- Credit Suisse takeover, Central Bank dollar liquidity boost renders light data schedule moot, focus on Lagarde testimony, other unscheduled central bank and govt speakers; FT Commodities Summit gets underway

- Banking crisis raises risk of policy misstep even higher

- GFC Lesson learnt: act swiftly and decisively, then go forensic

- As with pandemic, banking crisis brutally exposes major deficiencies of post-GFC regulatory drive

** PLEASE NOTE: Due to conference commitments, there will be no updates from Tuesday to Thursday this week. **

EVENTS PREVIEW

The day’s modest schedule of data was never going to elicit much reaction from financial markets, and with the moves by major central banks to shore up the availability of USD liquidity late on Sunday, following the acquisition of Credit Suisse by UBS, it is rendered irrelevant. Lagarde’s testimony to the European Parliament’s Committee on Economic and Monetary Affairs (ECON) will be centre stage on the events calendar, and follows the as expected no change in China’s LPR rates, with the likelihood that there will be other unscheduled comments from other central bank and government officials, as they try to restore some calm to markets. At least one lesson very clearly learnt from the GFC era by officialdom, namely to act decisively and swiftly, and if needed to run roughshod over any discussion of moral hazard, and legal obstacles, both of which can be discussed once the dust settles, and some semblance of calm has been restored. This crisis is far from over, but at least some of the immediate risks of an exponential ballooning of contagion effects have been mitigated. Be that as it may, policymakers face a major challenge in trying to ensure financial stability at the same time as fighting inflation, and this crisis only raises the risk of a policy misstep to an even higher level.

Nevertheless, the crisis serves to underline that post-GFC regulation has proved to be highly ineffective in preventing banking sector crises. As I have argued for more than a decade, the fundamental fault was to assume that the primary problem was bank capital ratios, when it was quite clear that financial market instrumentation, above all the leverage inherent in so many products, whose tail risks are still poorly understood, which was of greater importance. As a reminder, central banks were aware of this, as per this speech quote from BoE’s Haldane in 2014, when he was still the BoE’s director for financial stability: “One of the likely consequences of the crisis, and the resulting regulatory response, is that the financial system will reinvent itself. Financial activity will migrate outside the banking system. And with that move, risk may itself change shape and form. What previously had been credit and maturity mismatch risk on the balance sheet of the banking system may metastasize into market and illiquidity risk on the balance sheets of non-banks…. Risk, like energy, tends to be conserved not dissipated, to change its composition but not it’s quantum. So it is possible the financial system may exhibit a new strain of systemic risk – a greater number of higher-frequency, higher-amplitude cyclical fluctuations in asset prices and financial activity, now originating on the balance sheets of mutual funds, insurance companies and pension funds.” The fact of QE and the ZIRP/NIRP era driving investors to take on more risk (credit and duration) and greater leverage to generate ‘acceptable’ rates of return on capital, and the failure to railroad this liquidity tsunami into the real economy, and the reliance on self-regulation, as well as the associated feckless belief in ‘trickle down’ economics was always a cocktail for future trouble, as well as the sloth and cowardice of governments to enact ‘unpopular’ legislation, above all that which would antagonise their vested interest paymasters.

