ADMISI London Wheat Report for 16 January

- January 17, 2024

- ADMISI Grains Team

- Follow us on Twitter @ADMISI_Ltd

London Wheat Report

Schools have been closed and travellers are facing disruption following snowfall across parts of the UK. Weather conditions led to more than 100 school closures in Scotland and dozens in Merseyside. Fujitsu Europe’s boss has admitted the firm has a “moral obligation” to contribute to compensation for sub-postmasters wrongly prosecuted as a result of its faulty IT software.

An attack on a dry bulk carrier this week in the Red Sea region is set to lead to more diversions of grain cargoes around the Cape of Good Hope but most are still willing to risk using the Suez Canal for now, shipping sources said on Tuesday. There was a further attack on another European vessel today in the Red Sea. Houthi rebels attacked a Malta-flagged bulk carrier. The extent of the damage is not known at present. Shell also announced today it was suspending shipments through the Red Sea indefinitely.

An association representing thousands of grain farmers in Brazil projects production of 135 million metric tons of soybeans in the 2023/2024 cycle, according to a statement on Tuesday that mentioned extreme weather as hurting the outlook for the crop as the season progresses. Aprosoja Brasil’s estimate is lower than private forecasters’ projections of production that starts at around 143 million tons. It is also well below Brazilian crop agency Conab’s expectations of 155 million tons and a U.S. Department of Agriculture projection putting the crop at 157 million tons in the world’s largest supplier of soybeans.

Argentina is set for a corn and soy “super harvest” with production forecasts likely to keep climbing, a senior analyst at the Rosario grains exchange told Reuters on Tuesday, a major boost to the embattled grains-producing South American country. Cristian Russo, head of agricultural estimates at the Rosario grains exchange, said that both corn and soy had “very good chances” of topping the body’s current harvest forecasts of 59 million metric tons and 52 million tons respectively.

US markets were back open today after yesterday’s bank holiday. Corn and wheat were both off. Corn was down 4 cents at the time of writing and the wheat markets were taking a pasting. Chicago wheat was down 19 cents, Kansas 15 and Minap 10 at the time of writing. Soybeans were the only green on the screen today for US ags which found support and were trading up 7 cents at the time of writing, this was off from the high of 13 cents up on previous settlement.

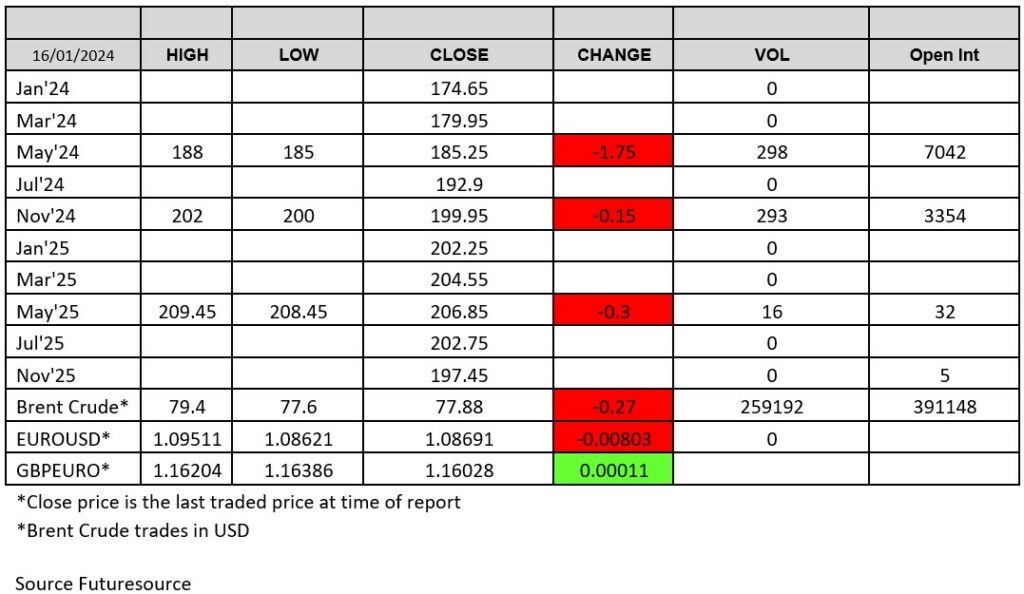

European wheat markets had a real split day. This morning saw the markets find support and this afternoon both Matif and London were dragged into the red by the big brother from across the pond. London May/ Nov spread widened again today as May took more of a tumble than Nov. May traded down £2 whilst Nov traded down £1. Volume was evenly spread across the two expiry’s and was strong with nearly 600 lots crossing the finish line. May 25 traded today for 16 lots between 208.45 and 209.45.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Ryan Easterbrook and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.