- Focus shifts to ECB on very busy day for major data; digesting hawkish Fed pause, broadly weak China activity and property data, PBOC MTLF cut, better than expected Japan Orders, Trade and Australian Employment; awaiting US Retail Sales, Industrial Production, NY & Philly Fed surveys & Import Prices

Fed sends very clear signal of intent with larger dot plot shift, while carving out room for manoeuvre - China data again weaker than forecast across the board; sky high youth unemployment, slowing Public sector FAI and deeper fall in Property Investment underline need for fiscal support

- ECB: further rate hike ‘baked in the cake’, guidance on proximity of ‘sufficiently restrictive’, and potential downward shift in assessment of risks to growth in the spotlight

- US Retail Sales: autos to weigh on headline, but core also seen sluggish; Industrial Production, NY & Philly Fed surveys to confirm manufacturing sector downturn; PPI suggests downside risk for Import Prices

EVENTS PREVIEW

As the focus turns from the FOMC meeting to today’s ECB and tonight’s BoJ policy meetings, there is a mountain of major data for markets to get their heads around, accompanied by the EU Finance Ministers’ meeting, and govt bond auctions in France, Spain and Canada. Statistically there are the array of China activity and property indicators, Japan’s Trade and Private Machinery Orders, Australian Unemployment and Indonesian Trade to digest, along with the expected 10 bps cut to the PBOC’s 1-yr MTLF rate. Ahead lie Indian Trade, US Retail Sales, Industrial Production, Import prices, NY & Philly Fed Manufacturing surveys, weekly jobless claims and Business Inventories, while Canada looks to Manufacturing Sales, Housing Starts and Existing Home Sales. Barring genuine outliers, there is a risk that much of the data ends up being little more statistical roadkill, with reaction primarily influenced by (often self-serving) views on central bank policy outlooks, and potential divergences going forward. In that vein, tonight’s BoJ policy meeting is not expected to see any changes to its ultra-easy monetary policy, but markets remain very wary that at some point, a shift may be hinted at that could send enormous shockwaves, as the example of December’s YCC target widening more than amply demonstrated, and above all given the subdued levels of current volatility (above all VIX, and to an extent even the US Treasury MOVE index).

** U.S.A. – FOMC meeting **

The Fed paused its rate hikes for the first since March 2022, but its “dot plot” was shifted higher to factor in two further rate hikes, rather than the one that had been anticipated, and in so doing sent a clearly hawkish signal, as well as carving out room for manoeuvre if incoming data justify a more extended pause, but in no way leaving its hostage to any misinterpretations about the pause. Its economic projections saw 2023 GDP growth revised up a lot more than many expected, though at 1.0% vs. prior 0.4%, growth would still remain tepid. Core PCE is now forecast at 3.9% vs. prior 3.6% in 2023, with 2024 held at 2.6%, and 2025 revised up marginally to 2.2%, while 2023 Unemployment is now seen at 4.1% vs. prior 4.5%, with 2024 & 2025 projections revised down 0.1 ppt to 4.5%. The statement had few changes, other than adjustments to reflect the pause in rate hikes, and the lack of dissent sent a renewed statement of intent on continuing to fight inflation, no ifs, no buts, and there was particular emphasis on core PCE ‘moving down decisively’. Nevertheless, markets continue to price in only one more rate hike, and a 20% chance of a further hike, and a 60% chance of a rate cut by year end.

