Good Morning: The Long & the Short of it and The Bigger Picture

Written by Marc Ostwald, ADMISI’s Global Strategist & Chief Economist

- Digesting mixed China Q3 GDP and monthly activity data, Japan Trade, awaiting US NAHB Index; very busy day for central bank speakers as OPEC+ holds production review meeting; Pelosi comments on stimulus bill, and a degree of rapprochement in Brexit talks the focal points

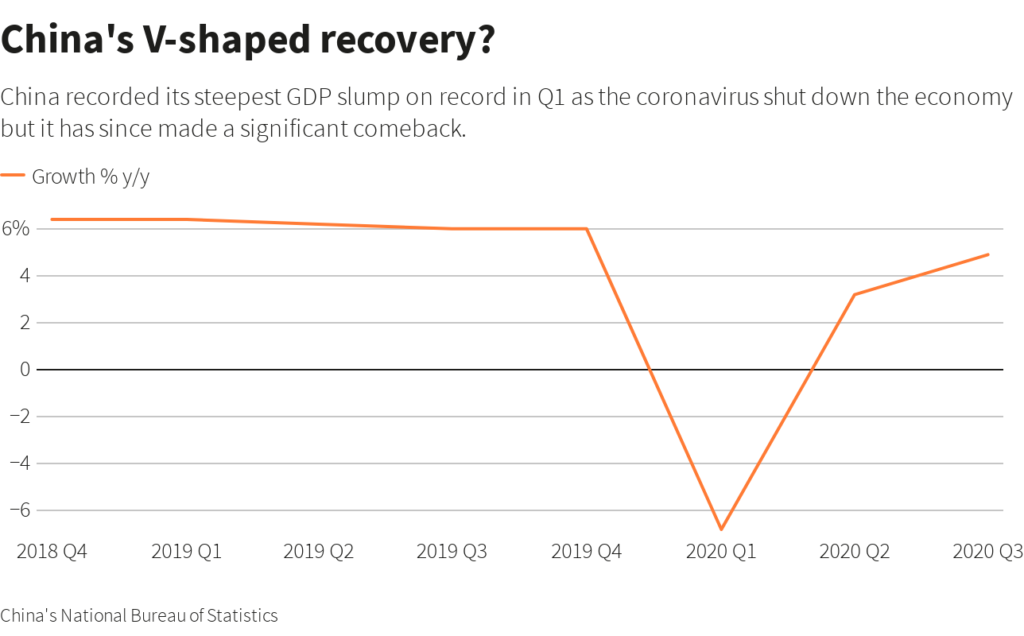

- China Q3 GDP misses forecasts, but still indicative of solid if still] patchy recovery: Retail Sales jump, Unemployment fall imply broader recovery in Q4

- US NAHB Housing Index: seen holding 35 year high, some modest downside risks given flattening of mortgage applications

- Chart: China GDP

EVENTS PREVIEW

A very busy schedule of data and events awaits, even if the bulk of the data highlights were published overnight, via way of China’s Q3 GDP and monthly activity indicators and Japanese trade, with US’ NAHB Housing Market Index the only statistical item of note ahead, along with Canada’s BoC Business Outlook survey. The events schedule is replete with central bank speakers, many speaking at the IMF payments conference, while OPEC+ hold an interim review meeting on production caps and near-term demand outlook (see Week Ahead preview below). Halliburton and IBM are likely to be the headline grabbers in terms of corporate earnings. In terms of the Brexit knife edge, the controversial Internal Markets Bill will be debated in the House of Lords, and will also be the subject talks between UK’s Gove and EC’s Sefcovic today, as both sides appear to be trying to tone down last week’s antagonistic rhetoric. The NAHB Housing Market Index is expected to hold at an over 35-yr high of 83, having rebounded from an 8-yr low of 30 in April, with risks perhaps to the downside of the consensus after such a steep rise, above all given the flattening of MBS Mortgage Applications in recent weeks; it would nevertheless confirm yet gain that the housing market is the biggest bright spot in the US economy. But for markets Pelosi’s expressed optimism on the passage of a stimulus bill before the elections will be the key short-term prop, as will some indications of rapprochement between the UK and EU on Brexit talks.

