SUPPLY/DEMAND REPORT HIGHLIGHTS

- USDA June supply/demand numbers as expected

- July Soybeans up on talk of increase US soybeans to Europe

- July Corn down on higher supply and lower exports

- July Wheat mixed with lower US exports vs. lower World crops.

- USDA estimated US 2022/23 soybean carryout at 230 vs 223 expected and 215 in May

- USDA estimated US 2022/23 corn carryout at 1,452 vs 1,449 expected and 1,417 in May

- USDA estimated US 2022/23 wheat carryout at 598 vs 606 expected and 598 in May

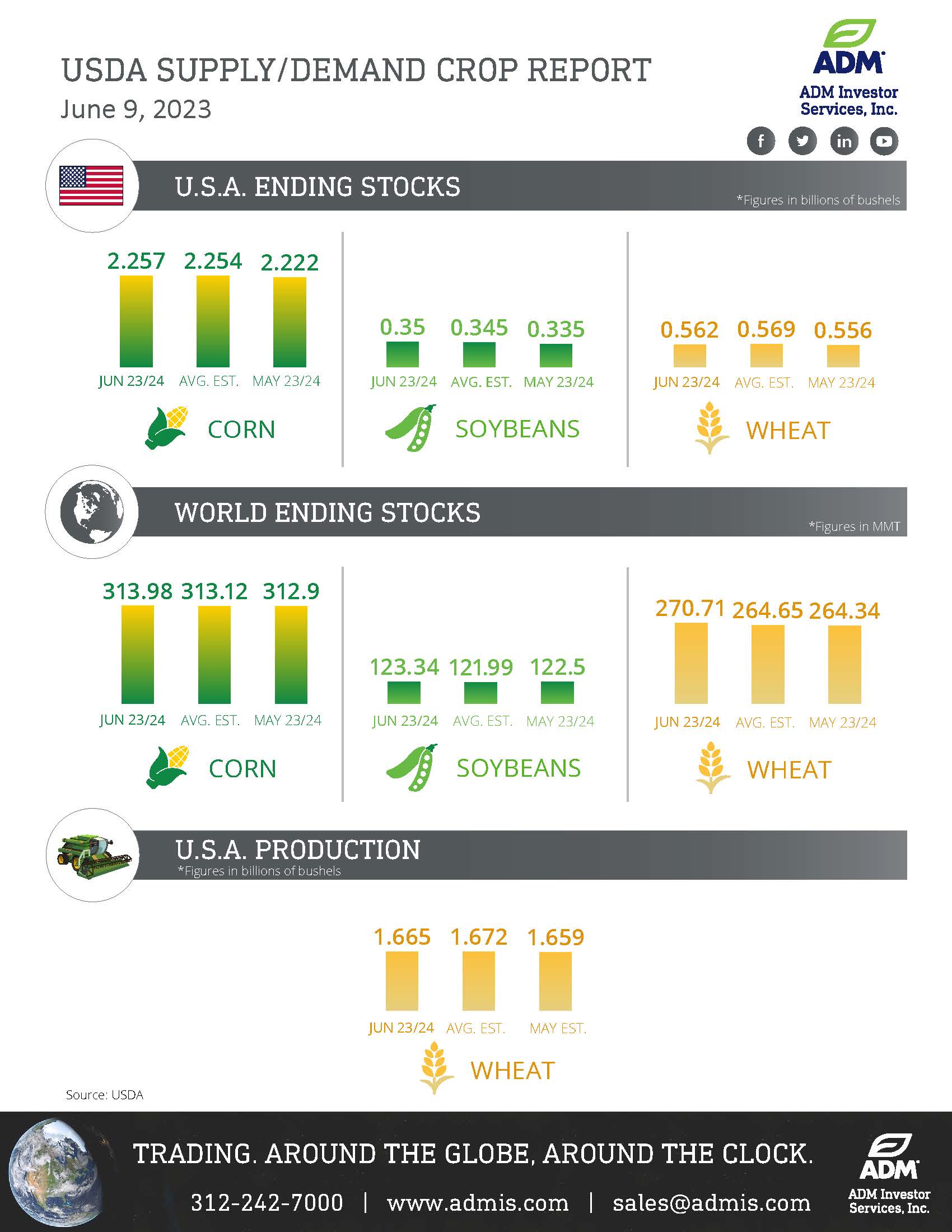

- USDA estimated US 2023/24 soybean carryout at 350 vs 345 expected and 335 in May

- USDA estimated US 2023/24 corn carryout at 2,257 vs 2,254 expected and 2,222 in May

- USDA estimated US 2023/24 wheat carryout at 562 vs 569 expected and 556 in May

- USDA estimated World 2023/24 soybean carryout at 123.3 mmt vs 122.0 expected and 100.5 last year

- USDA estimated World 2023/24 corn carryout at 314.0 mmt vs 313.1 expected and 297.6 last year

- USDA estimated World 2023/24 wheat carryout at 270.7 mmt vs 264.6 expected and 266.6 last year

- USDA estimated US 2023 wheat crop at 1,672 vs 1,650 and winter wheat 1,136 vs 1,130

- USDA estimated US 2023 HRW crop at 525 vs 514 and SRW at 401 vs 406.

Infographic

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.