TOP HEADLINES

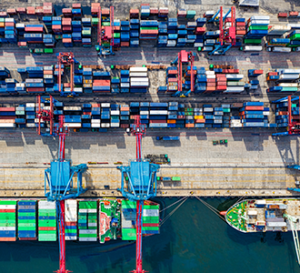

Russia destroyed 300,000 tons of grain since July in port, ship attacks – Kyiv

Russia has destroyed almost 300,000 metric tons of grain since July in attacks on Ukraine’s port facilities and on ships, the Ukrainian government said on Friday, underscoring the war’s threat to global food security.

In summer, Moscow quit a U.N.-brokered deal that had allowed exports of Ukrainian grain through the Black Sea safely. Since then, Russian forces have hit six civilian ships and 150 port and grain facilities during 17 attacks, destroying crops headed for export, Deputy Prime Minister Oleksandr Kubrakov said in a statement.

“This is Russia’s attempt to deepen the food crisis in the countries which depend on Ukrainian products,” Kubrakov said.

The damage on Ukrainian ports reduced the country’s grain export potential by 40%, he said. Russia has attacked port facilities on both the Black Sea and Danube River.

Ukraine is one of the world’s largest wheat and corn exporters.

The Russian Defence Ministry could not be immediately reached for comment.

Kubrakov said 21 grain-loaded vessels have already used a new “humanitarian” grain corridor in the Black Sea that Kyiv established in August.

He said that under the previous U.N. Black Sea Grain Initiative, Ukraine had exported 33 million tonnes of grain, with 60% of that shipped to African and Asian countries.

FUTURES & WEATHER

Wheat prices overnight are up 6 1/2 in SRW, up 3 in HRW, up 3 in HRS; Corn is up 1/2; Soybeans up 2 1/2; Soymeal down $0.20; Soyoil up 0.41.

Markets finished last week with wheat prices up 13 1/4 in SRW, down 14 1/2 in HRW, down 6 in HRS; Corn is up 5 1/2; Soybeans up 18 1/2; Soymeal up $15.20; Soyoil up 0.86.

For the month to date wheat prices are up 44 3/4 in SRW, up 8 1/4 in HRW, up 15 3/4 in HRS; Corn is up 17; Soybeans up 7 3/4; Soymeal up $8.60; Soyoil down 1.04.

Year-To-Date nearby futures are down 26.0% in SRW, down 24.4% in HRW, down 22.8% in HRS; Corn is down 27.2%; Soybeans down 15.6%; Soymeal down 18.5%; Soyoil down 14.1%.

Chinese Ag futures (JAN 24) Soybeans down 16 yuan; Soymeal up 15; Soyoil up 94; Palm oil up 130; Corn down 6 — Malaysian Palm is up 30. Malaysian palm oil prices overnight were up 30 ringgit (+0.80%) at 3767.

There were changes in registrations (-5 Soymeal). Registration total: 3,005 SRW Wheat contracts; 735 Oats; 4 Corn; 220 Soybeans; 67 Soyoil; 425 Soymeal; 402 HRW Wheat.

Preliminary changes in futures Open Interest as of October 13 were: SRW Wheat down 5,960 contracts, HRW Wheat up 1,207, Corn up 2,266, Soybeans up 3,450, Soymeal down 1,502, Soyoil up 4,373.

Northern Plains: Showers exited over the weekend but left behind some hefty amounts in the region that will lead to some delays in harvest and fieldwork. Another system will move through Tuesday and Wednesday with scattered light showers and more rain is forecast for early next week. It may become more difficult to get fall fieldwork done in a timely manner in such an active pattern.

Central/Southern Plains: Heavy rain in Nebraska last week will delay field work for some time, but help to reduce drought. Southwestern areas were missed by the system, but still have decent soil moisture in most areas, though that is waning for wheat establishment. Frosts occurred in western areas over the weekend, all the way to the Texas Panhandle and continue early this week as well. A system will largely miss to the north this week, but better rainfall is possible next week with a system moving through.

Midwest: A system brought widespread rainfall to the region over the weekend, including heavy rainfall over the northern half of the region. That will help to reduce drought, but will also delay fieldwork. Another system moves through later this week with widespread showers, though they are forecast to be lighter. Another system will move through next week as well, making it more difficult to complete fieldwork in some areas. Winter wheat will benefit from increased soil moisture in some areas.

Brazil: Scattered showers fell in central Brazil over the weekend, more like we would expect during the wet season. However, showers this week are forecast to be pretty light in these areas, being disrupted by fronts that continue to bring in more stable air behind them. They have been more likely to produce heavier rain for southern Brazil, which has dealt with flooding and wetness issues for filling and harvest of winter wheat, as well as corn and soybean planting, though the latter issues have not been as severe as expected due to the wetness. Producers are finding a way. They’ll need to find more ways this week as heavy rain falls again for much of the week.

