TODAY—WEEKLY EXPORT INSPECTIONS—WEEKLY CROP PROGRESS/CONDITIONS—

Overnight trade has SRW Wheat down roughly 9 cents, HRW down 13; HRS Wheat down 4, Corn is down 2 cents; Soybeans unchanged; Soymeal down $2.00, and Soyoil up 50 points.

For the week, SRW Wheat prices were up roughly 7 cents; HRW up 11; HRS up 18; Corn was up 17 cents; Soybeans up 31; Soymeal up $17.00, and; Soyoil up 95 points. Crushing margins were up 18 cents at $1.27; Oil share is down 1% at 30%.

Chinese Ag futures (January) settled up 62 yuan in soybeans, up 11 in Corn, down 2 in Soymeal, up 66 in Soyoil, and up 46 in Palm Oil.

Malaysian palm oil prices were up 51 ringgit at 2,993 (basis January) at midsession tracking rival vegoils

U.S. Weather Forecast: U.S. hard red winter wheat areas are now expecting significant rain, freezing rain, sleet and snow in some of the driest areas during the early to middle part of this week

South America Weather Forecast: Brazil rainfall was sufficient for a notable boost in soil moisture in Minas Gerais and Goias where rain totals varied from 0.60 to more than 1.50 inches; lighter and more sporadic rain occurred in other areas of Brazil allowing fieldwork to advance, although pockets still need significant rain. Brazil’s rainfall is similar for the coming ten days as to that of Friday; rain will fall in most of the nation at one time or another, but rainfall will be least frequent and least ignificant in the interior south. Argentina weekend rainfall was sufficient for a notable boost in soil moisture and improved soil and crop conditions; rainfall varied from 1.00 to 2.50 inches in heart of summer crop country with local totals to 3.00 inches. Argentina will receive additional rain into Monday morning and then a few follow up showers Tuesday and Wednesday before dry weather occurs for about a week.

Europe/Black Sea Region Forecast: Brief periods of precipitation will move across the European continent over the coming week resulting in a favorable mix of moisture and sunshine for winter crops; fieldwork will advance around the precipitation; this weekend and next week should trend drier; temperatures will be near to above average. Western CIS crop weather this week will bring erratic precipitation and warmer than usual temperatures; winter crops are turning dormant in the west and north which is normal. Ukraine precipitation will be limited after this week with the best chance for moisture during mid- to late-week.

The player sheet had funds net buyers of 6,000 SRW Wheat; bought 9,000 Corn; bought 8,000 Soybeans; bought 4,000 Soymeal, and; net bought 2,000 Soyoil.

We estimate Managed Money net long 51,000 contracts of SRW Wheat; long 253,000 Corn; net long 249,000 Soybeans; net long 94,000 lots of Soymeal, and; long 87,000 Soyoil.

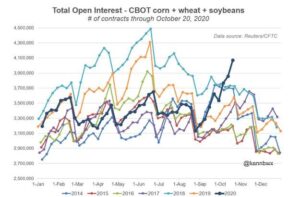

Preliminary Open Interest saw SRW Wheat futures up roughly 845 contracts; HRW Wheat up 1,400; Corn down 14,500; Soybeans down 40,000 contracts; Soymeal down 2,300 lots, and; Soyoil up 1,000.

There were changes in registrations (Corn down 360)—Registrations total 109 contracts for SRW Wheat; ZERO Oats; Corn 1; Soybeans 1; Soyoil 1,907 lots; Soymeal 250; Rice ZER0; HRW Wheat 135, and; HRS 1,195.

Tender Activity—Syria seeks 200,000t Black Sea wheat—Pakistan seeks 320,000t optional-origin wheat—Egypt bought 165,000t Russian wheat—Taiwan seeks 65,000t optional-origin corn—S. Korea bought 50,000t optional-origin feed wheat—

China has substantially increased purchases of U.S. farm goods and implemented 50 of 57 technical commitments aimed at lowering structural barriers to U.S. imports since the two nations signed a trade deal in January, the U.S. government said; in a joint statement, the U.S. Trade Representative’s (USTR) office and the U.S. Department of Agriculture (USDA) said China had bought over $23 billion in U.S. agricultural goods to date, or about 71% of the target set under the so-called Phase 1 deal; since the Agreement entered into force eight months ago, we have seen remarkable improvements in our agricultural trade relationship with China, which will benefit our farmers and ranchers for years to come,” U.S. Trade Representative Robert Lighthizer said

Strong global demand and ideas China may significantly increase grain and oilseed imports beyond already elevated levels kept speculators buying Chicago-traded grains and oilseeds last week; open interest also rose along with futures prices and fund optimism.