China – Q3 GDP, FAI, Industrial Production & Retail Sales

– Perspective is as ever everything with China’s data (leaving side deep seated credibility questions). Thus the lower than expected 2.7% q/q 4.9% y/y as against forecast 3.3% / 5.5% will disappoint some, but remains indicative of a solid recovery. The drag on GDP came unsurprisingly from the much slower recovery in Services, though anecdotal evidence points to an acceleration in Q4, perhaps more surprising was the rather tepid expansion in infrastructure spending given the hefty volume of fiscal stimulus and regional govt borrowing. As for the monthly indicators, Retail Sales bounced more than expected at 3.3% y/y (f’cast 1.6%, Aug 0.5%), and should accelerate further in October on the back of strong Golden Week holiday spending. Industrial Production (6.9% y/y vs. f’cast 5.8%, Aug 5.6%) continued to lead the recovery, though momentum will likely slow somewhat in Q4, but that will be offset by an acceleration in services, with the slightly larger than expected drop in the Surveyed Unemployment Rate to 5.4% from 5.6% suggesting that labour demand is starting to revive meaningfully, and per se modes well for Personal Consumption in Q4.

RECAP: The Week Ahead – Preview:

A new week arrives, but the challenges for markets remain familiar: an array of conflicting inputs and a wall of economic and political uncertainty, tempered by the hope of a vaccine (Pfizer’s news on Friday managing to sweep away the disappointments over J&J and Eli Lllly’s testing suspensions earlier in the week) and the ocean of central bank liquidity backstops (see below). The week’s schedule sees a mixed bag of data in significance terms, with China’s Q3 GDP and run of monthly activity indicators topping the bill, while the US has the Fed’s Beige Book and various housing indicators, the UK looks to inflation and budget data, Japan has Trade, the Eurozone has surveys, with Canada awaits CPI and Retail Sales. The final US presidential TV debate is accompanied by numerous central bank speakers and EM central bank policy meetings, while the US Q3 earnings season cranks into full gear. The govt bond auction schedule is very light in the Eurozone, while the UK sells £4.6 Bln in 3 auctions, and the US has 20-yr T-Bond and 5-yr TIPS sales. The OPEC+ meeting will review production plans, and the annual LME week meeting goes virtual; markets are expecting current OPEC+ production limits to be maintained, rather than loosened, though there appears to be the usual push back by Russia (wanting to increase production). The Brexit brinkmanship stand-off will of course be the other point of focus, with still few signs that the gap between the two sides can be bridged, above all given a deep seated rhetoric of mutual mistrust, though this sort of ultra-high stakes endgame has been seemingly inevitable, in light of the very tortuous record of the past four years. Markets continue to err on the side of expecting some form of last minute deal, however narrow, even if this is far from assured.

– The China Q3 GDP and monthly activity data get the week under way, and are forecast to show a moderation in Q3 GDP to a still very robust 3.3% q/q (Q2 11.5%), which would pick the y/y rate up to 5.5% from 5.3%, and edge year to date GDP into positive territory at 0.7% y/y from Q2’s -1.6%, confirming China as way ahead other major economies in terms of the recovery. Monthly indicators are however set to underline the patchy nature of the recovery, with Industrial Production accelerating modestly in y/y terms to 5.8%, and 1.0% from 0.5% y.t.d., while Retail Sales are seen picking from up 0.5% to 1.0% y/y, but still -7.4% y/y (prior -8.6%), October should see a more market improvement if anecdotal evidence about Golden Week holiday spending is any guide. For all of the fiscal pump priming that has been seen, Fixed Asset Investment is projected at 0.9% y.t.d from -0.3%, and the Surveyed Unemployment Rate is expected to remain elevated at 5.5%, relative to an average 4.5% pre-pandemic. Per se it should serve to underpin CNY strength, and inflows into Chinese assets, but next week’s Communist Party Congress (26-29) with the 2021-2025 five year plan will perhaps be more significant in outlook terms.

Elsewhere, Japan’s Trade data are expected to show Exports still in negative territory, but to show a sharp improvement form August’s -14.6% y/y to -2.5%, though Imports are seen contracting at -21.5% y/y vs. August -20.8%. The array of US housing sector indicators are forecast to remain very robust across the board – NAHB holding record high, Housing Starts up 2.8% m/m to a very strong 1.455 Mln SAAR, and Existing Home Sales accelerating 5.0% m/m to 6.30 Mln SAAR. UK inflation data are likely to pick up, but still remain far below the BoE’s target, CPI 0.6% from 0.2% y/y and core at 1.3% from 0.9% y/y, with PPI seen confirming the lack of pipeline pressures, though a ‘hard’ Brexit would almost certainly give a substantial boost in Q1 2021 due to inevitable supply chain disruptions and tariffs. That said, the impact from this combined with the current Covid-19 activity restrictions on both growth and above all Unemployment would render any spike in inflation rather moot. UK Retail Sales are expected to sustain the strong recovery seen in recent months, seen up 0.4% m/m to push the y/y rate up to 5.0% from 4.3%, though the details will inevitably highlight quite hefty divergences in sector terms, and perhaps a modest boost from stockpiling in anticipation of movement restrictions (but small by comparison to end Q1). G7 flash PMIs are expected to see little change in Manufacturing readings, though Japan should edge up closer to or above the 50.0 level if the latest monthly Tankan is any guide, but Services PMIs are expected to remain in the contractionary zone in the Eurozone, and drop back to 53.4 from 56.1 in the UK (with risks to the downside given that inflection points tend to be heavily amplified in the UK), while US readings for both sectors are forecast to be little changed at solid levels.