Argentina: It was dry over the weekend, a pattern that has been unfavorable for filling winter wheat and corn planting for the last couple of months. Northern areas should see some rainfall early this week with a front coming through, but the main growing area in the central is not expected to see much. Forecasts for a system this weekend into early next week are much more favorable.

The player sheet for Oct. 13 had funds: net buyers of 2,000 contracts of SRW wheat, sellers of 2,500 corn, buyers of 4,500 soybeans, sellers of 1,500 soymeal, and buyers of 3,000 soyoil.

TENDERS

- WHEAT SALES: The U.S. Department of Agriculture (USDA) confirmed private sales of 181,000 metric tons of U.S. soft red winter wheat for delivery to China in the 2023/24 marketing year. The deal followed another sale of 220,000 tons of wheat to China last week.

- SOYBEAN AND SOYMEAL SALES: The USDA also confirmed private sales of 117,300 metric tons of U.S. soybeans as well as 100,000 tons of soymeal, all for delivery to unknown destinations in the 2023/24 marketing year.

- DURUM WHEAT PURCHASE: Tunisia’s state grains agency is believed to have purchased about 100,000 tonnes of durum wheat in an international tender on Friday

PENDING TENDERS

- WHEAT TENDER UPDATE: The lowest offer in an international tender from Bangladesh’s state grains buyer to purchase and import 50,000 metric tons of wheat which closed on Oct. 11 was assessed at $298.19 a metric ton liner out.

- RICE TENDER: South Korea’s state-backed Agro-Fisheries & Food Trade Corp issued an international tender to purchase an estimated 50,100 metric tons of rice largely from the United States.

- RICE IMPORTS: Egypt’s supply ministry announced on Sunday it will import 250,000 metric tons of white rice to increase its strategic rice reserves to last more than six months, it said on Sunday. The rice is expected to arrive within six weeks of the contract date, the ministry said in a statement.

TODAY

US Export Sales of Soybeans, Corn and Wheat by Country

The following shows US export sales of soybeans, corn and wheat by biggest net buyers for week ending Oct. 5, according to data on the USDA’s website.

- Top buyer of soybeans: China with 884k tons

- Top buyer of corn: Mexico with 626k tons

- Top buyer of wheat: China with 220k tons

- Biggest cancellation: 364k tons of soybeans from Unknown Buyers

CROP SURVEY: US September Soybean Crush Seen at 160.5M Bushels

Projections are based on a survey of six analysts conducted by Bloomberg News on Oct. 12-13.

- Soybean crush seen 1.5% higher vs September of last year, and a decline of 0.6% vs a month ago

- Oil stocks at the end of last month seen at 1.202b lbs vs 1.459b a year earlier

NOPA September US soybean crush seen at 161.683 million bushels

The U.S. soybean crush likely rose last month to a September record, while soyoil stocks were estimated to have thinned to the lowest in nearly nine years, analysts said ahead of a monthly National Oilseed Processors Association (NOPA) report due on Monday.

NOPA members, which handle about 95% of all soybeans processed in the United States, were estimated to have crushed 161.683 million bushels last month, according to the average of estimates from nine analysts.

If realized, the September crush would be up 0.1% from the 161.453 million bushels processed in August and up 2.3% from the September 2022 crush of 158.109 million bushels. It would also be the largest September crush on record, eclipsing the prior record of 161.491 million bushels set in 2020.

The crush typically drops to an annual low around September as processors take downtime for seasonal maintenance ahead of the fall harvest and as the prior season’s stocks are whittled down.

Estimates for the September 2023 crush ranged from 153.700 million to 167.000 million bushels, with a median of 163.215 million bushels.

The NOPA report is scheduled for release at 11 a.m. CDT (1600 GMT) on Monday. NOPA issues crush data on the 15th of each month, or the next business day.

Soyoil supplies held by NOPA members as of Sept. 30 were forecast at 1.208 billion pounds, based on estimates from six analysts. If realized, it would be the smallest soyoil stockpile since December 2014.

Renewable diesel makers have been consuming ever-larger amounts of vegetable oils as new production capacity has come online.

NOPA members held 1.250 billion pounds of soyoil at the end of August and 1.459 billion pounds at the end of September 2022.

Soyoil stocks estimates ranged from 1.119 billion to 1.300 billion pounds, with a median of 1.200 billion pounds.

Brazil farmers plant 17.35% of 2023/24 soybean area – consultancy

Brazilian farmers have planted 17.35% of the area for the 2023/2024 soybean crop, compared with 22.60% at this time last year, consultancy Patria Agronegocios said on Friday.

