TODAY—EXPORT SALES—

Overnight trade has SRW Wheat unchanged, HRW up 4 cents; HRS Wheat up 2, Corn is up 3 cents; Soybeans up 1; Soymeal unchanged, and Soyoil up 5 points.

Chinese Ag futures (May) settled up 65 yuan in soybeans, up 16 in Corn, up 62 in Soymeal, down 10 in Soyoil, and down 50 in Palm Oil.

Malaysian palm oil prices were up 93 ringgit at 3,319 (basis April) now looking at lower inventory stocks.

In Argentina, net drying is expected in much of the region through next Wednesday. There will be some increase in erratic shower and thunderstorm activity Monday through Wednesday; though, this is likely to favor the west.

In Brazil, conditions are still expected to be favorable for crops in most of the nation. Rain through next Wednesday will be notably significant from Mato Grosso through Minas Gerais and some immediate nearby areas. This will notably improve soil moisture in a large portion of the northeast.

The player sheet had funds net buyers of 1,000 SRW Wheat; bought 15,000 Corn; net bought 14,000 Soybeans; bought 6,000 lots of Soymeal, and; net bought 4,000 Soyoil.

We estimate Managed Money net long 6,000 contracts of SRW Wheat; long 401,000 Corn; net long 159,000 Soybeans; net long 75,000 lots of Soymeal, and; long 115,000 Soyoil.

Preliminary Open Interest saw SRW Wheat futures up roughly 2,800 contracts; HRW Wheat up 2,900; Corn up 16,400; Soybeans up 1,200 contracts; Soymeal up 6,200 lots, and; Soyoil up 2,200.

There were no changes in registrations—Registrations total 49 contracts for SRW Wheat; ZERO Oats; Corn ZERO; Soybeans 169; Soyoil 1,286 lots; Soymeal 175; Rice 732; HRW Wheat 91, and; HRS 1,023.

Tender Activity—Japan bought 87,000t U.S./ Canadian wheat—S. Korea bought 29,000t Australian wheat; bought 32,000t U.S. wheat —Jordan passed on 120,000t optional wheat—S. Korea seeks 140,000t optional corn—Turkey seeks 235,000t optional corn—Egypt bought 58,000t optional soyoil—Tunisia bought 36,000t optional soyoil—

US Ethanol production for the week ended Jan 29 totaled 936,000 bls per day (up 0.3% vs a week ago, down 13.4% vs a year ago); Stocks were 24.3 mil bls (up 3.0% vs a week ago, up 3.6% vs a year ago); Corn use 94.6 mil bu vs 94.3 mil last week and 94.6 mil needed to meet USDA projections.

US ethanol inventories have returned to highs last seen in the early days of the Covid-19 pandemic, according to data from the EIA. The EIA reports that ethanol inventories rose 714,000 barrels in the past week to 24.32 million barrels — the highest inventories have been since early May. The inventory build-up appears to show the effect of coronavirus on people using their vehicles regularly. Meanwhile, ethanol production only inched up 3,000 barrels daily to 936,000 barrels per day.

US President Joe Biden’s pick to lead the Environmental Protection Agency said on Wednesday he will consult with general counsel to understand the options available for a program that exempts small refiners from biofuel blending obligations. Michael Regan, formerly head of North Carolina’s environmental regulator, said waiting for a ruling from the Supreme Court on a case related to the program was “one way to go.” He also emphasized transparency and communication around the waiver program and committed to following the law.

World food prices rose for an eighth consecutive month in January, hitting their highest level since July 2014, led by jumps in cereals, sugar and vegetable oils, the United Nations food agency said on Thursday. The Food and Agriculture Organization’s food price index averaged 113.3 points last month versus an upwardly revised 108.6 in December. The December figure was previously given as 107.5. The Rome-based FAO also said in a statement that worldwide cereal harvests remained on course to hit an annual record in 2020, but warned of a sharp fall in stocks and signalled unexpectedly large import demands from China.

