Written by Marc Ostwald, ADMISI’s Global Strategist & Chief Economist

The Week Ahead – Preview:

The new week was supposed to find its focal point in the ECB policy meeting, UK Budget and a deluge of US and China statistics, but the collapse of SVB Financial on Friday, which came hot on the heels of the closure of Silvergate Bank last Tuesday puts the SVB fall-out front and centre, given fears of a domino effect, which governments and regulators have been scrambling to try and avert over the weekend. The busy data run includes US CPI, PPI, Retail Sales, Industrial Production, Housing Starts, NAHB, NFIB, NY & Philly Fed Manufacturing and preliminary Michigan Sentiment surveys, with China looking to Retail Sales, Industrial Production, FAI and an array of property sector indicators, while the UK looks to labour data and BoE/Ipsos Inflation Expectations, Japan has Machinery Orders and Trade, Australia labour data and India CPI; while the OECD publishes its Interim Economic Outlook forecast update. There are also rate decisions in Indonesia, Russia and Ukraine with no changes expected, while China’s PBOC is expected to leave its 1-yr MTLF rate unchanged at 2.75% at this week’s operation. Scheduled central bank speakers are light this week, with the Fed and BoE in purdah ahead of next week’s policy meetings, but much will depend on the SBV fall-out.

In the commodities space, there are monthly reports from OPEC and IEA, and in the agricultural sector from France’s AgriMer and the International Grains Council (IGC), while the EU Commission is due to publish Net Zero Industry and Critical Raw Materials Acts, as well as proposals to reform EU’s electricity market design and a long-term competitiveness strategy. A busy week for conferences has amongst others: Fujairah Bunkering & Fuel Oil Forum, Mysteel Southeastern China Aluminum Summit, China Hydrogen Summit and the Eurasian Agri-commodities conference in Kazakhstan.

It will be a busy week for Govt bond supply in Europe, with the UK selling 10-yr, Germany 5 &, 27 & 30-yr, France 3, 5 & 7-yr and I-L 6, 13 & 30-yr, Italy 3, 6, 12 & 50-yr, Spain 5, 10 & 29-yr and the Netherlands 4-yr, while Japan sells 5 & 20-yr. There will however be no coupon supply in the US. But it will be the fortunes of credit markets in the aftermath of the SVB collapse which bear greater scrutiny, after spreads jumped wider at the end of last week. The latter is quite typical when UST yields quite sharply, given a certain degree of lagged reaction in credit.

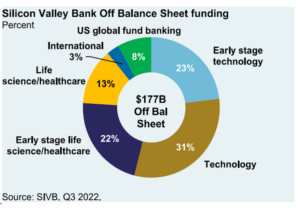

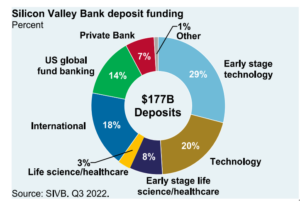

In respect of SVB, some initial observations can be found in this Al Jazeera interview at the weekend. The pace of the collapse was spectacular, though a quick look at the attached charts on its deposit funding and more importantly its off balance sheet funding and the table of its ‘unrealized losses’ as at end Q4, underline why it needed to try and raise more capital, as well as attesting to imprudent accounting practice, and effectively non-existent risk management. Given that so much of the start-up tech sector bleeds cash at a very rapid pace, and that the tech sector has been under a cloud for a protracted period, it was always vulnerable to a run on deposits. Nevertheless, the chart of unrealized gains/losses on Investment securities underlines just how acute the problem has become more broadly, especially at any bank which chooses to opt to switch securities from ‘available for sale’ to ‘hold to maturity’ and is dependent on deposits for funding. Per se this is somewhat more reminiscent of the S&L (Savings & Loans) crisis (1996 to 1995) than the GFC, and leaves US regional banks vulnerable to deposit runs. On the other side of the coin, it is going to cast a long shadow over start-up funding in the tech sector, though many will observe that lending standards for the sector have been lax, and the sharp rise in US rates and the various cryptoverse debacles was always likely to force investors into an appointment with economic realities. While Treasury secretary Yellen ruled out a bail-out at the weekend, the US legislature will need to think long and hard about tech sector start-ups are going to be funded. if the aims of the Inflation Reduction Act in respect of ‘re-shoring’ tech related manufacturing and services are going to be realized. But in the first instance, this is about halting a domino effect of bank runs and start-up business failures, as well as how the spectacular about turn in US Treasury yields in reaction to it, with the 2-yr falling 50 bps from Wednesday close to Friday, underlines both the total lack of market liquidity depth, and now leaves the Fed with a big headache in terms of policy transmission.