The figure, however, is above the average of the last five years of 16.79%, said the consultancy, highlighting the weekly advance in the southern state of Parana, while top grain-producing Mato Grosso is showing a noticeable delay.

Brazil shipping agents warn clients drought disrupting corn shipping on barges

A severe drought is disrupting barge traffic on the Tapajos river in the Amazon rainforest, shipping agencies told clients this week as Brazil enters the final months of 2023’s corn export season.

“Due to the dry season in the Amazon River, the current situation of barges’ navigation at the Tapajos River is getting restricted,” shipping agent Alphamar said in a note to clients, seen by Reuters. The barge convoys are smaller than usual and in some cases barges are reducing their loads by about 50% in order to safely navigate on some parts of the Tapajos, it added.

Cargonave, another agent, told clients the vessel MV Bravery, which was supposed to anchor at Santarem port to load corn in Para state, was affected.

“The improbability of loading due to lack of logistics to supply the ship is something real and relevant,” Cargonave wrote.

According to Cargonave data, the MV Bravery was shown as due to arrive at Santarem on Oct 10. It will now berth on Oct. 25, when it is due to take almost 56,000 metric tons of corn to Iran.

Cargonave said the draft of private ports on the banks of the Tapajos river is at the lowest levels ever.

Amport, a group representing Amazonian private port operators including Cargill ABNO.UL and Louis Dreyfus Company LOUDR.UL, said barge convoys are reducing their loads by 50% on the Madeira river and 40% on the Tapajos, respectively.

Reducing loads is normal during the dry season but by a smaller proportion, Amport said.

The Madeira river’s mouth region remains 70 cm (27.56 inches) above levels reached during a historical drought in 2010, while the Tapajos is 25 cm (9.84 inches) above its 2010 minimums, Amport said.

Barge operator Hidrovias do Brasil HBSA3.SA acknowledged “a critical and rapidly changing scenario.” But the company reiterated its barges are running with about two-thirds of capacity on the Tapajos, which is enough to ensure navigability at this time.

The main seaports receiving grain cargos from inland rivers are Itacoatiara, Santarem and Barcarena, and they are operating normally, Amport said.

Despite the effects of the drought, Amport still projects moving around 25% more vegetable bulk in 2023 than in 2022 through Brazilian Amazonian river and seaports.

Egypt Plans to Start Hedging Its Wheat Purchases Next Year

Egypt plans to hedge against global wheat price increases next year, Finance Minister Mohamed Maait said.

“There is a good possibility that we do the wheat hedging next year,” Maait told Bloomberg News in an interview in Marrakech, Morocco, where he’s attending the annual meetings of the International Monetary Fund and the World Bank.

One of the world’s top wheat importers, Egypt is already in talks with multiple banks on the plan, Maait said Thursday, without identifying them.

Egypt has signaled numerous times in recent years that it planned to start hedging wheat. In 2021, the country’s supply minister said it was in talks with Citigroup Inc. over protecting itself against price increases. That followed negotiations three years earlier with other banks.

The country already takes such steps in the oil market. To mitigate against increases in global fuel prices, the finance ministry hedged close to 50% of its imports up to June 2024, Maait said.

Egypt relies on subsidized wheat to feed its population. Global prices have halved from records reached last year, but remain volatile in the wake of Russia’s invasion of Ukraine. Egypt’s ongoing foreign currency crunch has also added to food-import challenges.

SOYBEAN/CEPEA: Dollar depreciation and lower demand press down soybean prices in BR

Soybean prices have dropped in the Brazilian market this week. Pressure came from both the dollar depreciation against the Real (by 2.4% between October 5-11, to BRL 5.052 on Oct. 11th) and the progress of the soybean harvest in the United States – by Oct. 8th, 43% of the national soybean crop had been harvested in the US, according to the USDA. This context led importers to the Northern Hemisphere and resulted in lower demand for the Brazilian soybean.

Between Oct. 5-11, the ESALQ/BM&FBovespa soybean Index (Paranaguá) and the CEPEA/ESALQ Index (Paraná) decreased a steep 2.6% and 2.3%, respectively, to BRL 141.21 per 60-kg bag (USD 27.95)/bag and BRL 134.42 (USD 26.61)/bag on Wednesday, 11. On the average of the regions surveyed by Cepea, prices dropped 1.8% in the over-the-counter market (paid to farmers) and 1.2% in the wholesale market (deals between processors).

On the other hand, at the Chicago Mercantile Exchange (CME Group), the Nov/23 contract for soybean rose 0.7% between Oct. 5-12, to USD 12.90/bushel (USD 28.44 per 60-kg bag) on Thursday, 12. Besides higher demand, international valuations were influenced by estimates for lower soybean production in the US.

