Soybeans, corn and wheat traded higher. Soymeal and soyoil were unchanged. US stocks were higher. Crude was higher. US Dollar was higher. Gold was lower. Meats were higher.

SOYBEANS

Soybean traded higher. Talk of persistent South America dry weather offered support. MG Brazil Sep 1- Nov 30 rainfall is the lowest in 40 years. Fact funds are long soybean suggest the market is vulnerable for setbacks if there is a change in South America weather. Some liquidation and rolling of open long December soymeal and soyoil positions before first notice weighed on soymeal and soyoil and dropped soybean board crush margins. Some feel that a tight US soybean balance sheet could suggest some rationing may have to be down to lower US crush. US soybean exports were near 74 mil bu. China shipped 51.0 mil bu. Cumulative 2020-21 US soybean exports are 897 vs 529 last year, up 368 mil bu. USDA is forecasting a 524 mil bu increase in 2020-21 US soybean exports with their current estimate of 2,200 mil bu, which appears low. Appears market needs some new China buying US soybeans to push over key resistance.

CORN

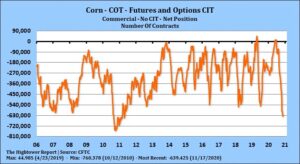

Corn futures traded higher. Meat futures also traded sharply higher. Corn futures were supported by talk of higher US exports and lower carryout There was 334 mt US corn announced to unknown. Some feel this could be either S Korea or China. US corn exports were near 33 mil bu. Cumulative 2020-21 US corn exports total 364 mil bu vs 221 mil bu last year, up 143 mil bu. USDA is projecting an 872 mil bu increase in 2020-21 US corn exports with their current guess of 2,650. Some feel final exports could reach 2,900. This could drop US carryout down closer to 1,550. Dalian corn futures were higher overnight. Dalian corn futures continue to make new highs. Managed funds are beginning to roll net long positions from the Dec to the March. This is widening spreads. Index funds are near record long corn. Commercials are near record net short corn futures. Dry weather in South America and Black Sea could drop corn crops there. There is also talk that both Russia and Ukraine feeders are asking their Government to limit corn exports.

WHEAT

Wheat futures traded higher. Wheat futures continue to trade mix fundamentals. Managed funds have reduced their net long in Chicago wheat. This due to low export demand. Weekly US wheat exports are 455 mil bu versus 454 last year. USDA goal is 975 versus 965 last year. Total US wheat export commit is tonnes is near 12.3 mmt versus 12.3 last year. USDA goals is 26.5 mmt versus 26.3 last year. USDA est World trade near 190.8 mmt versus 191.8 last year. USDA est Russia exports near 39.5 mmt versus 34.4 last year. Ukraine 17.5 versus 21.0 last year. EU exports 26.p versus 38.4 last year. Trade est US winter wheat crop ratings up 1 pct to 47 good/ex. Some feel WH may be in a 5.90-6.50 range until more is known about World 2021 supplies. There is some talk that HRW and HRS could be deliveries against Chicago.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.