- Busy day on all fronts: digesting China GDP and activity indicators, UK labour data; awaiting German ZEW survey, Eurozone Trade, US Housing Starts, NY Fed Services Index and Canada CPI; plenty of central bank speakers, broader mix of US Q1 Earnings reports; Finland, Netherlands and UK debt auctions

- China data mixed: Retail Sales robust but boosted by base effects, Unemployment fall encouraging, Industrial Production and FAI underline private sector demand still sluggish

- UK labour data: higher than expected wage growth put pressure on BoE for further hike, though structural factors at work; Employment data rather contradictory, but underline labour market remains tight

- Canada CPI: further fall in headline and core CPI expected, offering some solace for BoC despite relatively resilient economy

- US Housing Starts: partial reversal of unexpected February strength seen, tighter financial conditions, high inventories should temper homebuilding

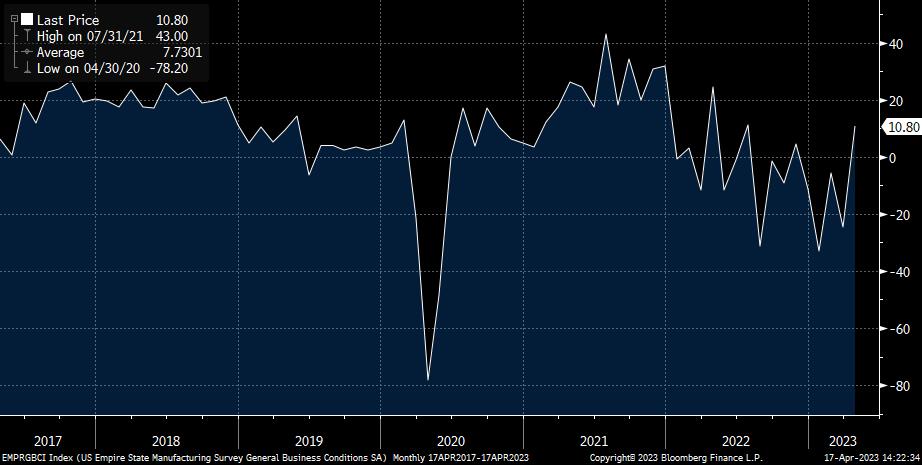

- US regional Fed surveys increasingly erratic as outlook uncertainty remains high

