ADMISI London Wheat Report for 3 November

- November 4, 2022

- ADMISI Grains Team

- Follow us on Twitter @ADMISI_Ltd

London Wheat Report

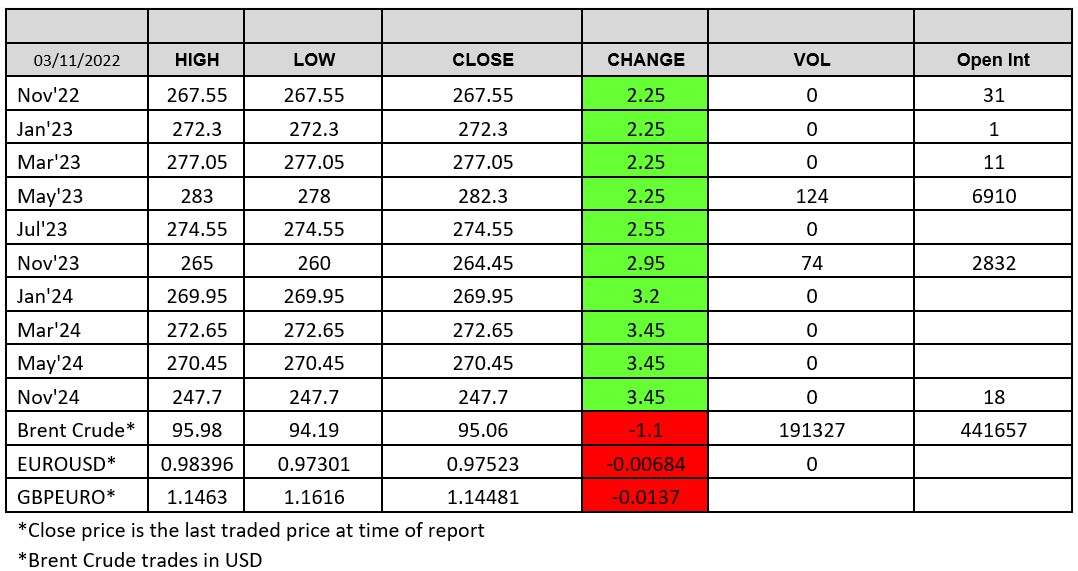

Source: FutureSource

Primary news today was following on from yesterday’s news that the Kremlin is now back in the grains corridor agreement and will always guarantee grains shipments to Turkey. Obviously a deal has been done/reaffirmed with Erdogan … one of the primary back routes for sanctioned goods to enter Russia. Also worth noting the amount of Russian cash flowing into Turkey currently. Turkey does hold the keys for the Bosporus so could limit movements of Russian vessels theoretically if games started again although this is highly unlikely. Kremlin decided to jump in today to say that they hadn’t committed to extending the grains corridor even though they are now ‘back in the party’. Classic. This flipping a coin decision making has promoted knee jerk reactions in the market which do make it difficult to be spec short. 8 ships are due to move through the corridor today.

US fed appears to believe that Ukraine will continue to ship grain as their appetite to fight inflation continues. Fed raised rates by 75bp and BOE raised their rates today by 75bp to 3% which is unsurprising and economic woes continue, with some pumping out more doom and gloom than others.

Well I wouldn’t have liked to be in the position of the funds recently with fund buying equating to an estimated 25k CBOT contracts on Monday and Tuesday only to reverse those yesterday which will have made a seriously grim P&L. Grain shipments are continuing again and the insurers are once again happy to insure cargoes, serious U-Turn there again. Pretty average day for London wheat with 184 lots trading across the market. Weaker pound has helped bump up price levels. Waterlogged Aussie crop faces quality downgrades with around half the wheat on the east coast which equate to 8Mmt facing potential downgrades. Matif wheat didn’t move much with Dec-22 settled down €0.50 on yesterday at €340.75/t.

Talk today that China has bought 1Mmt of corn from Brazil for Dec/Jan delivery. China has listed 136 Brazilian export facilities that approved to ship corn to China. Ukraine corn exports were pegged at 1.8Mmt – 2Mmt, a season high. Rouen port data has confirmed a rare rapeseed cargo departing to the US. Feb-23 rapeseed settled €2.25 down on yesterday at €660/t.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2022 ADM Investor Services International Limited

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.