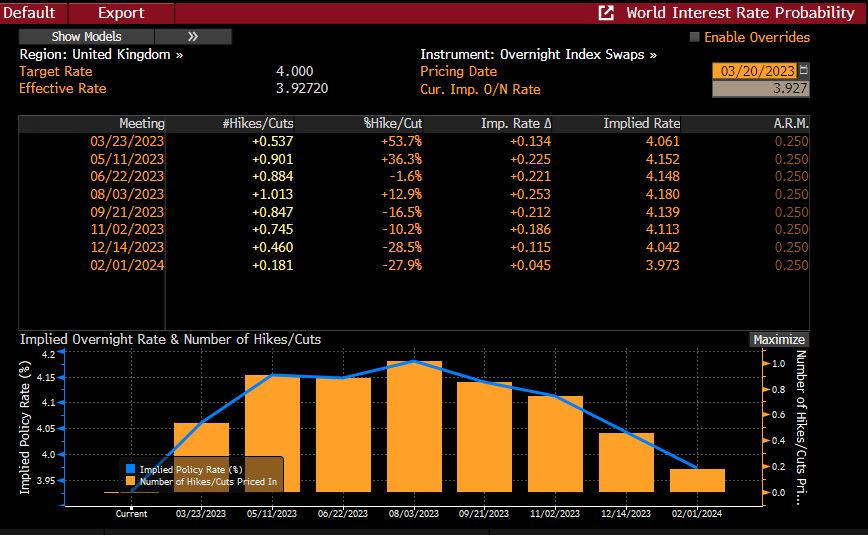

Be that as it may, in the commodity space the FT Commodities Global Summit gets underway, the EU publishes its monthly MARS Crop Bulletin, and the UN Intergovernmental Panel on Climate Change is due to publish its latest ‘synthesis report’. Markets will debate whether the central bank Swap liquidity moves make rate hikes at this week’s policy meetings less likely, and have indeed moved to price rate hikes at this week’s meetings as no more than a risk – see attached charts. As noted in the week ahead, the question is whether primary credit markets gradually re-open, with issuers essentially needing to weigh up whether the sharp fall in underlying govt bond yields effectively offsets the widening in credit spreads.

RECAP: The Week Ahead – Preview

The Week Ahead – Preview:

The ‘banking crisis’ is likely to remain front and centre in the new week, and following the weekend acquisition of Credit Suisse by UBS. The calendar of data and events is dominated by major central bank meetings, with the Fed primus inter pares, and accompanied by BoE, SNB, Norges Bank, while Brazil’s BCB, Nigeria’s CBN and Philippines’ BSP head the run of EM central bank meetings. The data schedule is overall light, with the UK focussed on CPI and Retail Sales, as is Canada, the US looking to Durable Goods Orders, New & Existing Home Sales, and Brazil and Mexico looking to inflation, while the G7 flash PMIs and Germany’s ZEW Expectations head a busy run of surveys. Politically there is the potential for some furore if former US President Trump is indicted and arrested as he has suggested; China’s President Xi is said to be heading to Moscow for a meeting with Putin, while the week ends with a 2-day EU leaders’ summit. In the commodity space, there will be particular focus on whether the sharp down draft in oil prices continues, with a busy week for conferences headlined by the FT Commodities Summit in Lausanne, while there are also the Eurogas, Australis Domestic Gas Outlook and Rabobank Farm2Fork, as China has Aluminium and Lithium conferences. The run of commodity reports features the EU MARS Crop Bulletin, USDA Red Meat and Milk Production, and Beef, Pork and Poultry |Cold Storage data, and Brazil’s Unica Cane Crush and Sugar output data. The corporate earnings schedule is light outside of China, which has results from the likes of Chalco, China Mobile, China Meituan, China, Shenhua Energy, China Telecom, Sinopec, Tencent, Xiaomi and Zijin Mining, with the US’ General Mills and Germany’s RWE featuring elsewhere. A relatively busy week for govt bond supply has 20-yr & 10-yr I-L, and the UK 4 & 30-yr, while the EU, Germany, Belgium and Finland all hold auctions in the Eurozone.

Despite all the turmoil in the banking sector, none of the major central banks meeting this week are expected to back from further rate hikes, with the Fed and BoE seen hiking 25 bps to 4.75/5.0% and 4.25 respectively, the SNB by 50 bps to 1.50% and Norges Bank by 25 bps to 3.0%; China’s 1 & 5-yr LPR rates are seen unchanged, but last Friday’s 25 bps cut in bank reserve requirements is of greater relevance. Pausing now would make a resumption of rate hikes more of a challenge, though perhaps less for the BoE, and could run the risk of deepening bank sector contagion fears in markets, given many would ask ‘is there something they know that we don’t?’

