ADMISI London Wheat Report for 31 October

- November 1, 2022

- ADMISI Grains Team

- Follow us on Twitter @ADMISI_Ltd

London Wheat Report

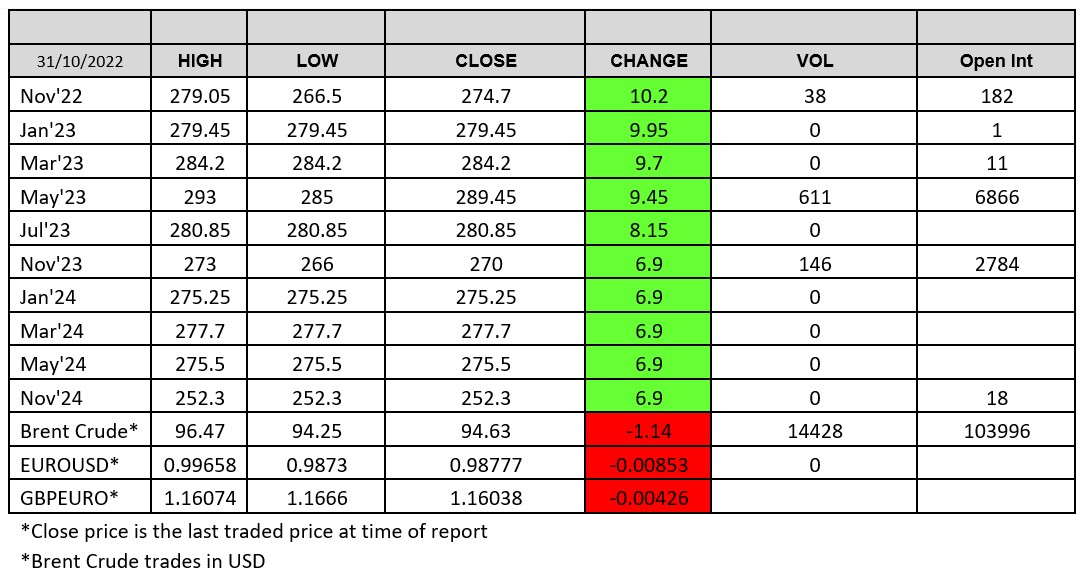

Source: FutureSource

Hello Monday. Main news story over the weekend is that Vladdy and the boys have pulled out of the Grain corridor deal after Russian Naval ships were attacked at Sevastopol on Saturday morning by Ukrainian drones apparently, with one frigate sustaining damage. Following this, news came out that Russia were pulling their co-operation in the grain deal which isn’t monumentally surprising although there was mixed feeling in the market last week. Substantial bombardment of Ukrainian infrastructure was seen this morning as a retaliatory measure with around 80% of Kyiv without water. Lula da Silva is returning to the Brazilian presidency, having narrowly beaten Bolsonaro in a very tight play off. Bank of England is anticipated to be reviewing rates on Thursday with an increase likely, current base rate is 2.25%.

Following the corridor news, Chicago what futures were trading up 6% this morning and Chicago corn jumped more than 2% on the news. Chicago Mar-23 hit trading highs of 911.25/bu before pulling back and trading in the 890/bu range, up 41 cents on Friday’s close, at time of writing. All three US wheat contracts were trading above all key moving averages but the 200 day. Matif Dec-22 hit trading highs of €353.25/t before settling up €14.75 on Friday at €352.50/t. London wheat futures followed suit, trading higher. Even after the cessation of Russian participation, grain boats were still leaving Ukrainian ports today with 12 ships sailing today. UN and Turkey are on the case to see if an agreement or mediation with the Kremlin can be done. Standard games in play really. Issue will be if Lloyds start to pull shipping cover for Black Sea transit as currently insurers are offering cover of up to $50m per cargo. So far Lloyds insurer Ascot has pulled new policies until the they have a better understanding of the situation.

Global fundamentals remain unchanged and US exports are still pretty flat. Planting conditions are pretty good both in Europe and the US. Mississippi river level still remains low. Brazil is turning to Russia and the US for wheat supplies due to the Argentine drought, Brazil is a net wheat importer. IKAR raises Russia 2022 wheat crop forecast to 101Mmt, there are concerns if exports aren’t continued at pace there is going to be a cracking wheat carry over of circa 27Mmt in Russia for next season. Bird flu woes continue in Europe and the UK with all poultry and captive birds in England ordered to be kept indoors. Pakistan bought 385kt of a 500kt wheat tender, optional origin purchase but expectation it’s Russian wheat.

First notice day today for Nov Chicago Soybeans today. Matif rapeseed Feb-23 settled up €26.25/t on Friday at €665/t.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2022 ADM Investor Services International Limited

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.