- US Holiday to subdue trading volumes; Japan PPI, German & India WPI, China New Home Prices & MTLF Operation, Australia Inflation Gauge to digest; Canada Q4 BoC Business Survey, Manufacturing & Home Sales ahead; BoE financial stability testimony, Eurozone Finance Ministers meeting & Davos WEF

- Week Ahead: BOJ meeting, US Retail Sales, China GDP, UK CPI and labour data top busy run of data and events; Fed Beige Book, ECB minutes and raft of central bank speakers; Q4 earnings; China tops busy week for govt bond auctions

- Week Ahead – Commodities: IEA and OPEC oil market reports; Global Food and Agriculture Forum; Northern hemisphere cold weather front; BHP and Rio Tinto production report

EVENTS PREVIEW

With the US on holiday, markets are likely to get off to a subdued start, despite a relatively busy run of data and events. There is the higher than expected, but largely base effect driven Japan PPI to digest, along with the expected no change PBOC MTLF operation and a further fall in China Home Prices, Australia’s MI Inflation Gauge, Indonesia Trade, German and Indian WPI. The remainder of the data schedule is dominated by Canada, with the focus on the Q4 BoC Business Outlook Survey, accompanied Existing Home and Manufacturing Sales, with the former likely to weigh quite heavily along with Wednesday’s CPI in whether the Bank of Canada hikes rates again at its 25 January policy meeting. The Davos WEF gets underway, though there will be more interest in the BoE testimony on last year’s Gilt market debacle and the Eurozone Finance Ministers meeting. Last but not least, after a period of unseasonably warm weather, a blast of Arctic cold weather is stretching down across many parts of the northern hemisphere, bringing snow and flooding to many parts, though in many key agricultural regions lacking much in the way of precipitation.

RECAP: The Week Ahead – Preview:

The new week sees a busy run of data from China (Q4 GDP, Retail Sales, Production, FAI, Property Investment), USA (Retail Sales, Industrial Production, NY & Philly Fed Manufacturing & NAHB surveys, Housing Starts & Existing Home Sales) and the UK (Unemployment, CPI, Retail Sales), Japan (CPI, Machinery Orders & Trade), Canadian CPI, Australian Unemployment and Indian WPI and Trade. Perhaps most significantly it also sees the first BoJ policy meeting of the year, along with the Fed’s Beige Book, December ECB minutes, China MTLF and LPR fixings, many central bank speakers, Davos World Economic Forum, and a busy run of US (26 S&P 500 companies) and other Q4 earnings. Commodity markets will be focussed on the OPEC and IEA Oil market reports (particularly given the nascent recovery in crude oil prices), the Global Food and Agriculture Forum in Berlin, as well as key Q4 production reports from mining behemoths BHP and Rio Tinto. Govt bond issuance is again plentiful, and for a change is led by China via way of CNY 192 Bln of central govt and a whopping CNY 275 Bln of Munis in terms of couponed issuance. The ‘looming debt ceiling’ cap is shifting more US borrowing into T-Bills ($249 Bln total), accompanied by $12 Bln of unloved 20-yr & $17 Bln 10-yr TIPS. In Europe the UK sells 2-yr & I-L 8-yr, Germany 5-and 30-yr, with multi-tranche auctions in France (mediums & I-L) and Spain. Labour unrest remains a severe problem in UK public services (results of the teachers’ vote this week), while in France the unions will be back on the streets to protest the latest attempt by President Macron to raise the retirement age. The US Martin Luther King Day holiday on Monday, and China and East Asia’s wind down for next weekend’s Lunar Year holiday will impair trading volumes and market liquidity, and may well be a prompt for some spikey volatility.

Given that the US labour and CPI data did not really provide the ‘compelling’ evidence for an already heavily discounted Fed ‘pivot’ on rates, even if they should prompt a further tempering in the size of Fed rate hikes. Markets will be hoping that this week’s data is grist to the mill for recession chatter (rather perverse when seen in the old light of day), even if a number of forecasters have been revising estimates higher, both for the US, as well as Europe. Retail Sales are seen down 0.9% m/m, weighed down by auto sales and a steep fall in gasoline and used car prices, while the core ‘Control Group’ measure is expected at -0.4%, with retailer discounts to clear inventories seen as a drag as demand ebbs (Redbook retail sales continued to fall), with Restaurants perhaps the only bright spot (though the Services ISM fall implies downside risks). Both Industrial Production and Manufacturing Output are seen dipping (-0.1% and -0.2% m/m respectively), while the NY and Philly Fed Manufacturing surveys are likely to retain a clearly negative balance, even if modestly better than in December, details on Orders and Outlooks will be closely watched. The run of housing sector data (NAHB survey, Housing Starts and Existing Home Sales) are expected to remain very negative, as high mortgage rates and poor affordability continue to weigh, with little sign of any reprieve in the near-term. Meanwhile PPI is seen down 0.1% m/m headline and up 0.1% m/m core, with continued easing in energy and core goods prices offset by a likely slower, though still elevated rise in Services prices, per se, confirming ebbing pipeline pressures.

