ADMISI London Wheat Report for 6 June

- June 7, 2023

- ADMISI Grains Team

- Follow us on Twitter @ADMISI_Ltd

London Wheat Report

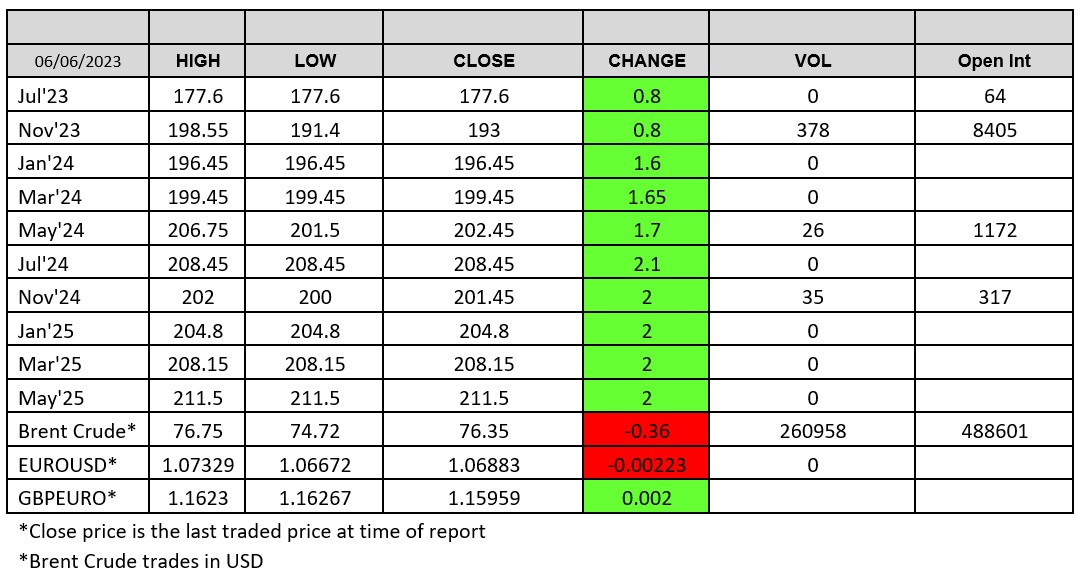

Source: FutureSource

Well the main news today was the implosion of the Kakhova dam on the Dnipro river that got blown up last night causing a substantial amount of flooding. With the renewed Ukrainian summer offensive supposedly on the move, it’s no surprise that this has been done and it’s been muted for a while. With the downstream areas to Kherson and surroundings flooded, it will be an absolute mare to move armour and tracked machines across terrain earmarked for the offensive so a nice little tactical plan from the Kremlin. Serious amount of water though! The vast reservoir behind the dam is one of the main geographic features of southern Ukraine, 240 km (150 miles) long and up to 23 km (14 miles) wide. The reservoir holds 18 cubic kilometres (4.3 cubic miles) of water – a volume roughly equal to the Great Salt Lake in the U.S State of Utah.

Brent crude was surprisingly down today after the announcement that Saudi were going to be tightening valves. USDA crop conditions came out last night with corn conditions falling 64%, 3% lower than trade expectations as the national adequate soil moisture hits 10-year low for this point of the year.

US crop progress report:

Corn planted 96% (+4% WoW, +5% 5yr avg)

Corn condition 64% Gd/Exc (-6% WoW, -9% YoY)

Soybean planted 91% (+8% WoW, +15% 5yr avg)

Soybean condition 62% Gd/Exc (no data YoY/WoW)

Winter wheat harvested 4% (no data WoW, unch 5yr avg)

Winter wheat condition 36% Gd/Exc (+2% WoW, +6% YoY)

Spring wheat condition 64% Gd/Exc (no data YoY/WoW)

Topsoil moisture 56% Adeq/Surp (-8% WoW, -19% YoY)

Subsoil moisture 56% Adeq/Surp (-7% WoW, -15% YoY)

Wheat markets got the most support from the dam busting, with both US and European markets shooting up on the open before cooling off. Dry forecasts continue to try to crank up support for US wheat a the market talks it up. Russian wheat exports in 2023/24 may reach 45.7 million of metric tons (MMT), as per SovEcon estimate. The analysts expect exports to surpass previous year’s record by 3%. EU weekly wheat exports jump to 324kt led by Poland in week ending 4th of June.

Chicago wheat shot up on the open with Sep-23 hitting a high of 659.75 before trading a cent lower around the 634 level at time of writing. Matif wheat shot up with Sep-23 hitting a trading high of €236.50/t before settling down €0.25 on yesterday at €230.25/t. Traded volumes on Matif were strong with Sep trading 47,675 contracts, levels not seen for a while. London wheat also followed global markets higher with Nov-23 hitting a trading high of £198.55 before settling marginally higher on yesterday.

Beans weren’t being very active today and spent most of the day trading around the unchanged. 165kt of beans was sold to Spain which is terribly exciting. EU soybean imports rose 54.6& to week ending 4th June at 382,251t although overall down 11.5%. Matif rapeseed Aug-23 gained support, settling up €6.00 on yesterday at €429.50/t.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2023 ADM Investor Services International Limited3

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.