SOYBEANS

Soybean futures ended lower. Increase supply of Argentina soymeal and talk that once US new crop soybeans will be used for crush, soybean and soymeal prices should drop. Malaysian palmoil prices are lower as stocks rise. This limits the upside in soyoil futures. Weekly US soybean export sales were 16 mil bu. Total commit is 945 vs 852 ly. USDA goal is 2,085 vs 2,145 ly with some looking at exports closer to 1,900. USDA will estimate US Sep 1 stocks on Sep 30. Trade should be close to 240 mil bu. July-Sep crush is est near 531mil bu vs 496 ly and exports 278 vs 117. Negative residual is guessed at 74 vs 91 ly. Tropical storm Hermine will be closely watched with one forecast estimating landfall near Louisiana and the other north Florida around Oct 1.

CORN

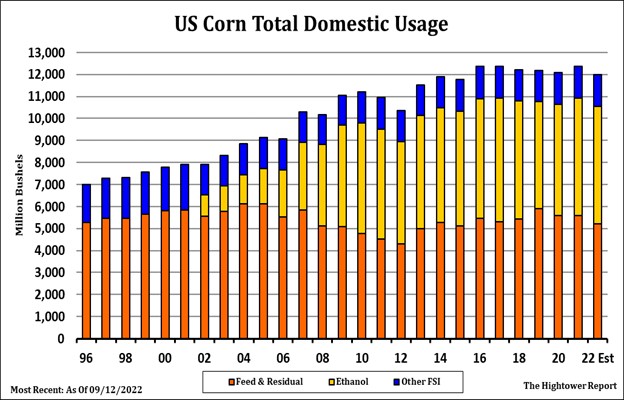

Corn futures managed a small gain in a relatively tight range. Corn futures, like many markets, are trying to find value with the war in Ukraine and possible Russian escalation and strong US domestic basis offering support. Approaching US harvest and slow US export sales may be offering equal resistance. Continued uptrend in USD offers resistance while bottoming action in Crude may also be offering equal support. There was some concern that drop in weekly US ethanol production could signal lower domestic travel as summer ends and school begins. Weekly US corn export sales were 7 mil bu. Total commit is 491 vs 981 ly. USDA goal is 2,275 vs 2,475 ly with some looking at exports closer to 2,000. USDA did announce 105 mt of US corn was sold to Mexico and 101.6 mmt to unknow. IGC lowered World corn crop to 1,168 mmt with US down to 354.2 vs 364.7 previous. Some feel US crop could drop further in October. USDA will estimate US Sep 1 stocks on Sep 30. Trade should be close to 1,500 mil bu vs 1,235 ly. July-Sep FSI is est near 1,696 mil bu vs 1,671 ly, feed and residual 637 vs 617 ly and exports 518 vs 594. Total July-Sep demand near 2,851 versus 2,883 last year.

WHEAT

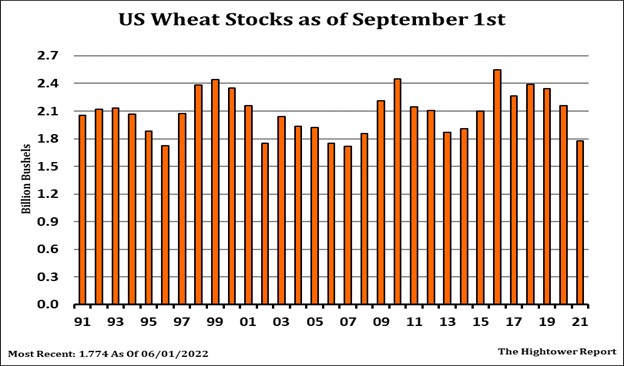

Wheat is wheat. Futures ended higher on concern over Black Sea exports. Volatility continues after US Fed raised rate 75 basis points. Fed Chairman pledged to increase rates until Inflation is down to 2 pct. This could drop domestic, global demand and push USD higher. ICG increased World wheat crop from 778 mmt to 792. They increased Russia to 100 mmt. Weekly US wheat export sales were 6 mil bu. Total commit is 382 vs 396 ly. Trade look for US Sep 1 wheat stocks near 1,375 mil bu vs 1,774 ly. Exports near 187 vs 237. Matif wheat closed near a 12-week high with the chart is turning increasingly positive. Some fundamentalist question tech pattern with majority of day trade moved by algorithm machines trading the latest headline. Still. WZ is near resistance and the 200 DMA near 9.28. Head and shoulders bottom suggest a test of 9.50 but futures are becoming overbought. KWZ has a similar pattern with 10.05 200 DMA next resistance. MWZ has initial resistance near 200 DMA at 10.10 then 100 DMA near 10.42.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.