- FOMC meeting centre stage, as UK GDP and activity data, higher than expected Swedish CPI, German and India WPI are digested; US PPI, Brazil Retail Sales and IEA Oil Market report ahead; German 10-yr sale

- UK April GDP: few surprises as retail and Films/TV pace Services rebound, Manufacturing & Construction drop, focus shifting swiftly to next week’s key CPI ahead of MPC rate decision

- Fed rate decision: CPI data offer sufficient rationale for pause; dot plot, growth and inflation forecasts likely revised up; tricky balancing act for Powell & Co to avoid markets thinking ‘pivot’ in reaction to ‘pause’

- US PPI expected to underline very modest pipeline pressures

Recording of today’s Daily Energy Podcast

EVENTS PREVIEW

The FOMC rate decision and press conference will likely render much of the remaining data and events moot, though UK monthly GDP and Swedish CPI will have an impact on their respective domestic markets. There are German and Indian WPI to digest, with US PPI and Brazilian Retail Sales ahead, along with the last of this month’s Oil Market reports from the IEA. A light day for govt bond issuance sees Germany sell 10-yr, while homebuilder Lennar is the highlight on the corporate earnings calendar. Yesterday’s sharp about turn in US Treasury yields which initially feel in reaction to CPI, but quickly reversed, underlines poor underlying liquidity conditions, as well as the risk of some spiky volatility after the FOMC decision.

** U.K. – April GDP and activity indicators **

There were very few surprises in today’s data, with both monthly GDP and Index of Services exactly as expected, though the detail reveals that strength in retail and the TV/Film sector offsetting a small drag (-0.07 ppt) from health, the latter due to strikes; manufacturing and Construction were also a drag. But given the much stronger than expected rise in basic wages seen in yesterday’s labour report, today’s activity data will be a minor consideration in next week’s MPC rate decision, at which markets now see a risk of a 50 bps hike, with next week’s CPI data now the key factor.

** U.S.A. – FOMC meeting / PPI **

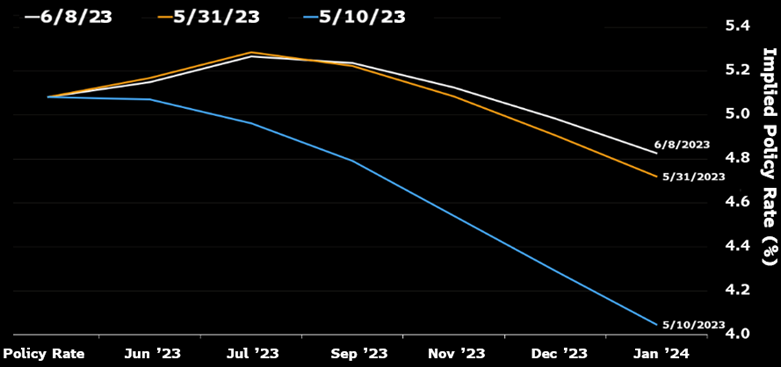

Yesterday’s CPI was mixed with headline a tad below forecasts at 4.0% y/y, while core CPI slipped slightly less than expected to 5.3% y/y, though the core Services ex-Housing sub-index encouragingly dropped to 4.6% y/y, with higher than expected OER (housing) and a sharp jump in Used Auto Prices accounting for much of the headline core CPI pressure. That outcome should be sufficient for the Fed to justify a widely discounted decision to keep rates unchanged (at 5.00/5.25%) for the first time since the Fed started hiking rates in March 2022. Nevertheless, the latest ‘dot plot’ and Powell’s press conference are expected to hint at a July rate hike. The committee’s forecasts are also likely to see marginal upward revisions to growth and inflation forecasts, and a downward revision to Unemployment. Watch out for potential for some dissent on the rate vote, with both Bowman and Kashkari recently suggesting that the case for a pause had as yet not been made. While markets have back reversed much of the rate pivot that had been anticipated in April, and continue to anticipate the risk of rate hike in July (see chart), but still look for a rate cut by year end. What Powell and the FOMC will wish to avoid is markets ‘misinterpreting a pause’ as a pivot signal, and this will be their biggest challenge. It could if it chooses lean on the second policy target, namely Employment, emphasizing that labour demand remains very robust, and the economy relatively resilient, and that this continues to pose an upside risk on inflation going forward, and rules out a pivot well into next year, though this would leave it hostage to fortune, in a which ‘data dependent’ does not. PPI is likely to underscore the already evident diminishing pipeline pressures, with headline expected to fall to 1.5% y/y from 2.3%, and ex-Food, Energy & Trade to 3.0% y/y from 3.4%.

To view the full report and to sign up for daily market commentary please email admisi@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 02547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2025 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.