SOYBEANS

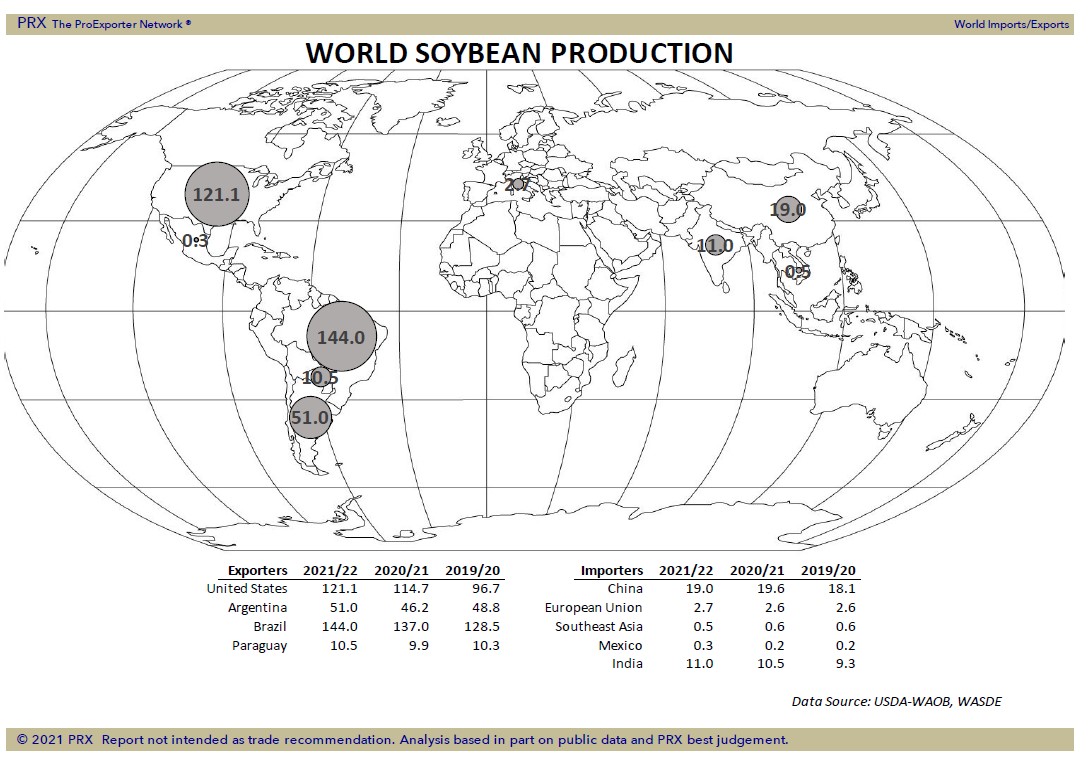

Soybeans traded higher on a lack of follow through selling. SX ended near 12.06. Initial resistance is near 12.11. Key will be if SX can trade back over the pre USDA bearish report high near 12.30. US Midwest is clearing. East Midwest harvest may have been slowed due to rains. Farmers still report harvest yields above early hopes and may be above USDA October yield. Trade est US Sep NOPA crush near 155 mil bu vs 159 in August and 161.5 ly. Board crush margins are making new highs on drop in soybeans and rally in soyoil. Soyoil is also back near 49 pct of crush. Talk that India is reducing vegoil import tariffs and higher rapeseed values is helping soyoil. There was talk that China was buying a few cargoes of US Feb soybeans and Brazil March. Deferred China Crush margins have turned positive, US weekly soybean exports sales are est near 600-1,400 mt vs 1,042 last week. US soybean export commit is only near 930 mil bu vs 1,490 last year. USDA goal is 2,090 vs 2,265 ly. Both Brazil and Argentina has seen good rains this week. USDA est their combined 2022 crop near 195 mmt vs 185 ly.

CORN

Corn futures ended higher. CZ had an inside day and closed near 5.16. Initial resistance is near 5.25. Key will be if there is enough buying to trade back over the pre USDA crop report high near 5.33. There was little new news. US Dollar was lower and Crude was higher. Most commodities did try to rebound from recent selloff. Some of the recent selling was linked to IMF report suggest supply chain disruptions and drop in global health would lower 2021 and 2022 growth. US Dollar is trading off one year high. Some feel increase US debt could weigh on the Dollar. There remain concern that a slower US economy and higher food and fuel prices could reduce consumer disposable income and reduce high cut beef demand and food demand. EU corn price have dropped due to talk of higher yields. Ukraine is the first country to est lower 2022 corn acres due to high cost of planting especially fertilizer and energy. Weekly US ethanol production was higher than last week and last year. Stocks were marginally lower than last week and last year. Margins remain positive. US crushers are trying to reach for more coverage but so far US farmer is a reluctant seller. Latest corn harvest yields in east have turned higher and near record. Some est US corn harvest now near 55 pct vs 41 last week. Weekly US corn export sales are est near 700-1,600 mt vs 1,265 last week. USDA goal is 2,500 mil bu vs 2,753 ly. Some feel final exports could be closer to 2,700.

WHEAT

Wheat futures managed to traded higher and ended near 7.24. KWZ is near 7.31. MWZ is near 9.60. Some of the bulls were surprised at the selloff in WZ from 7.40. USDA estimated a lower US 2021/22 Wheat carryout and for the first time in 8 years below 600 mil bu. USDA also lowered World wheat end stocks with exporters stocks to use ratio record low. Still some feel that futures had become overbought and due for a correction. IMF report of slower global 2021 and 2022 economy could have been the catalyst for some profit taking. WZ remains in an uptrend since the June, 2020 low. WZ had an inside day with initial resistance near 7.37. Bulls still feel fact US HRW export prices may be competitive in 2022 will support a new higher trend in prices. Some also fear La Nina could lower US and Russia 2022 wheat crops. Weekly US wheat export sales are est near 250-500 mt vs 333 last week. USDA goal is 875 mil bu vs 992 last year. USDA also est World trade near 199 mmt vs 200 last year and domestic feed a record 158 mmt vs 156 last year. World end stocks drop from 288 mmt last year to 277.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.