EVENTS PREVIEW

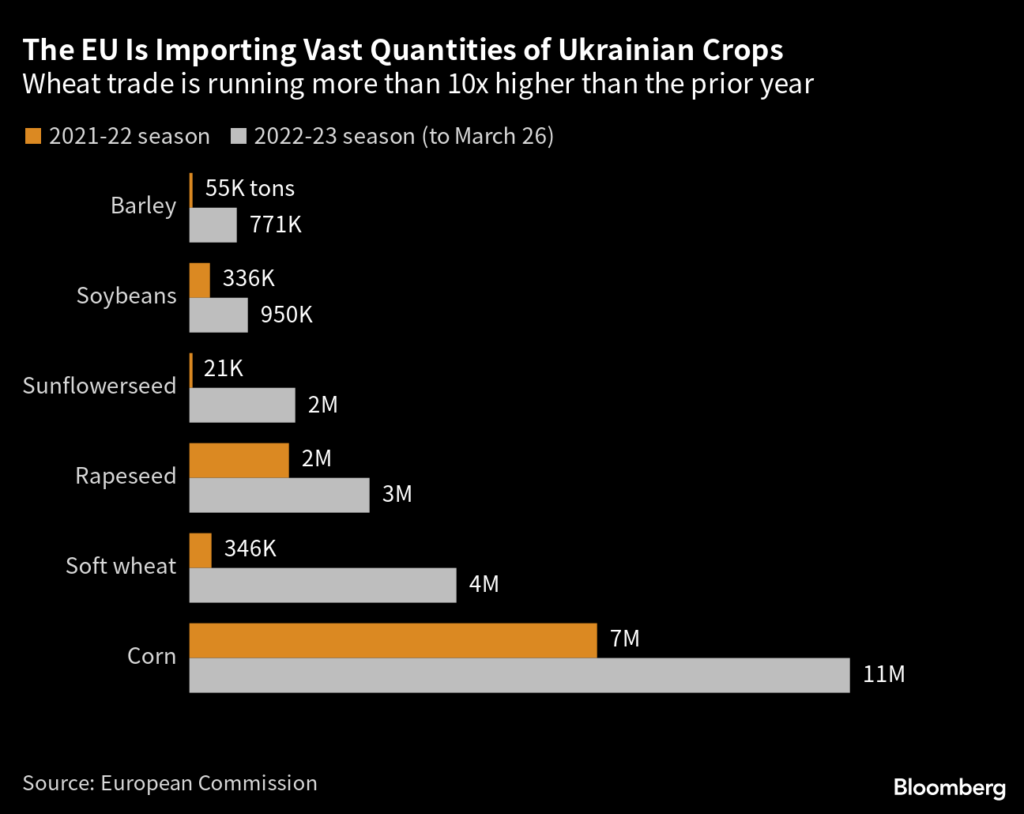

A much busier run of data, events and corporate earnings awaits, with the overnight China Q1 GDP, and monthly activity and property sector, along with UK labour data to digest. Ahead lie Eurozone and Italian Trade, Germany’s ZEW survey, US Housing Starts and NY Fed Services index, and Canadian CPI. On the central bank front, Bank Indonesia held rates as expected, with a rash of BoC, BoE, ECB and Fed speakers ahead, while a busier day for govt bond auction has Finland selling 5 & 24-yr, Netherlands 29-yr and the UK 30-yr. The US corporate earnings run has a further slew of financials via way of Goldman Sachs, Bank of America, Bank of New York Mellon, as well as Johnson & Johnson, Lockheed Martin, Netflix and United Airlines. Canada’s CPI is expected to see headline ease to 4.3% y/y from 5.2% headline, but see core measures decelerate a more modest 0.4 ppt to 4.5% and 4.4%, per se supporting the BoC’s rate pause, even if the economy has proved rather more resilient than it had anticipated. In the agricultural sector, a close eye will be kept on the bans on imports of Ukrainian grains being imposed by some CEE EU countries, as well as the uncertainty over the future of the UN Grain Corridor – just how much pressure there is from accumulated inventories from the Ukraine in the EU is all too evident from the attached Bloomberg graphic.

** China – Q1 GDP, March Retail Sales, Industrial Production & FAI **

Overall the Q1 GDP and monthly data were rather mixed with Q1 GDP (2.2% q/q vs. exp. 2.0%) and Retail Sales (10.6% y/y vs. exp. 7.5%) a good deal stronger than expected, but the latter was but very hefty base effects (March 2022 -3.5%), which will be even stronger in April, and is in any case undermined by the continued weakness in CPI, which suggests consumer demand is sluggish. By contrast, Industrial Production was rather lacklustre (3.9% vs. exp. 4.4%), and Fixed Assets Investments at 5.1% y/y missed a forecast of 5.7%. The detail of the latter underlined that strength in Infrastructure Investment (8.8% y/y) continues to see a big drag from Property Investment (-5.8% y/y vs. forecast -4.7%), while Public sector FAI at 10.0% y/y contrasts with a further modest deceleration to just 0.6%. The larger-than-expected drop in the Surveyed Unemployment Rate to 5.3% suggests official measures to boost labour demand are getting traction, but it still remains a good deal than pre-pandemic levels, per se presenting a headwind to private consumption. The litmus test on whether the recovery is sustainable, above all bearing in mind increasing concerns about local govt debt levels as well as external demand, will come in Q3, when benign base effects fade, and a clearer picture of underlying demand trends emerges.

** U.K. – Feb/Mar Labour and Wages **

The much higher than expected, though unchanged net of revisions, Headline and ex-Bonus Average Weekly Earnings at 5.9% and 6.6% y/y respectively are the headline grabber in this month’s labour report, and somewhat more concerning for the BoE given that relatively strong base effects should have been a drag on both. Barring a much sharper-than-expected drop in CPI tomorrow, it suggests that the BoE is more likely to hike at its May meeting. The Employment data were a concern by dint of the sharp contrast between the LFS data and HMRC Payrolls, with the latter posting a modest 31K rise following a sharp downward revision to February to 39K from 98K, while the LFS measure posted a bumper increase of 169K vs. expectations of 50K, though the Unemployment rate rose to 3.8% from 3.7%, with Vacancies barely changed at 1.105 Mln vs. prior 1.122 Mln. As noted in the week ahead, the BoE’s primary challenge with regards to the labour market is the fact that the key pressures are very clearly structural and not cyclical, and again highlighting how much need there is for much better coordination of monetary and fiscal policy in the UK.

** U.S.A. – March Housing Starts, April NY Fed Services Activity **

Following on from the as-expected marginal rise in the NAHB Housing Market Index, today’s Housing Starts are expected to see a partial reversal of February’s unexpected 9.8% m/m rebound, with a 3.5% m/m fall to a still respectable 1.40 Mln SAAR pace. Inventories of new homes are way above long-term averages, and the collapse of SVB and Signature Bank and the spill-over to regional banks will serve to tighten conditions for builders. The regional Fed Services surveys (NY Fed version due today) are so new that their value as service sector activity is totally untested, even if this was a relatively stable economic environment, and it will be all the more difficult to judge their value, when considers the volatility in the established Manufacturing surveys, as is all too evident in the attached chart of the NY Fed Manufacturing. The latter was prone to erratic m/m changes prior to the pandemic, but as was evident in the 35.4 point turnaround in yesterday’s April report, this has now become little more than a bellwether for the broader uncertainty about the US and global economic outlook.

To view the full report and to sign up for daily market commentary please email admisi@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.