To some extent, this week’s run of Chinese Q4 GDP and December activity and property indicators are rather moot and historical, as the focus (and hope) for markets is the recovery in H1 2023, and further policy easing at Monday’s PBOC MTLF Operation and Friday’s Loan Prime Rate (LPR) fixings. Be that as it may, Q4 GDP is forecast to fall 1.2% q/q, dragging the y/y down to just 1.6% from Q3’s 3.9%, with 2022 GDP seen at a very lacklustre 2.7%. Retail Sales are seen sliding 9.0% from November’s -5.9%, while Industrial Production is seen almost flat at 0.1% y/y, with Fixed Asset Investment seen slowing to 5.0% y.t.d. from 5.3%, while the surveyed Unemployment is expected to edge up a further 0.1 ppt to 5.8%. Property Investment is forecast to post an accelerated fall of -10.5% y/y, with Residential Property Sales likely to contract even more sharply than November’s -28.4% y/y, underlining that restoring confidence in the sector will take time and considerable effort.

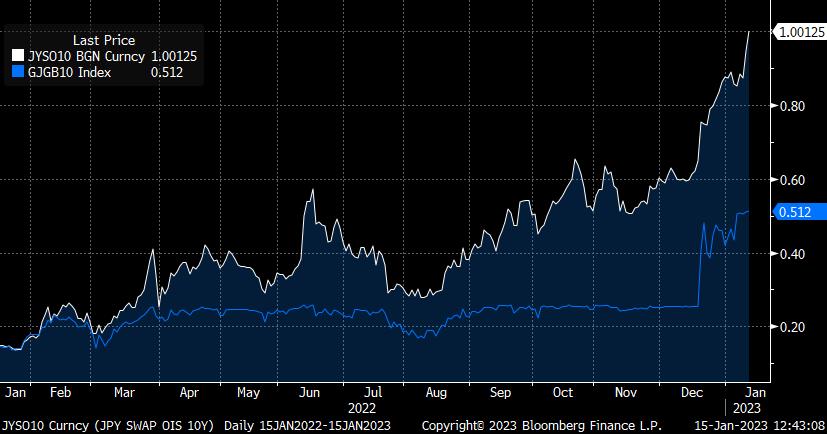

As for Japan, all eyes will be on Wednesday’s BoJ meeting, rather than the run of data, which is forecast to see a somewhat smaller trade deficit on lower energy prices, a renewed though modest slip of 1.2% m/m in the ever volatile Private Machinery Orders, and for National CPI to echo Tokyo readings, ticking up 0.2 ppt to 4.0% headline, and to 3.1% from 2.8% ex Fresh Food & Energy. The consensus expects no change in either the Call Rate or 10-yr JGB yield targets, nor any further adjustments to the bandwidth on the latter. That said, markets would appear to be discounting the risk of a further move if the pressure on 10-yr JGB yields, and a colossal widening in the 10-yr JPY OIS swap spread (see chart) are anything to go by. However the latter is far more technical than some would have us believe, and consequent on the December band widening, and testament to the fact that Japan’s money markets have been ‘cryogenically frozen’ for many years, thanks to BoJ policy. Restoring JPY money market functionality was always going to be painful, as well as sending shock waves elsewhere, and was always going to be a sine qua non before the BoJ could start to wind back its ultra-easy monetary policy. The BoJ will update its forecasts, with current FY core CPI likely to be revised up slightly from 3.9%, but the issue is whether it tweaks its forecasts up for the following 2 years from prior estimates for both of 1.6%, i.e. falling short of the 2.0% target; GDP forecasts for FY 2022 & 2023 may be tweaked modestly lower. If FY 2023 CPI forecast is revised higher (?1.8%), the BoJ may well emphasize that this is primarily due to continued supply problems, and reiterate that a shift in policy would have to see both stronger (domestic) demand and an acceleration in wage growth. Given the dislocation of JPY Swap rates relative to JGB yields, it will underline that it is monitoring and assessing related financial stability issues, but is unlikely to adopt or announce any specific measures to deal with this.

