ADMISI London Wheat Report for 17 January

- January 18, 2023

- ADMISI Grains Team

- Follow us on Twitter @ADMISI_Ltd

London Wheat Report

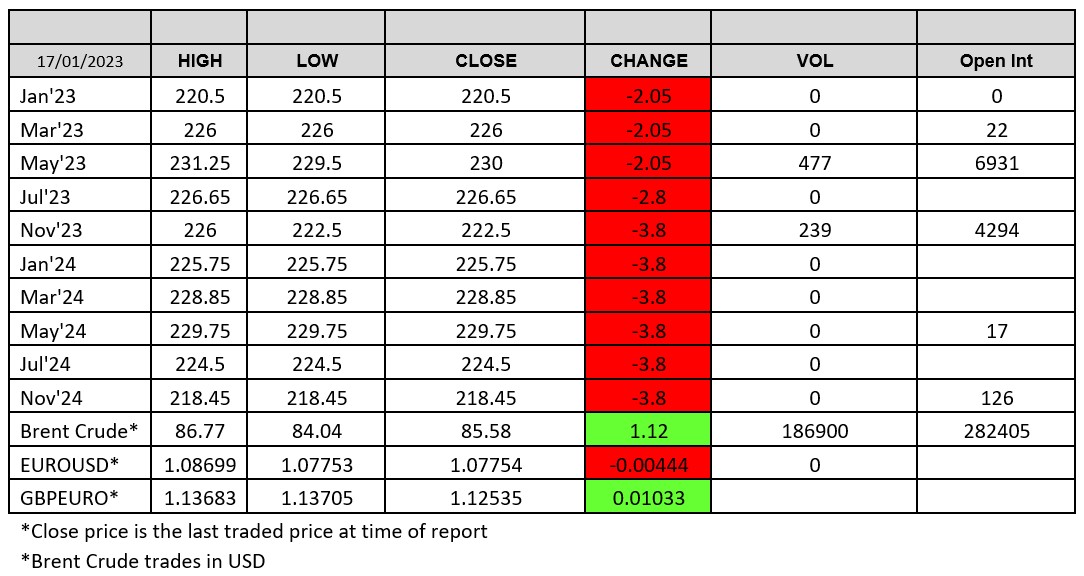

Source: FutureSource

US markets reopen post MLK day. More chatter on the markets as excitement to China cranking up its economy continues. Tanks for Ukraine from European nations in sight as German government states that it will be for the new German defence minister to decide post resignation of the previous one. LVMH Moët Hennessy Louis Vuitton became Europe’s most valuable company today surpassing €400bn. Belarus and Russia have been holding joint military drills. Saudi Arabia’s state grains buyer SAGO will become General Food Security Authority (GFSSA) announced the govt today. Russia became the third-largest oil supplier to India in 2022, making up about 15% of total purchases, dragging down OPEC’s share to the lowest in more than a decade, data obtained from industry sources show. So all exciting stuff on the macro markets.

Wheat markets kicked off the day being pretty bearish, both in the US and the EU. Chicago wheat was trading lower with Mar-23 trading down 10/11 cents lower on the majority of the day before strengthening towards the end of the day and gaining a couple of cents. This was primarily due to stronger US weekly export data, with US wheat exports up 53% WOW to 320,473t. EU weekly wheat exports were up to 137kt or 116% WOW. YTD currently stand at 17.6Mmt.

Matif Mar-23 settled down €0.75 on yesterday at €286.75/t. London wheat had another strong day overall with 437 lots traded on the May contract. We are yet again pushing lower. Even with decent export demand recently with shipments off to Spain, Netherlands and Belgium, we are still going to have a decent carry over into new crop.

South America seem to now have a favourable forecast over the next couple of weeks. USDA announced sales of 119kt of beans to unknown. Chicago beans were trading up a couple of cents at time of writing. US weekly soybean exports are up 42% WOW t 2Mmt, above market expectations. China’s hog herd has seen some increased growth, with reports on Reuters stating that it currently stands at 452m head or up 7% from the prior year. Positive news for beans. Brazil’s 2022/23 soybean planting is 99.2% complete according to Conab. Brent crude was 1.3% up in today’s trade. Matif rapeseed Feb-23 settled down €7.25/t on yesterday at €556.25/t.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2022 ADM Investor Services International Limited

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.