According to a report from the USDA released on Thursday, 12, the estimates for the American output of soybean in the 2023/24 crop were revised down by 1% compared to that predicted in September, to 11.7 million tons, the lowest since 2019/20, when the US produced less than 100 million tons.

However, the higher output in South America is expected to offset the lower supply in the Northern Hemisphere. Thus, the world output is estimated at 399.5 million tons by the USDA. Brazil is expected to produce 163 million tons, according to the USDA, and 162 million tons, according to Conab (Brazil’s National Company for Food Supply), almost two-fold (+92%) that from 2022/23.

Heavy Rains to Disrupt Wheat Planting in Parts of China

Heavy rains will hit parts of China’s biggest grain producing areas in the next ten days, affecting crops from wheat to rice, the country’s weather bureau said.

Medium-heavy rains are expected this week in western areas of Henan province, the country’s top wheat hub, which could lead to too much moisture in the soil and hinder planting of the staple grain, the National Meteorological Center said in a report on Monday.

Low temperatures and rains, expected in most parts of southern China over the period, will slow the maturing of the late rice crop, it said. Higher precipitation in northwestern and southwestern regions could also disrupt the corn harvest and wheat plantings.

Production in China, the world’s largest food consumer, is threatened by the rise in extreme weather patterns globally. Any significant crop damage or losses could push the country to source more from the global market and further tighten supplies.

Persistent heavy rains in the summer lashed China’s wheat crop in the north, particularly in Henan, damaging a large chunk of the harvest. China has stepped up purchases of better-quality wheat from the global market to bolster domestic supplies.*

Indonesia’s 2023 Unmilled Rice Production Seen Falling 2.05% (1)

Indonesia’s unmilled rice production this year estimated to drop by 1.12 million tons to 53.63 million tons on smaller harvest area, the statistics agency known as BPS says in a statement on Monday.

- Milled rice production estimated at 30.90m tons in 2023 vs 31.54m tons in 2022

- Harvest area seen declining 2.45% y/y to 10.2 million hectares

- Prolonged dry season due to El Niño has caused failed harvest and plantings in parts of the country, agency’s acting head Amalia Adininggar Widyasanti says on Monday

- Jan-Sept. unmilled rice production estimated at 45.33m tons

- Jan-Sept. milled rice output fell 0.22% to 26.11m tons

- Indonesia to see biggest rice deficit in Dec. at 1.45m tons, with total 2023 rice surplus estimated at 0.28m tons

- Surplus and deficit figures calculate domestic output and consumption, while excluding imports

Indonesia Sees 2023 Corn Output Falling by 12.5% to 14.46M Tons

Indonesia’s corn production this year is estimated to fall to 14.46 million tons, from 16.53 million tons last year, the statistics agency says in a media briefing on Monday.

Corn harvest area this year seen shrinking to 2.49m hectares, from 2.76m in 2022

US Crops in Drought Area for Week Ending Oct. 10: USDA

The following shows the percent of US agricultural production within an area that experienced drought for the week ending Oct. 10, according to the USDA’s weekly drought report.

- Corn crops experiencing moderate to intense drought remained at 59%

- Drought exposure at this time last year was 49%

- Soybean crops in drought unchanged at 58%

US Pork Production Up 2.2% This Week, Beef Down: USDA

US federally inspected pork production rises to 545m pounds for the week ending Oct. 14 from 533m in the previous week, according to USDA estimates published on the agency’s website.

- Hog slaughter up 1.8% from a week ago to 2.609m head

- Beef production down 1.8% from a week ago, cattle slaughter falls 1.8%

- For the year, beef production is 5.2% below last year’s level at this time, and pork is 0.2% above

Recent Rains Should Benefit US Autumn Fertilizer Season

The global urea market was unsettled in advance of another tender from India, with the prior one securing fewer tons at lower prices than anticipated. Low Mississippi River water levels have hindered barge traffic, but Midwest rain this week should bring relief. Canadian potash shipments rose 43% in August after a strike disrupted July exports.

Ammonia, Phosphate Prices Rise Ahead of Autumn Demand

Fertilizer prices were mixed, with urea falling slightly at New Orleans (NOLA) and Brazil as the global industry awaits India’s latest tender results on Oct. 20. Urea also slipped at some inland US terminals, though phosphate prices were strengthening in advance of autumn application and ongoing river transportation issues due to low water levels. Other nitrogen prices were also firming, fueled by the sharp rise in Tampa ammonia for October and additional inland ammonia terminal increases. New ammonia offers in the eastern Corn Belt rose to $725-$750 a short ton (st) from last week’s flat $725, while truck offers from Gulf production points jumped to as high as $625/st vs. the prior $550 level. Ammonium sulfate also moved up, with AdvanSix posting a $15/st increase at Hopewell and in the Midwest on Oct. 13.

Interested in more futures markets? Explore our Market Dashboards here.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.