ADMISI London Wheat Report for 16 April

- April 17, 2024

- ADMISI Grains Team

- Follow us on Twitter @ADMISI_Ltd

London Wheat Report

Ukraine’s grain harvest is likely to fall to about 52 million metric tons this year from 58 million tons in 2023, mostly due to an expected smaller sowing area, the farm ministry said on Tuesday in its first official harvest forecast for 2024. Speaking of Ukrainian grain, the lowest offer presented to the Egyptian state GASC was for 60K tonnes of Ukrainian wheat at $218.90.

Chicago wheat futures extended their fall for a second consecutive session on Tuesday as a strengthening dollar and huge exports of cheap grain from Russia continued to pressure prices and trade near their lowest since 2020. Kansas and Minap wheat were largely unchanged at the time of writing.

France’s farm ministry on Tuesday estimated the total soft wheat area in France at 4.39 million hectares, down 7.7% from 2023 and still at its second lowest in 30 years despite a small increase in its projection for winter wheat sowings. Torrential rain during autumn disrupted sowing in France, the European Union’s largest grain producer, raising concern that farmers would be unable to complete planting plans and that drilled crops would lose yield potential.

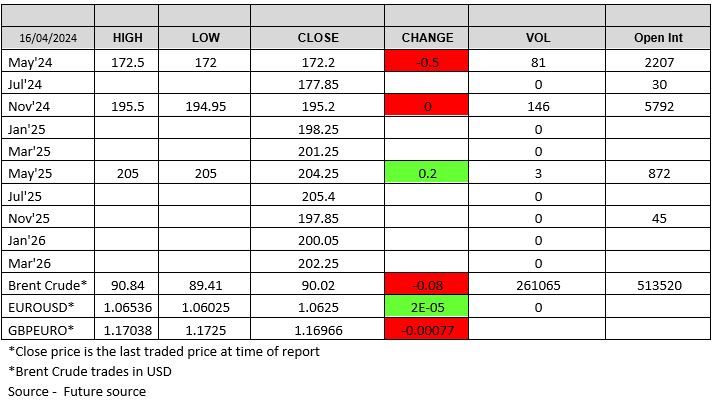

London wheat was largely unchanged today and all traded months were trading within a range of less than a £1 all day. All eyes are starting to look at the old crop May 4 to see what will happen with first notice day in site. Will the longs or the shorts come out on top? It’s fair to say most believe it’s not going to stay where it currently is. This will obviously have some effect on the May 4/ Nov4 spread which is currently trading at £22.75. Volume wasn’t anything spectacular with just over 200 lots crossing the line across the curve.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Ryan Easterbrook or Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.