Central bank speakers are again very plentiful across the G7, though by their own admission, there is little that they can do to fight the economic fall-out from the pandemic other than ensure that financial conditions remain stable, even if very uneven in terms of availability for both businesses and consumers. The Fed’s Beige Book should offer some insights on that issue, as well as the extent of concerns about the Capitol Hill gridlock on a stimulus package, and the impact on labour demand and corporate outlooks. But the most significant interventions by Fed speakers in recent days have been Mester’s speech on Friday in the context of the Cleveland Fed’s annual US payments systems report (https://nam02.safelinks.protection.outlook.com/?url=https%3A%2F%2Ft.co%2F0WkTmWjcCP%3Famp%3D1&data=04%7C01%7CMegan.Hodgson%40admisi.com%7C1e72f01419e347e9a42008d87405cffe%7C2f55bf3242d444b3a8c2930ac8b182b2%7C0%7C0%7C637386915620497010%7CUnknown%7CTWFpbGZsb3d8eyJWIjoiMC4wLjAwMDAiLCJQIjoiV2luMzIiLCJBTiI6Ik1haWwiLCJXVCI6Mn0%3D%7C1000&sdata=NQOKqwJbC0qOP72O29KtCYLci2t%2ByZgtTXDSe9tRmLU%3D&reserved=0) which was unequivocal in supporting for speeding up research into (and creation of) central bank sponsored digital currencies, which would clearly have likely profound implications for the USD. Secondly the weekend FT interviews with Rosengren (arch hawk) and Kashkari (arch dove) calling for much tougher regulation to curb ‘excessive risk-taking’ in a (protracted) low interest rate environment, with Rosengren talking about how low for longer rates can be counter-productive, and Kashkari effectively saying that central banks continuously back stopping markets was not sustainable (‘ “As soon as there’s a risk that hits, everybody flees and the Federal Reserve has to step in and bail out that market, and that’s crazy. And we need to take a hard look at that’).

A busy week for EM central bank policy meetings will inevitably focus on Turkey and to a lesser extent Russia, though the latter is seen on hold, as are all the other central banks. As for Turkey, the pressure on the TRY and by extension the central bank due to the numerous political tensions, and the sharp erosion of FX reserves to service external debts has perhaps never been greater. The recent consolidation of the TRY is partly due to measures to choke offshore TRY liquidity, and expectations of a substantial rate this week, with the consensus looking for a 150-175 bps hike. Barring a far more aggressive move, there may be an element of ‘sell the fact’, above all given the very obvious determination of the political to continue its aggressively confrontational stance in all areas of dispute, and the ongoing woes of the economy.

The US corporate earnings season cranks into full gear, with most sectors seeing a number of majors reporting, and there is also a busy schedule in Asia and Europe. Bloomberg suggest the following will be among the highlights: Halliburton, Procter & Gamble, Lockheed Martin, UBS, Tesla, Verizon, Biogen, Snap, Travelers, Standard Bank, Chipotle, Manchester United, Intel, AT&T, Hermes, Sirius XM, Southwest Airlines, American Express, Daimler, Barclays, Netflix, IBM, Coca-Cola, Volvo, Abbott Labs, Philip Morris, Union Pacific, Ericsson, Texas Instruments and WD-40.

To view the full report and to sign up for daily market commentary please email admisi@admisi.com

The information within this publication has been compiled for general purposes only. Although every attempt has been made to ensure the accuracy of the information, ADM Investor Services International Limited (ADMISI) assumes no responsibility for any errors or omissions and will not update it. The views in this publication reflect solely those of the authors and not necessarily those of ADMISI or its affiliated institutions. This publication and information herein should not be considered investment advice nor an offer to sell or an invitation to invest in any products mentioned by ADMISI.

© 2020 ADM Investor Services International Limited.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.