All eyes on US labour data; German Orders surge, French production drop and RBA statement on monetary policy to be digested; Canada Unemployment also ahead; BoE’s Pill sole scheduled central bank speaker

US labour data: Payrolls seen around pre-pandemic level, solid but slower pace; wage growth expected to ease marginally, but still above Fed comfort level

BoE shifting emphasis to ‘higher for longer’, as peak rate nears

EVENTS PREVIEW

The monthly US labour report stands tall over the end-of-week proceedings, with the unexpected surge in German Factory Orders (paced by engineering, computers & electronics & metals, with a big drop in Autos & parts), French Industrial Production and Q2 Wages to digest along with the RBA Statement on Monetary Policy (SOMP), while Canada’s Unemployment is the other item ahead. BoE’s Pill is the sole scheduled central bank speaker ahead, and plastics giant LyondellBasell Industries will likely be the highlight of an otherwise lighter run of US corporate earnings.

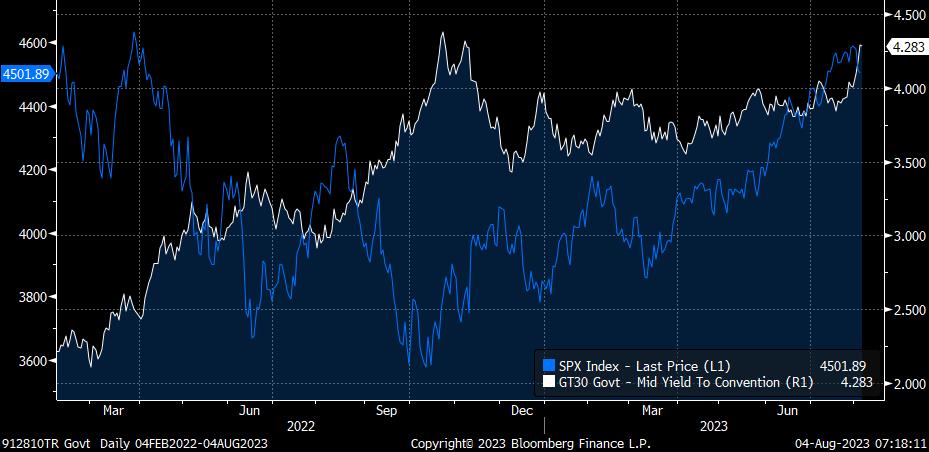

As for yesterday’s BoE meeting, the primary take home is that the MPC is shifting its emphasis to ‘higher for longer’, with the new forecasts effectively doubling down on that message, even if the BoE’s forecasting record hardly bares much scrutiny in terms of its reliability. A terminal rate at 5.50% still appears to be the most likely outcome, though July & August inflation and wage data are likely to be key. In terms of increasingly flaky risk appetite, the attached chart of US 30 yr yields vs. the S&P500 should serve as a reminder about durations risk, as was more than amply demonstrated last year.

Next week brings US and China inflation readings, UK Q2 GDP and monthly activity data, German Industrial Production, China’s credit aggregates, Japan’s Wages and Household Spending. There will be a smattering of Fed speak, but nothing is currently scheduled in terms of ECB, BOE or BoJ speakers, while India’s RBI is seen delivering another ‘hawkish hold’. In the commodity space, the USDA publishes its monthly WASDE report and the US EIA its monthly Short Term |Energy Outlook (STEO), Brazil’s Conab and Unica monthly grains and sugar S&D reports respectively.

** U.S.A. – July labour market report **

Markets are now clearly ignoring ADP reports, after another much stronger than expected 324K, notwithstanding the marginal downward revision to June to 455K from an originally reported 497K, though strength in the ADP report does often translate to some downside risks to the Unemployment Rate, which is seen unchanged at 3.6%. Payrolls are forecast at a little changed 200K vs. June’s 209K, with Private Payrolls expected to rebound to 180K from June’s soft-ish 149K (weakest since March 123K), both of which imply that labour demand is around pre-pandemic levels, with Manufacturing Payrolls seen little changed at 5K, still not implying the desultory sector labour demand suggested by a July ISM Manufacturing Employment sliding to 44.4 from 48.1, which was the worst since July 2020. But with the Fed increasingly equivocal on the rate outlook, and a sharp undershoot on Q2 Unit Labour Costs on yesterday’s 1.6% vs. expected 2.5%, and Q1 revised down to 3.3% from 4.2% (though the ECI is a better measure of wage growth), it will be Average Hourly Earnings that attracts attention, this has run at 0.4% m/m in the past 3 months, or a 3-mth annualized rate 4.8%, a little too high for Fed comfort, though implying consumers are now seeing an increase in real wages, a modest slip to 0.3% m/m is expected. The Labour Force Participation is seen unchanged at 62.6%, well above the pandemic trough of 61.3%, but still a distance away from the 63.3% pre-pandemic, and therefore still implying impediments for some re-joining, and per se some residual tightness. Overall if broadly in line with expectations, it would reinforce the idea of higher for longer on Fed rates, with the focus then shifting to next week’s CPI and PPI data.

To view the full report and to sign up for daily market commentary please email admisi@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.