- U.S. OCTOBER 1 ALL CATTLE ON FEED 104.0 PCT (TRADE ESTIMATE 103.2 PCT) – USDA

- U.S. SEPTEMBER CATTLE PLACED ON FEED 106.0 PCT (TRADE ESTIMATE 102.5 PCT) – USDA

- U.S. SEPTEMBER CATTLE MARKETED 106.0 PCT (TRADE ESTIMATE 105.8 PCT) – USDA

China’s imports of soybeans from Brazil jumped 51.4% in September from a year ago, data showed, as cargoes purchased earlier in the year cleared customs; China brought in 7.25 million tons of the oilseed from Brazil in September, up from 4.79 million tons last year

Chinese Vice Premier Hu Chunhua has stressed the need to strengthen agricultural production, including the planting of autumn and winter crops, to lay a good foundation for the next year; solid work in autumn and winter planting is vital for securing next year’s harvest,

Chinese leaders met Monday to formulate an economic blueprint for the next five years that is expected to emphasize development of semiconductors and other technology at a time when Washington is cutting off access to U.S. technology

The prices of live pigs in China declined 5 percent in mid-October compared to the previous 10 days, data from the National Bureau of Statistics (NBS) showed

Brazilian food processor BRF SA said on Friday that Chinese authorities have authorized the company to resume exports from its chicken plant in the town of Dourados that had been banned since July over coronavirus concerns.

Russia’s October exports of wheat, barley and maize (corn) are estimated at 5.00 million tons, down from 5.65 million tons in September, the SovEcon agriculture consultancy said.

Ukraine has harvested 48.8 million tons of grain from 12.7 million hectares, or 83% of the sown area, as of Oct. 22, Ukraine’s economy ministry said; it said farmers had completed the wheat and barley harvest and collected 13.1 million tons of corn from 2.8 million hectares, or 52% of the sown area; the ministry expects the grain crop could fall to around 68 million tons in 2020 from a record 75 million tons in 2019 due to severe drought

High demand from importers and rapid wheat exports have helped Ukraine’s 2020 milling wheat export prices to increase by about $7 a ton over the past week, agriculture consultancy APK-Inform said; Ukrainian 12.5% protein Black Sea wheat prices stood at $255-$258 a ton free on board (FOB) at the end of the week; for lower-quality 11.5% protein wheat, prices were between $253 and $256 a ton FOB.

Ukrainian sunflower oil export prices have risen $15-$20 per ton over the last week due to steady demand from importers, APK-Inform consultancy said; bid-ask sunoil export prices rose to $985-$995 per ton on a free on board (FOB) Black Sea basis for October-November delivery; the Ukrainian sunoil producers’ association said last week sunflower oil exports may fall to 5.6 million tons in the Sept. 2020-Aug. 2021 season from around 6.6 million in 2019/20 due to a smaller sunseed harvest and sunoil output

Maize harvesting is in full swing in Europe and the effects of summer drought are being seen in contrasting yields, which could push down production this year despite a sharp increase in plantings, analysts said; forecasters have made steep cuts to their estimates of the European Union-wide maize harvest due to drought, and consultancy Strategie Grains last week reduced its outlook to below last year’s production.

Sudanese and Israeli officials will meet in the coming weeks to discuss a package of cooperation deals to “achieve the mutual interests of the two peoples,” Sudan’s Foreign Ministry said; the ministry statement came three days after President Donald Trump announced that Sudan would start normalizing ties with Israel; the statement said the deals would cover agriculture, trade, aviation and migration, but did not provide details on the timing or location of the meetings.

Sudan’s acting minister of agriculture and natural resources said his country aims to produce more than 1 million tons of wheat under its Gezira agricultural project

Exports of Malaysian palm oil products for October 1 – 25 rose 7.2 percent to 1,398,027 tons from 1,304,331 tons shipped during September 1 – 25, cargo surveyor Intertek Testing Services said

Malaysia’s palm oil exports during the Oct. 1-25 period are estimated up 7.05% on month at 1,412,361 metric tons, cargo surveyor AmSpec Agri Malaysia said.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.