,400.

There were no changes in registrations—Registrations total 49 contracts for SRW Wheat; ZERO Oats; Corn ZERO; Soybeans 169; Soyoil 1,273 lots; Soymeal 175; Rice 732; HRW Wheat 91, and; HRS 1,023.

Tender Activity—Taiwan seeks 100,410 U.S. wheat—Japan bought 57,000t Australian wheat—Jordan bought 60,000t optional-origin wheat—Philippines passed on 145,000t optional-origin wheat–

U.S. Ethanol production for the week ended Feb 19 totaled 658,000 bls per day (down 27.8% vs a week ago, down 37.6% vs a year ago); Stocks were 22.8 mil bls (down 6.2% vs a week ago, down 7.8% vs a year ago); Corn use 66.5 mil bu vs 92.0 mil last week and 95.7 mil needed to meet USDA projections.

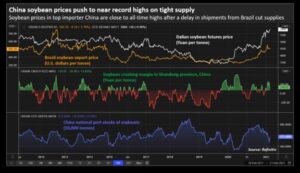

Hit by Brazil shipment delays, Chinese soybean crushers forced to shrink output

- Shortages of beans expected to last until at least mid-April

- China’s soybean, soymeal prices rally as cargoes get delayed

- Higher meal inventories to cushion impact of delayed cargoes

Chinese soybean crushers are expected to curtail operations sharply in the coming months due to harvest delays in top exporter Brazil, pushing up prices and likely leading to a rundown in inventories. The shortage will be widely felt and probably last till at least mid-April, said analysts, crushers and traders. Bean shipments from Brazil to southern China will be very limited in March. Supplies will be tight, said a manager with a major crusher in southern China. We originally planned to suspend operations for a couple of days but now we will have to extend that to two weeks as our cargo got delayed.

In spite of planting delays and then rains that disrupted harvesting of Brazil’s soybeans this year, the country will produce a record crop of almost 133 million tonnes in the 2020/2021 cycle, according to the average of forecasts in Reuters poll.

With second crop sowing delays now reaching historic levels, 2020/21 total Brazil corn production is tentatively kept at 105.2 [95-111] million tons. Total corn area is still seen at 18.9 million hectares, although the prospect of lower second crop corn area is rising, despite strong prices. The area estimate is now 0.8 million hectares below USDA’s World Agricultural Outlook Board (WAOB) figure from February, which assumes total corn sowings at 19.7 million hectares and national-level yield of 5.53 tons per hectare.

High vegetation densities throughout the main Pampas maintain 2020/21 Argentina corn production at 46.0 [42.0–48.9] million tons, despite continued warm/dry weather and resulting soil moisture depletion. Our current estimate puts planted area at 6.4 million hectares, slightly above 6.3 million hectares reported by Bolsa de Comercio in Buenos Aires, but below the Bolsa de Comercio in Rosario’s 7.1 million hectares. In February’s WASDE (09 February), USDA placed Argentina corn production at 47.5 million tons, unchanged from last update. Bolsa de Comercio in Buenos Aires and Bolsa de Comercio in Rosario currently forecast production at 46 and 48.5 million tons, respectively.

German pig and piglet prices increased again this week as markets recover from the impact of import bans on German pork and reduced slaughterhouse capacity, the association of German animal farmers VEZG said on Wednesday. German pig prices rose to 1.30 a kg slaughter weight from 1.21 euros last week. Prices had last week risen from 1.19 euros, roughly the level since November 2020 when markets were hit by widespread import bans on German pork after African swine fever (ASF) was found in the country and by reduced slaughterhouse capacity after coronavirus outbreaks.

As recent bouts of cold batter Southern wheat producing areas, 2021/22 Russia wheat production is tentatively maintained at 78.4 [68.5–91.0] million tons.

Despite colder than average recent temperatures, favorable snow cover and ample soil moisture levels maintain 2021/22 Ukraine wheat production at 26.7 [21.6-32.3] million tons, still 1.5% above our estimation for the 2020/21 season (26.3 million tons). Given healthy growth before overwintering, prospects for healthy emergence in spring remain positive.

Despite a potentially crippling recent cold blast impacting winter wheat areas, 2021/22 EU wheat production is kept at 152.6 [137.0–161.3] million tons (mmt). A well-hardened crop and beneficial snow cover in the areas that saw the worst cold maintains current yield expectations. Soft and durum wheat areas are still expected at 23.6 and 2.4 million hectares, respectively.

Front-month wheat and rapeseed futures on Euronext set new multi-year highs on Wednesday, as tightening short-term supplies and technical signals fuelled more buying. A rally in Chicago wheat, as forecasts of dry weather in part of the U.S. Plains added to recent concerns over frost damage, supported the gains in Paris wheat, while rapeseed was again buoyed by strength across oilseed and vegetable oil markets. March milling wheat settled 4.50 euros, or 1.9%, higher at 245.25 euros ($297.83) a tonne, after earlier rising to 246.25 euros, its highest front-month price since May 2013. The nearby position continued to be supported by market participants covering open positions in the run-up to the contract’s expiry. May ended 1.4% higher at 232.75 euros a tonne. It earlier climbed to a new one-month high at 233.75 euros after breaching resistance at 230 euros.

India is likely to harvest a record 109.24 million tonnes of wheat this year, the farm ministry said, further boosting stocks at government granaries that are fast running out of storage space due to more than a decade of bumper production. Wheat output in India, the world’s second biggest producer, is expected to go up by 1.3% in the crop year to June 2021, the Agriculture & Farmers Welfare Ministry said in its second crop forecast for 2020/21. Rice output is estimated to rise by 1.2% to 120.32 million tonnes.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.