USDA attache lowers Brazil 2020/21 corn crop estimate to 105 million T – Reuters News

Rains help maintain Brazil corn yield prospects but raise sowing delay concerns – Refinitiv Commodities Research

Argentine agricultural exports were disrupted on Wednesday as truckers blocked roads around the Buenos Aires ports of Bahia Blanca and Quequen and authorities cleared roads near the main export hub of Rosario. Concern over the road blocks still meant reduced numbers of cargoes arrived at Rosario, raising doubts about future shipping flows from the hub that ships some 80% of Argentina’s grains exports. Chambers representing the soy, corn and wheat industries in Argentina issued a joint statement asking the national government to come up with a solution to the drivers’ demands.

Inflation-hit truck drivers are pressing demands for lower taxes, tolls and fuel prices as well as the establishment of set fee schedules to be paid by farmers for ground transportation. Mired in recession since 2018, Argentina had more than 36% inflation last year and 4% in December alone.

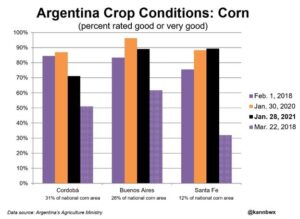

Wire story reports Argentina’s upcoming corn and soybean harvests will not be among the country’s best on record, but they certainly seem to have averted possible disaster a la 2018 after a historically dry start. Above-average rainfall in January went against the general dry trend common across Argentina during a La Nina, the cool phase of the equatorial Pacific Ocean. This brought much-needed moisture to the crops, which as of last week were mostly in good condition. But the La Nina pattern is still in place, and Argentina is not yet out of the woods as the forecast has turned dry through mid-month, just as crops begin to enter the critical stages for yield formation. As of Jan. 28, data from Argentina’s agriculture ministry suggested that the portions of soybeans in good or very good condition in Buenos Aires, Cordoba and Santa Fe were roughly 83%, 90% and 96%, respectively. Those three provinces account for three-quarters of the country’s planted area.

Russia may launch its own price benchmarks for calculation of a formula-based export taxes for wheat, barley and corn, which officials are discussing, Interfax new agency reported; Moscow is trying to reduce wheat exports to help curb rising domestic food prices. It imposed the tax of 25 euros ($30) per tonne for Feb. 15 to 28, rising to 50 euros/tonne from March 1. It also plans to switch to a more complicated formula-based regime sometime between April 1 and July 1. The formula may be set at 70% of the difference between the price of wheat per tonne and $200,

Ukrainian soft milling wheat export prices lost $2-$3 a tonne on Wednesday, pressured by ample Russian wheat sales and competition with European grain, consultancy APK-Inform said; Asking prices for Ukrainian 12.5% protein soft wheat stood between $288 and $296 per tonne FOB Black Sea as of Feb. 3; the lower quality 11.5% protein soft wheat prices decreased by $2-$3 to $286-$294 per tonne FOB.

European wheat eased on Wednesday following falls in Chicago and ongoing speculation that planned export taxes could prompt farmer selling in Russia and increase competition with European origins; Benchmark March milling wheat unofficially closed 0.55% lower at 224.75 euros a tonne.

India’s southern state of Andhra Pradesh will use a deepwater port to export rice for the first time in decades amid a global shortage of the grain, according to a government order which could raise shipments this year by a fifth.

Indonesia’s palm oil exports fell 9% last year as global demand was disrupted by the coronavirus pandemic, the Indonesian Palm Oil Association (GAPKI) said while forecasting exports would recover in 2021. Indonesia exported 34 million tonnes of palm oil and its refined products in 2020. Exports to China and Europe dropped last year, while shipments to India and Pakistan still saw some growth. Output of the oil stood at 47 million tonnes last year, down slightly from 2019. Domestic use of palm oil in 2020 was around 4% higher despite lower demand from hotels and restaurants.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.