The narrative around the UK economy has calmed down from the pall of gloom during latter part of 2022. But as with the Eurozone, “not as bad as everyone was saying” does not equate to good; both the government and the economy remain fragile, with plenty of challenges ahead, with the UK events schedule starting with testimony on financial stability from BoE’s Bailey and Woods to Parliament’s Treasury Select Committee about last year’s Gilt market meltdown, due to pension funds LDI related fire sales. Following on from the mixed activity data for November, labour data kicks off this week’s statistical run, with a solid, though more modest 63K in HMRC Payrolls expected (vs. Nov 107K), with Vacancies also likely to slip, but remain far above pre-pandemic levels. The less timely LFS Employment measure is seen flatlining, with the ILO Unemployment Rate seen unchanged at 3.7%, though the focus will be on whether the prior month’s increase in the workforce was a one off, or indeed signalled an improving trend. As for the Average Weekly Earnings data, any analysis has to take very adverse base effects from 2021 need to be taken into account, i.e. from a peak of 7.3% y/y in June 2021, the core ‘ex-Bonus’ measure fell to a trough of 3.6% in December, with the fall from October to November being 4.3% to 3.8%. Thus forecast expectations of 6.2% y/y headline (vs. prior 6.1%) and ex- Bonus 6.3% y/y (vs. prior 6.1%), per se most of the increase will be base effects; to be sure wages are clearly rising at a much faster pace than pre-pandemic, but remain deeply negative in real terms. Also bear in mind the cumulative impact of the decade prior to the pandemic, in which real wage growth was flat at best, and negative for considerable periods. Wednesday’s CPI is seen up 0.3% m/m, easing the y/y rate to 10.5% from 10.7%, and much depending on how a sharp fall in petrol prices is offset by the continued pressure on Food prices, as well as ongoing upward pressures on Services, as the cumulative impact of a broad range of price increases and wages are passed through to consumers; core CPI is expected to ease only marginally to 6.2% from 6.3%. As with so many countries, the UK housing market is under pressure from rate hikes, and per se it is no surprise that the RICS House Price Balance is seen falling to -30 from -25. The week rounds off with Retail Sales and GfK Consumer Confidence, with the latter expected to edge up again to -41 from -42, but still well below the GFC and Covid-19 lows. Retail Sales are seen up 0.5% m/m, with the fact that some Black Friday sales will be included, and the fact this was the first Christmas since 2019 unimpeded by the pandemic expected to have given a boost, though rail strikes may have been a dampening offset. If forecasts are correct, then the y/y contraction would improve from -5.9% to -4.0%, but most of this will be down to flattering base effects from the -1.5% m/m fall in December 2021.

Elsewhere Monday’s Q4 Business Outlook survey and CPI on Wednesday will likely weigh quite heavily in whether the Bank of Canada hikes rates again at its 25 January policy meeting, with markets discounting an 80% probability of a further and final 25 bps hike. Much will depend on whether headline and core CPI ease more than the modest -0.1 ppt seen on the two core measures to a still very lofty 4.9% y/y and 5.2% y/y respectively. In Australia, the Unemployment Rate is seen unchanged at 3.4%, with Employment expected to slow to a more normal +25K, after jumping 64K in November.

On the central bank front outside of the BoJ meeting, the December ECB minutes will be scrutinized for some clues about the size of hikes in February and March, as will the numerous number of ECB speakers at the Davos WEF. Of particular note within the minutes will be what persuaded the hawks to back down from demanding a further 75 bps rate hike in December, with Lagarde’s comment that rates will increase at a “steady pace” perhaps indicating, perhaps offering a clue that a steady pace of 50 bps hikes through to the March meeting, barring unforeseen development, was the compromise. Otherwise Norges Bank is expected to hold rates at this week’s meeting, but hint strongly at one further rate hike by the end of Q2, while 25 bps rate hikes are seen from Bank Indonesia (5.75%) and Bank Negara Malaysia (3.0%), with Turkey’s TCMB seen holding again at 9.0%.

Among the corporate earnings highlights this week, according to Bloomberg news, will be: Asian Paints, Avenue Supermarts, Charles Schwab, Discover Financial, EQT, Fastenal, Goldman Sachs, HDFC Bank, Interactive Brokers, Investor AB, M&T Bank, Morgan Stanley, Netflix, PNC, PPG, Procter & Gamble, Prologis, Sartorius Stedim, Schlumberger, State Street, Truist Financial. The focus will remain on outlooks and margins, as well as planned buyback volumes, given that the latter has been a key prop for equities (above all US) for the best part of a decade.

To view the full report and to sign up for daily market commentary please email admisi@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.