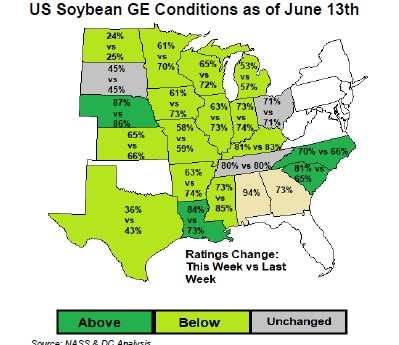

SOYBEANS

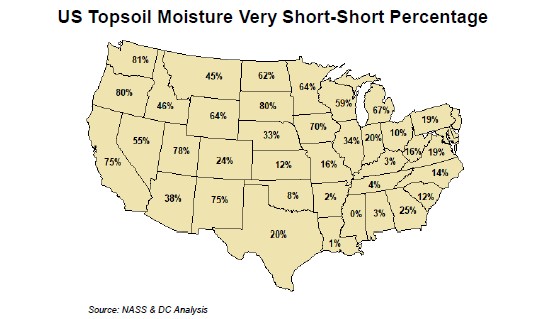

Soybeans traded lower. Despite one of the largest weekly drop in US weekly crop ratings the forecast of a needed rain early next week across the Midwest continues to weigh on prices. SN has dropped from 16.23 high and sliced through the 20 day moving average near 15.35 and the 50 day near 15.14 but has for now found support near 100 day near 14.47. SX dropped from a high near 14.80 below the 20 day near 13.98 and has found support near 13.60. USDA dropped US soybean rating to 62 pct G/E vs 67 last week and 72 last year. IA dropped to 61 from 73, IL dropped 10 to 63, MN dropped 9 to 61, SD is 45 with 5.7 mil acres and ND is 24 with 7.0 mil acres. One crop watcher est US 2021 soybean yield near 50.8 vs USDA 50.8 with planted acres near 88.0 vs USDA 87.6. Soyoil trying to find value after potential mis information on Biden and US biofuel policy and lower palmoil prices due to concern about lower demand.

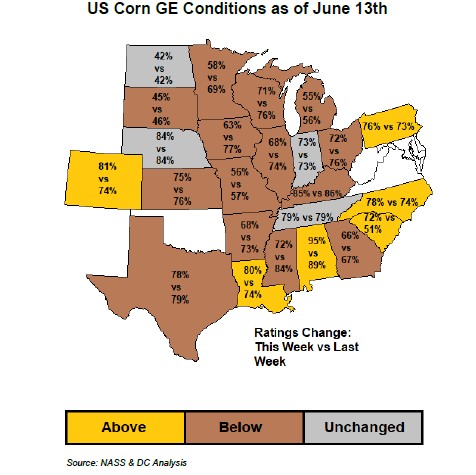

CORN

Corn futures traded lower on continued forecast of needed rains early next week across the heart of the US Midwest. This despite an historical drop in weekly US corn crop ratings. Dry and warm this week suggest that during next weeks rains, the ratings could drop again especially in the Dakotas, MN and IA. IL farmers report mostly good crops but all could use a rain to maintain current conditions. USDA dropped US corn rating to 68 pct G/E vs 72 last week and 71 last year. IA dropped to 63 from 77, IL dropped 6 to 68, MN dropped 11 to 58, SD is 45 with 5.6 mil acres and ND is 42 with 3.3 mil acres. One crop watcher est US 2021 corn yield near 177.5 vs USDA 179.5 with planted acres near 93.5 vs USDA 91.1. US 2nd week weather forecast calls for .75-2.00 inches of rain across the US Midwest Sun-Tue. Todays noon GFS update reduced rains in IA. MN, ND and SD could also miss the rains. Our weather guy feels that WCB rain could be less than normal in July with temps above normal. CN has dropped from a high near 7.17 below the 20 day near 6.66 and found support near 6.47. CZ dropped from 6.28 below the 20 day near 5.68 and 50 day near 5.68 but bounced off support near 5.56.

WHEAT

WN and KWN ended lower. Slow World export demand, approaching US winter wheat harvest, and weaker corn prices has weighed on prices. WN has dropped from a high near 7.67 to a low near 6.40 before bouncing to near 7.00 then dropping again to near 6.60 support. Resistance is 6.80. KWN dropped form a double top near 7.40 to a low near 6.06, tried to bounce to near 6.54 before trading back down to today low near 6.02. Bigger US 2021 HRW crop and no export demand has pushed prices lower. MWN dropped from a high near 8.07 in early May to a low near the 100 day moving average in late May near 6.68. Rallied to a new high near 8.40 on weather concerns only to pullback on general grain washout to near 7.40. US winter wheat harvest is 4 pct vs 15 last year. Ok yields are better than expected with high test weight but low protein. USDA dropped the HRS crop rating to 37 pct G/E vs 81 last year. ND is 29 vs 84 ly. Egypt cancelled their tender for World wheat.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.