While the Fed is obviously wary of contagion risks, it still views the banking sector as being well capitalised, and it will want to stress that the inflation battle is not won, and it remains too high, so a 25 bps hike seems very likely, though like the ECB it will likely stress a high level of uncertainty, and offer no guidance, and emphasize data and financial conditions dependency. The ‘dot plot’ will probably shift a little higher in terms of peak (5.375% from 5.125%), with growth and inflation forecasts edged up, and unemployment edged down. Powell will likely underline high vigilance on financial conditions, but also inflation still being too high, growth holding up relatively well and the labour market remaining very tight, and an obviously difficult balancing act on financial stability vs. fighting inflation. He will doubtless face a lot of questions about banking sector risks, whether the Fed and other regulators have been asleep at the wheel in terms of balance sheet risks and accounting practices, and the significance of last week’s jump in Discount Window borrowings. He will also be at pains to point out that the BFTB programme is not QE, as it is based on loans on collateral, and not outright purchases of securities.

Ahead of the BoE rate decision, CPI is expected to rebound in m/m terms to 0.6% m/m, which would see the y/y pace ease modestly to a still very high 9.9%, with core CPI seen edging down 0.1 ppt to 5.7% y/y. January’s downside miss was above all due to some unexpected downward pressure from Services (above due to airfares), which is likely to have been a temporary factor, and seen partially unwound this month, which along with food will largely offset a further fall in non-food goods prices. But with last week’s labour data confirming the labour market remains tight, even if wage pressures appear to have peaked, and given some stimulus from the Budget, the BoE majority is expected to opt for one further 25 bps hike to 4.25%. Markets are priced for only a 60% probability of one further hike (by August), and see Base Rate at the 4.0% at the end of the year. Whether the BoE hikes or not is perhaps rather moot, the outlook for the UK economy remains challenging on a short to medium-term basis, and it is fiscal policy and legislative measures which will ultimately decide whether the many challenges the economy faces will take more or less time to overcome. Friday’s Retail Sales are seen posting a further modest rise (0.2% m/m) after seeing some unexpected strength (0.5% m/m) in January, and despite some better news on energy prices, household consumption is set to remain very sluggish, with risks for this month’s reading skewed somewhat to the downside of the consensus.

As for the SNB, February’s higher than expected CPI predicates expectations of a further 50 bps hike at the SNB’s quarterly policy meeting, though it will obviously be monitoring this week’s market reaction to the UBS acquisition of Credit Suisse, and hoping that financial stability risks start to ease, so that it can revert to focussing on the economy in policy terms.

G7 flash PMIs as the end of the week are forecast to see a modest improvement in Manufacturing, albeit still mostly contracting, and a slight setback in most Services readings. Much may depend on data collection timing, given some risk of contagion effects to non-financial sentiment from the ‘banking crisis’. Prices sub-indices will require particular monitoring, given the easing in both oil and gas prices.

But ultimately the week will be about whether market fear around the banking sector start to ease, which will boil down to hopes that there are not any renewed shocks. Attention will then turn to month and quarter end portfolio rebalancing, particularly after the extreme volatility, as well as whether primary credit markets re-open after being temporarily shuttered due to the aforementioned volatility and contagion risk fears.

Earnings highlights for the week according to Bloomberg News are likely to include: Accenture, Anta Sports Products, China Citic Bank, China Merchants Bank, China Mobile, China Pacific Insurance Group, China Petroleum & Chemical, China Shenhua Energy, China Telecom, General Mills, Meituan, Nike, PDD Holdings, People’s Insurance Group of China, RWE, Tencent, Wanhua Chemical Group, WuXi AppTec, Wuxi Biologics Cayman, Xiaomi, Yihai Kerry Arawana, Zijin Mining Group.

To view the full report and to sign up for daily market commentary please email admisi@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 02547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2025 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.