Busier day for statistics with German Orders, French Industrial Production and Europe Services PMIs to digest ahead of US ADP Employment and Services ISM; US election day results in view as SCOTUS starts to hear arguments on IEEPA tariffs class action case, with wary eyes on tech sector equity market wobble.

Eurozone: German Orders, French Production, most Services PMIs offer some brighter signals on economic outlook, though many other challenges remain.

USA: ADP Employment seen posting very modest gain, but positive outturn probably enough to steel numerous Fed dissenters on further rate cuts.

EVENTS PREVIEW

The aftermath of US election Tuesday may prove to be the key theme for the day, as Republicans and Democrats weigh up whether the results (a clean sweep for the Democrats) behove them to start getting serious about a compromise to end the US government shutdown, or dig in deeper (notably the CBO now estimates that if the shutdown runs to a toral of 8 weeks from the current 5 then it could knock Q4 GDP down by 2.0 ppts). The US Supreme Court (aka SCOTUS) begins its hearing arguments on the legality of about 60% of trade tariffs, which in truth is less about the tariffs themselves, which largely rely on the International Emergency Economic Powers Act (IIEPA) of 1977, the cumulation of various legislative measures following the 1971 ‘Nixon Shock’, but rather about the limits (or seeming lack thereof) of the executive powers of the presidency. There is no timetable for a ruling; it may take many weeks, but if it does rule against these tariffs, it will be the most constitutionally significant ruling since 1952 when SCOTUS blocked a Truman administration move to nationalise a steel company during the Korean War. Be that as it may, Sweden’s Riksbank, Poland’s NBP and Brazil’s COPOM are all expected to hold rates at their policy meetings, while Services PMIs, US ADP Employment, German Factory Orders and French Industrial Production top the statistical agenda. Corporate earnings are again plentiful, with Asia looking to Mitsubishi Motors, Mitsui & CO, Softbank, Toyota Motor, as Europe focuses on BMQ, Marks & Spencer, Novo Nordisk, Orsted, Telecom Italia, Verbund and Vestas. Across the pond, Albermarle, Bunge Global, Fidelity and Qualcomm are among those that will attract attention.

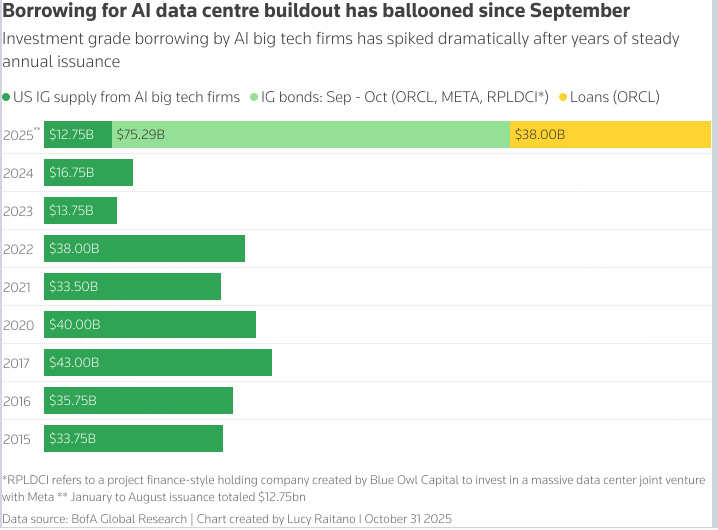

The other talking point will be the sell-off in tech stocks, which has occurred despite generally better than expected earnings reports, but with AI investment spending skyrocketing (see chart), and Mag7 corporate borrowing ballooning (as per mega issuance from Meta and Alphabet in the past week), and free cash flow sliding rapidly, current valuations look all the more challenging. For the time being, this has the hallmarks of a correction rather than a major risk-off cycle. But as ever, it is how this may impact heavily leveraged positions, and the knock-on effects into illiquid private credit markets, particularly given that cash buffers (outside of Berkshire Hathaway) are very low, which will determine how much damage to risk appetite there will be.

Souorce: BoFA Global Research/Chart created by Lucy Raitano at Reuters.

In terms of the overnight news, there was better news on German Orders, but this was still only the first rise in 5 months, while the m/m pick-up in French Industrial Production still leaves output flat for the quarter. Rather more encouraging was the substantial rises in Italian and Spanish Services PMIs echoing the confirmed jump in Germany, even if France remains in contraction (unsurprising given the level of political uncertainty), but it will only strengthen the ECB’s view that current policy settings are ‘appropriate’. By contrast, China’s RatingDog Services PMI dipped as expected, with the primary drag coming from a contraction in export orders, and an accelerated drop in the Employment sub-index, and reinforcing the view that domestic demand needs a big boost, and quickly. But markets, above all commodities, will be more focussed on China’s follow-up announcement and measures to last week’s trade truce extension with the US, which are proving to be much less ‘gung-ho’ than the US govt statements – the primary questions relate to whether the announced Soybean purchases are anything more than a political gesture, and whether the chatter around China making enquiries about purchasing US Wheat actually turn into actual orders. Metals also took heart from the trade truce, but other news on consolidating domestic output in copper and aluminium, along with long standing issues in the steel sector, suggest that the trade truce short-covering rally in commodities may need some further positive news to really get some additional traction. Over in the US, the line-up of dissenters on a further Fed rate cut continues to impress, and in the absence of US payrolls or JOLTS Job Openings, this puts the focus on today’s ADP, where a modest, even meagre 30K increase is expected. But with inflation elevated and underlying growth fairly solid, the dissenters will likely suggest that the weakness in labour demand does not warrant further policy easing. Otherwise, the focus will be on the Services ISM, that is expected to pick up modestly to 50.8 from 50.0, with a word of warning that m/m fluctuations in the Employment sub-index have a long track record of not being correlated with Payrolls.

To view the full report and to sign up for daily market commentary please email admisi@admisi.com

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 02547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2025 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.

Latest News & Market Commentary

ADM & Industry News

The Ghost in the Machine Q3 2025

October 6, 2025

ADM Exceeds 5M Regenerative Agriculture Acreage Gal

September 9, 2025