Good Morning: The Long & the Short of it and The Bigger Picture

Written by Marc Ostwald, ADMISI’s Global Strategist & Chief Economist

- US election cliff hanger continues to dominate; digesting Japan Wages & Spending, German Production & unsurprising FOMC meeting & RBA SOMP; awaiting US & Canada labour data, smattering of central bank speakers as infection rates continue to escalate

- US election: market reaction less a function of gridlock, and far more due to incessant chop of options related flows

- US labour data: payrolls growth & unemployment rate fall seen slowing; seasonal adjustment, rising permanent layoffs and ADP suggest downside risks

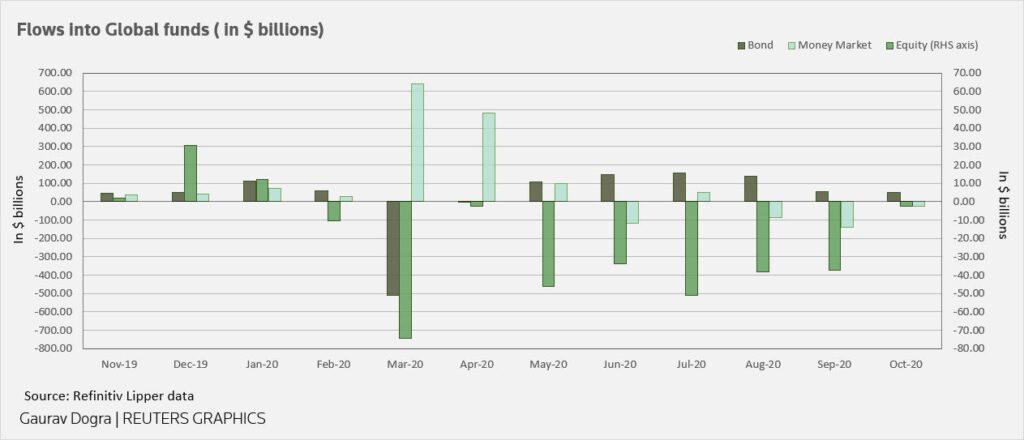

- Chart: Lipper US fund flows

EVENTS PREVIEW

Another turbulent week draws to a close, and the hope that a curtain can be drawn on the US election drama, even if this may be a forlorn hope given the likely equally forlorn legal challenges being tabled by the Trump campaign, and even if this is resolved, spiralling infection rates will continue to cast something of a pall. Indeed the observation which has been made by a number of commentators about equity market reaction to the US election that it really has little to do with the imputed results, nor even the chances of a fresh US stimulus package, but rather with traders hedging short-dated options flows – again a reminder that much of that excess central bank liquidity continues to be spun around the unreal world of financial markets, and rarely reaches the real economy. Be that as it may, there are some data snippets including the US monthly labour market report and indeed Canada’s equivalent, which follow on from Japan’s Labour Cash Earnings & Household Spending, German Industrial Production and French Trade, and the wholly unsurprising FOMC meeting and press conference. There are more corporate earnings to digest, with a sprinkling of G7 central banks speakers also on hand, but whether any of this really has a sustained impact on markets is highly debatable, given that derivative flows continue to be the proverbial tail that wags the cash and index dog.

U.S.A. – October Payrolls / Unemployment

– While the ADP report has been a very poor guide to the official Payrolls over the year, the broad based loss of momentum in hiring, across many sectors and business sizes, would appear to it with the idea that a combination of a renewed rise in infection rates, political uncertainty (above all the failure to pass a fiscal support package). The consensus looks for a 593K rise in headline Payrolls (vs Sept 661K), and a stronger 685K rise in Private Payrolls (Sept 877K), with the assumption that census related hiring will likely tail off and weigh on headline Payrolls. The seasonal adjustment for October assumes a strong level of holiday (Thanksgiving) related hiring, which will likely prove to be rather sluggish this year, above all given that rebound in infection rates, and imparts some downside risk. The rising volume of layoffs, above all at larger companies, also puts the focus on the pendulum swing from temporary to permanent layoffs. While the Unemployment Rate continues to paint a deceptive picture, due to misclassification issues, the loss of momentum in the labour market rebound is expected to be confirmed via a dip to 7.7% from September’s 7.9%, and the Underemployment Rate (last 12.8%) will again require attention. Average Weekly Hours are for the time being of greater importance than the heavily distorted wages data, and are forecast to remain high at 34.7, on a combination of efforts to rebuild inventories to meet pent-up demand in the manufacturing sector, and with employers favouring longer hours for existing employees than hiring new staff, above all given the myriad of uncertainties.

To view the full report and to sign up for daily market commentary please email admisi@admisi.com

The information within this publication has been compiled for general purposes only. Although every attempt has been made to ensure the accuracy of the information, ADM Investor Services International Limited (ADMISI) assumes no responsibility for any errors or omissions and will not update it. The views in this publication reflect solely those of the authors and not necessarily those of ADMISI or its affiliated institutions. This publication and information herein should not be considered investment advice nor an offer to sell or an invitation to invest in any products mentioned by ADMISI.

© 2020 ADM Investor Services International Limited.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.