** China – May Retail Sales, Industrial Production, FAI & Property data **

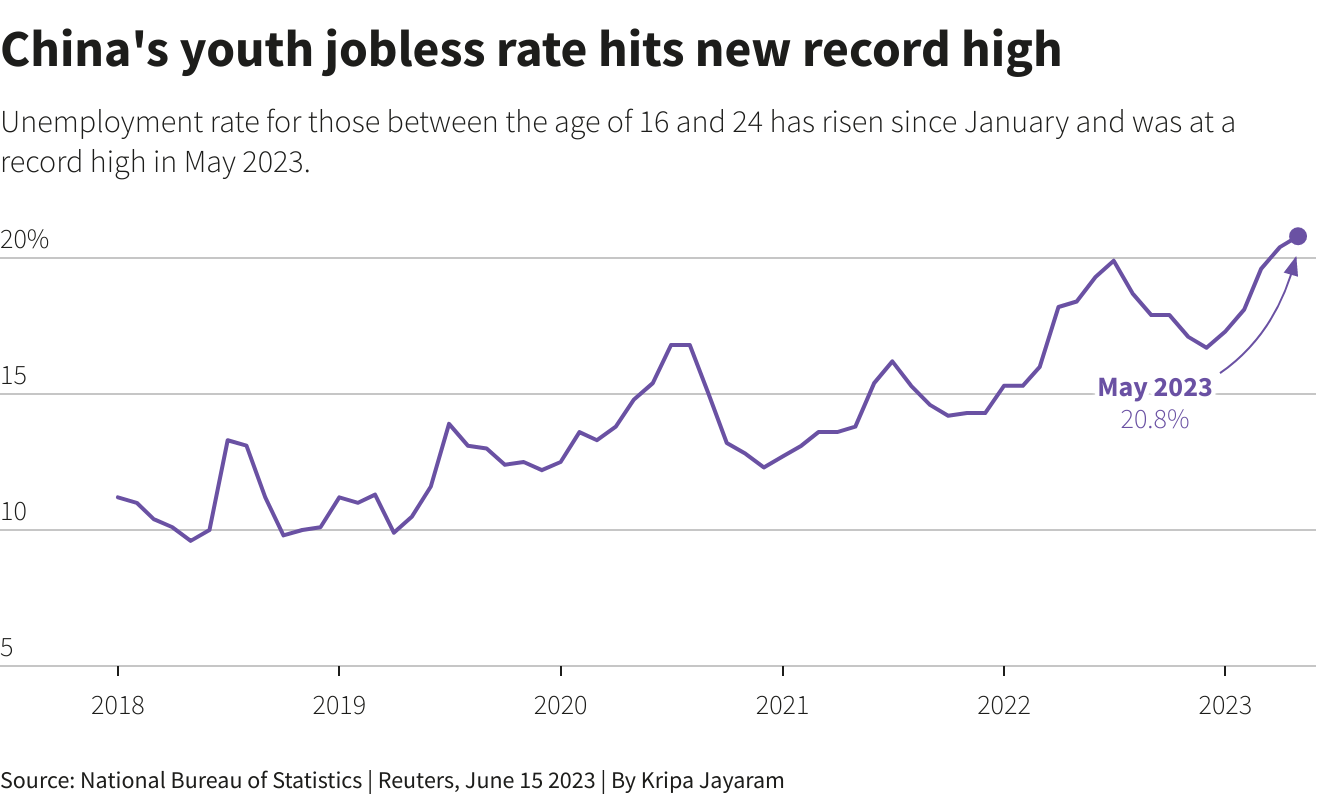

The PBOC’s anticipated 10 bps cut to its 1-yr MTLF was in effect an acknowledgement of the run of activity data, which again missed forecasts across the board, with Industrial Production at best tepid at 3.5% y/y, and Retail Sales at 12.5% y/y heavily flattered by base effects. Perhaps of more concern was the miss Fixed Assets Investment at 4.0%, with Private FAI registering a drop of 0.1% y/y, and Public FAI decelerating to 8.4% y/y from 9.4%, despite all the front loading of local government borrowing. While headline Unemployment was unchanged at 5.2% as expected, youth Unemployment hit a new record high of 20.8% (see chart), which will continue to send alarm bells to Chinese authorities. This along with the Property sector woes (Investment worse than expected at -7.2%) will have to be front and centre of any fiscal package to boost the sluggish economy.

** Eurozone – ECB rate decision**

The ECB is expected to deliver another 25 bps hike to 3.50% Depo and 4.0% Refi, but the focus will be on the statement guidance and the updated staff economic forecasts. If, as many anticipate, forecasts for 2024 and 2025 inflation and growth are revised down (though 2023 may be revised slightly higher), to a large extent acknowledging recent data, then this will likely reinforce the view that the ECB will pause after one final further rate hike in July. They will however be cautious in signalling an end to rate hikes, knowing that both June and July are likely to see some renewed upward on core CPI (above all from travel), and likely note there remain upside risks on inflation, even if the cumulative impact of their rate hikes is still ‘work in progress’. The question is whether Lagarde offers any comments on how close rates are to being ‘sufficiently restrictive’, and whether the obvious headwinds to growth feature more prominently, and prompting a switch from growth risks being characterized as balanced (May) and now being to the downside.

** U.S.A. May Retail Sales, Industrial Production, June NY & Philly Fed surveys **

The reversal down in June Auto Sales (15.1 Mln SAAR vs. prior 15.9 Mln)will weigh on headline Retail Sales (exp. -0.2% m/m), while core measures are seen up 0.2% m/m, though this is in part a reflection of a shift back to greater spending on services (only restaurants & bars feature in Retail Sales), and away from Goods. Industrial Production and Manufacturing Output are seen little changed, with weekly jobless claims expected to ease back to 250K after last week’s sharp jump, with unseasonal retooling closures in the auto sector, and fraudulent activity said to have exaggerated the prior week’s surge. The NY and Philly Fed surveys are forecast to show both in recession territory, even if the very wild m/m changes in the NY survey undermine its credibility. Import Prices round off this week’s run of inflation data, with energy prices set to drag on the headline, seen at -0.5% m/m, though the ex-Petroleum is also seen slipping -0.1% m/m, with yesterday’s PPI imparting a downside risk.

To view the full report and to sign up for daily market commentary please email admisi@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 02547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2025 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.

Latest News & Market Commentary

ADM & Industry News

The Ghost in the Machine Q3 2025

October 6, 2025

ADM Exceeds 5M Regenerative Agriculture Acreage Gal

September 9, 2025