Very light day for data and events, digesting Japan PPI & monthly Tankan, Australia Wage Price Index and final Eurozone national HICP readings; awaiting Fed speakers, BoC minutes and IEA monthly oil market report.

- U.S.A.: subdued US Goods CPI hardly a cause for celebration, as Services CPI ex Housing implies core CPI not trending towards Fed 2.0% target, suggests speculation about 50 bps Fed September rate out of place

- Low rates and bond volatility fuelling risk appetite, but perception vs. reality starting to look chasm-like

EVENTS PREVIEW

There is little on the data schedule that will trouble summer markets, with Japan’s PPI and Australia’s Q2 Wage Price Index to digest and nothing of significance ahead. The IEA rounds off this week’s round of monthly oil market reports, and will also publish its annual energy market statistical supplement. The Bank of Canada’s July policy meeting minutes are accompanied by some further Fed speakers.

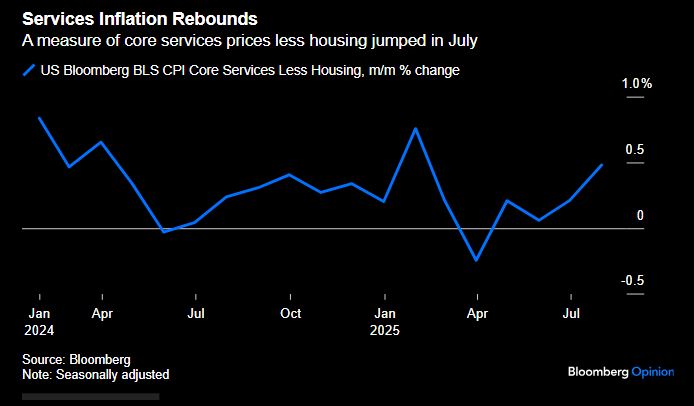

Yesterday’s US CPI has been construed as confirming the likelihood of a Fed rate cut in September, and yet core CPI was slightly above expectations 0.3% m/m and a very lofty 3.1% y/y (relative to target). While good price inflation remained relatively subdued, which some will interpret as signalling a modest impact from tariffs, it remains the case that the impact of tariffs, which has been persistently delayed, will only start to meaningfully show up in coming months. Rather more worryingly, especially for the likes of the dissenting Waller (Bowman’s case appears to rest far more on the labour data – i.e. the data for which the head of the BLS was ‘fired’) is the upturn in Services CPI (0.3% m/m 3.8% y/y), above all ex-Housing at 0.5% m/m. To be sure Airfares (4.0% m/m) had a sharp impact, but as the attached chart highlights, the seasonal trend is running a good deal higher than in 2024, and it would be disingenuous to suggest that it is consistent with core CPI converging to the Fed’s 2.0% target. Be that as it may, risk assets, above all equities, celebrated this with a move to new highs in many cases. The latter is being given extra rocket fuel by speculation about a potential 50 bps rate cut in September, presumably partially rationalised by Miran’s temporary appointment to the FOMC. The case against 50 bps primarily boils down to last year’s 50 bps cut having been a mistake, above all due to FOMC members over-interpreting the transient weakness in labour demand last summer (sic! Ed.), which one might add probably contributed to the extended pause in rate cuts this year. Be that as it may, the other key drivers of the current rally, aside from Q2 earnings (above all Mag 7) is very subdued interest rate volatility. As can be seen both in the chart of the narrow range in which the Dec 2025 SOFR future has traded over recent months, and over the year to date as a whole compared to the 2024 rate expectations roller coaster, and the very low level of the MOVE Treasury volatility index, which is in turn helping to keep the VIX subdued. Of course what is missing from this rationale is any discussion of tariffs, geopolitical tensions, uncertainty, policy ambiguity, or political interference in monetary policy, which fits with markets whose reaction function has been severely impaired (above all by QE liquidity, which has not risen this year despite QT programmes), and is largely reliant on momentum trades, with the derivatives tail very much ‘wagging the dog’. This is a classic example of a perception vs. reality divide that has a tendency to unravel in a disorderly fashion, though the degree generally varies according to happenstance, the worst example being the GFC.

To view the full report and to sign up for daily market commentary please email admisi@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 02547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2025 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.

Latest News & Market Commentary

ADM & Industry News

The Ghost in the Machine Q3 2025

October 6, 2025

ADM Exceeds 5M Regenerative Agriculture Acreage Gal

September 9, 2025