Be that as it may, and following on from a mixed labour report on Friday, US CPI is expected to see headline and core up 0.4% m/m, to edge headline y/y down 0.4 ppt to 6.0% and core 0.2 ppt to a still very lofty 5.4%. Much looks likely to depend on the extent of the rebound in energy prices (both gasoline and utilities) and core goods, which are likely to see a sizable rebound in Used Car Prices, with OER/Shelter (i.e. housing) likely to ease slightly in m/m terms from January’s 0.7%, but remain high. The other wild card is how much medical care costs (elevated in January) are offset by the previously mentioned drag from medical insurance. Retail Sales on Wednesday will also be sensitive after January’s unexpected 3.0% m/m headline surge, with headline seen dipping -0.4% m/m, and core measures down -0.3%, which would be a modest correction to January’s jump, though as ever revisions to prior month readings can be quite sharp.

UK labour data are forecast to show a solid 60K gain in Payrolls, though the less timely Unemployment Rate is expected to edge up 0.1 ppt to 3.8%; but the focus will be on Average Weekly Earnings, where the consensus sees headline easing 0.2 ppt to 5.7%, and ex-Bonus to dip 0.1 ppt to 6.6%. But in both cases this would be largely accounted for by benign base effects, but at least break the relentless rise since December 2021, though remaining way above the BoE’s comfort zone.

China’s aggregated Jan/Feb activity data are seen painting a mixed picture, with Industrial Production seen slowing quite sharply to 2.6% y/y from 3.6%, though the strength of manufacturing surveys and benign base effects suggest some upside risks. By contrast Retail Sales are forecast to post a sharp jump to 3.5% y/y from December’s -0.2% y/y, the latter dampened by the surge in Covid infection rates, and if the jump in Services PMIs and anecdotal evidence on LNY spending is any guide, the rebound may be even stronger. Fixed Asset Investment is expected to slow (4.5% y/y vs. prior 5.1%, while Property Investment is seen contracting at a slower pace (-8.3% vs. prior -10.0%), though it is the looming balance sheet resolution plans and measures, which are rather more relevant to any prospect for a turnaround in the sector.

As for the ECB meeting, a 50 bps hike to 3.0% Depo and 3.50% Refi is baked in the cake, and heavily signalled, the question is what guidance is given for May, with markets discounting a 50 bps hike, while ECB hawks such Austria’s Holzmann are already pressing for 50 bps hikes in May through July, which earnt him a stern rebuke from Italy’s Visco for not adhering to the ‘data dependent’ mantra, while chief economist Lane warned against policy being on ‘auto pilot’. A lot will depend on the forecast revisions, with 2023 headline CPI likely to be edged down, but more than offset by a sizeable upward revision to core for 2023 (Dec forecast 4.2%) and more modestly for 2024; but the 2025 forecast (last 2.4%) will be key in signal terms, with any downward revisions perhaps an acknowledgement that the sharp shift up in market rate expectations since the February and December meetings is in line with the ECB’s own expectations. There may be some tweaking of growth forecasts, which should be slightly higher. The question then will be how the statement and Lagarde’s describe risks to the CPI outlooks, more than likely adjusted as being to the ‘upside’ against February’s more balanced.

The Q3 corporate earnings season is largely completed, but there are still a good number of significant companies reporting this week, with Bloomberg News suggesting the following will be among the highlights: Adobe, Alimentation Couche-Tard, Aramco, Assicurazioni Generali, BMW, Dollar General, E.on, Enel, FedEx, Foxconn Industrial Internet, Franco-Nevada, Gitlab, Hon Hai Precision Industry, IndiTex, Ping An Insurance, Porsche, Prudential, Verbund and Volkswagen. Focus is however shifting to Q1 2023 earnings, and even if the potentially acute fall-out from the SVB collapse is avoided, it is worth running the rule over actual S&P 500 Q4 results and Q1 expectations. According to Refinitiv, Q4 2022 yr/yr earnings are expected to be -3.2%, excluding the energy sector, the estimate is -7.4%. As per Factset: “for Q1 2023 the estimated earnings decline for the S&P 500 is -6.1%. If -6.1% is the actual decline for the quarter, it will mark the largest earnings decline reported by the index since Q2 2020 (-31.8%). On December 31, the estimated earnings decline for Q1 2023 was -0.4%. Ten sectors are expected to report lower earnings today (compared to December 31) due to downward revisions to EPS estimates. For Q1 2023, 81 S&P 500 companies have issued negative EPS guidance and 25 S&P 500 companies have issued positive EPS guidance.” These figures speak for themselves and confirm that there is no denying there is an earnings recession in the US. Interestingly it contrasts with the fact that research from JPMorgan Chase shows that of the Stoxx Europe 600 companies that have reported so far, some 56% beat estimates, with earnings per share rising 4% on average and sales climbing 15%.

To view the full report and to sign up for daily market commentary please email admisi@admisi.com

The information within this publication has been compiled for general purposes only. Although every attempt has been made to ensure the accuracy of the information, ADM Investor Services International Limited (ADMISI) assumes no responsibility for any errors or omissions and will not update it. The views in this publication reflect solely those of the authors and not necessarily those of ADMISI or its affiliated institutions. This publication and information herein should not be considered investment advice nor an offer to sell or an invitation to invest in any products mentioned by ADMISI.

© 2023 ADM Investor Services International Limited.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.