ADMISI London Wheat Report for 04 October

- October 5, 2022

- ADMISI Grains Team

- Follow us on Twitter @ADMISI_Ltd

London Wheat Report

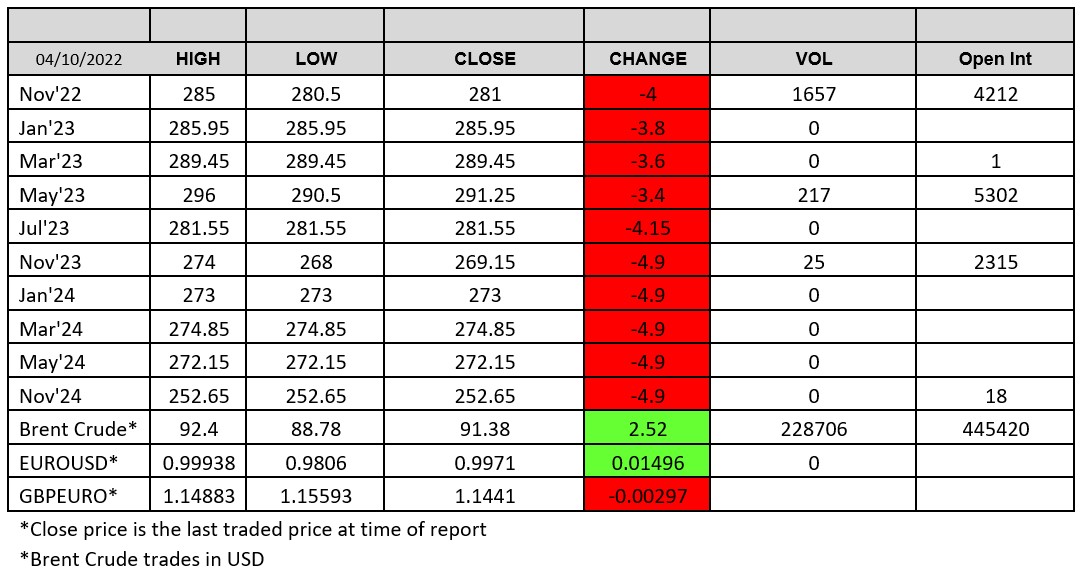

Source: FutureSource

Grains were coming off in today’s trading. USDA crop report Corn Conditions 52% G/E, Soybeans 55%. Corn harvest 20% vs 12% last week, and 27% a year ago. Soybeans 55% G/E vs 55% last week, and 58% a year ago. Winter wheat planted 40% vs 31% last week, and 45% a year ago. GBP continued to strengthen today, trading at 1.1445 at time of writing, partially helped by the pause in US treasury yields which have been on a relentless climb. US weather still looks good for the foreseeable which should allow US harvest to crack on.

US and European wheat markets pulled back. Ukraine’s winter wheat sowing for the 2023 harvest has covered only a third of the area completed at the same time last year, agriculture ministry data showed on Tuesday. Canada’s Alberta province leads harvest progress with 88% completion. Almost 6 million tons of grain and foodstuffs have been shipped from Ukraine’s Black Sea ports through an export corridor that opened in early August, according to the latest line-up posted by the United Nations. Rain is hampering Brazilian wheat harvest currently. Tunisia have hit the market to purchase circa 150kt of soft wheat. Soft wheat exports from the European Union in the 2022/23 season that started on July 1 had reached 9.15 million tonnes by Oct. 2, data published by the European Commission showed on Tuesday. Matif Dec-22 wheat settled down €1.25 on yesterday at €349.75/t.

Chicago soybeans were supported today as was Matif rapeseed, helped by the support in crude with Brent climbing up 3.17% on yesterday at time of writing. A four-week currency devaluation that expired on Sept. 30 spurred farmers to trade 16.1m metric tons of soybeans, according to the Buenos Aires Grain Exchange. Brazil 2022/23 Soy Planting 4.5% Done as of Sept. 30: Safras This compares with 4.0% a year ago and 3.1% in a 5-year average, according to a report from consulting firm Safras & Mercado. The lowest offer presented at an Egyptian state purchasing tender for vegetable oils on Tuesday was $1,285/t c&f for 11,000 tonnes of sunflower oil. Matif rapeseed Nov-22 settled up €13 on yesterday at €646.25/t.

Contact the ADMISI Grains and Oilseeds Derivatives Brokerage team

Hanne Bell, Ryan Easterbrook, Dominic Enston and Aaron Stockley-Isted

Phone: +44 (0)20 7716 8477 or +44 (0)20 7716 8140 Email: intl.grains@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice. ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG. A subsidiary of Archer Daniels Midland Company.

© 2022 ADM Investor Services International Limited

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.