TODAY—EXPORT INSPECTIONS—CROP PROGRESS/CONDITIONS—

Overnight trade has SRW Wheat down roughly 11 cents; HRW down 11; HRS Wheat down 12, Corn is down 6 to 12 cents; Soybeans down 5 to 12; Soymeal down $3.00, and Soyoil down 55 to 75 points.

For the week, SRW Wheat prices were up roughly 27 cents; HRW up 33; HRS up 34; Corn was up 59 cents; Soybeans up 55 cents; Soymeal up $15.00, and; Soyoil up 210 points. Crushing margins were up 2 cents at $0.91 (July); Oil share unchanged at 42%.

Chinese Ag futures for (September) settled up 62 yuan in soybeans (at U.S. $26.00), up 32 in Corn (at $11.20), down 35 in Soymeal (at $520), down 14 in Soyoil (at 63.05 cents), and up 32 in Palm Oil.

Malaysian palm oil prices were down 78 at 4,349 (basis July) at midsession still correcting gains after prices had best week in two decades.

U.S. Weather Forecast: The United States will remain relatively good for spring planting, emergence and establishment of crops in the Midwest, central and northern Plains, Tennessee River Basin and southeastern states.

There is still concern over crop and field conditions in parts of the Delta because of wet conditions and in the heart of the Midwest because of wetter biased weather over the next two weeks.

Rain is expected in the northern Plains and Canada’s Prairies and should bring some much needed relief to dryness that should translate into better planting and establishment conditions for summer crops as time moves along. Improved winter and early spring crop conditions are also expected in the northern Plains and Canada’s Prairies.

South America Weather Forecast: Brazil is to see temporary relief in areas that receive rain in Parana and some immediate neighboring areas during the next ten days. Some relief is also expected in eastern Sao Paulo and southeastern Minas Gerais, but the amount of rain that reaches key Safrinha corn country will be very low. Parana will be the greatest recipient of rain and could experience the greatest dryness relief, but central and eastern parts of the state will be wetter than western areas. Temperatures will be near normal except in the far south of Brazil where readings will be cooler biased both this week and next week. Crop moisture stress will continue without significant relief despite a few insignificant showers in Mato Grosso, Mato Grosso do Sul, Goias, western Sao Paulo and southwestern Minas Gerais.

Argentina’s weather will be ideal for summer crop maturation and harvest progress. The environment might also be good for some early season wheat planting later this month

The player sheet had funds net buyers of 4,000 contracts of SRW Wheat; bought 10,000 Corn; bought 11,000 Soybeans; net bought 10,000 Soymeal, and; bought 2,000 in Soyoil.

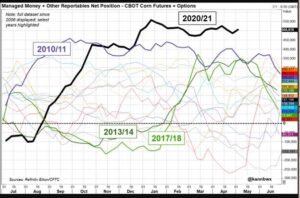

We estimate Managed Money net long 31,000 contracts of SRW Wheat; net long 402,000 Corn; long 204,000 Soybeans; long 80,000t Soymeal, and; net long 93,000 Soyoil.

Preliminary Open Interest saw SRW Wheat futures up roughly 365 contracts; HRW Wheat up 600; Corn up 19,100; Soybeans down 2,300 contracts; Soymeal up 9,100 lots, and; Soyoil up 4,400.

Deliveries were 2 Soymeal; ZERO Soyoil; 159 Rice; ZERO Corn; 7 HRW Wheat; ZERO Oat; 14 Soybeans; ZERO SRW Wheat, and; ZERO HRS Wheat.

There were changes in registrations (Soyoil down 2; Rice up 124)—Registrations total 134 contracts for SRW Wheat; 16 Oats; Corn ZERO; Soybeans 198; Soyoil 1,157 lots; Soymeal 175; Rice 1,396; HRW Wheat 1,289, and; HRS 522.

Tender Activity—S. Korea bought 60,000t Black Sea feed wheat—Egypt seeks 30,000t optional-origin soyoil, 10,000t sunoil—

Speculators’ bullishness toward Chicago-traded grains and oilseeds has hovered near record levels since late last year as global demand accelerates and supplies tighten, though various market participants have recently been in the driver’s seat when it comes to the persistent rally, especially in corn. In the week ended May 4, speculators in the “other” category increased their net long to 133,068 futures and options contracts from 107,963 a week earlier according to the U.S. Commodity Futures Trading Commission. That coincided with a 6.5% gain in most-active futures.

Stocks of canola plunged by 37.7% at the end of March 2021 compared to the same period in 2020, in part due to increased demand during the COVID-19 pandemic, according to a farm survey by Statistics Canada released on Friday.

China sold 142,659 tonnes of wheat, or 3.56% of the total offered, at an auction of state reserves last week, the National Grain Trade Center said. The volume sold, at an average price of 2,401 yuan ($373.41) per tonne, declined further from the prior week when 361,975 tonnes of wheat were sold, after the government moved in to restrict the auctions.

Chinese buyers bought 1.36 million tonnes of U.S. corn, matching their seventh biggest ever purchase of U.S. supplies of the grain, the U.S. Agriculture Department said on Friday. The deal comes after China issued guidelines in April recommending the reduction of corn and soymeal in pig and poultry feed. Corn prices have surged to their highest in more than eight years on concerns about a tightening global supply base due to strong demand in biofuels and dry conditions in key growing areas of Brazil. The corn will be shipped during the 2021/22 marketing year that starts in September. The deal was China’s biggest since it booked a deal to buy 2.1 million tonnes of U.S. corn, its most ever from the United States, in January.

Argentine biotech company Bioceres and local food company Havanna have signed an agreement to produce food based on genetically modified HB4 wheat, the firms said in a joint statement. The country is interested in increasing production by way of genetically modified HB4 wheat, which is resistant to droughts.

Ukraine has sown a total of 4.4 million hectares of spring grains as of May 6, or 58% of the expected area, agriculture ministry data showed. Farms have sown 2.4 million hectares of corn, 1.3 million hectares of barley, 226,400 hectares of peas, 172,200 hectares of wheat and 185,400 hectares of oats. The overall grain area is likely to total 15.5 million hectares this year, including 7.6 million of spring grains, the ministry has said.

Maize planting in the European Union is in full swing as farmers catch up on a slow start during a chilly April, with warmer and wetter weather needed this month to get the crop off to a good start. Early forecasts project the 27-nation EU, a major producer and importer of maize (corn) for livestock feed, will harvest a bigger crop this year, as yields in Romania and other nations recover from drought in 2020 and the EU crop area stays stable. French farmers were in the latter stages of planting, having accelerated field work since an early April freeze. But the proportion of emerged crops was lower than it was a year ago, according to farm office FranceAgriMer, a sign that dry, cool weather has hindered germination.

Euronext wheat ended higher on Friday, adding to a weekly gain, as grain markets rallied further on corn supply tensions. September milling wheat on Euronext settled up 1.75 euros, or 0.8%, at 232.00 euros ($281.97) a tonne, leaving the contract 5.8% higher over the week. It rose earlier on Friday to 233.25 euros but faced chart resistance near last week’s life-of-contract high of 233.50 euros.

On Euronext’s maize (corn) market, June futures rose as high as 265.00 euros a tonne, a front-month price not seen since July 2012. New-crop November set a new contract high at 225.50 euros.

In rapeseed, August futures set a new contract high at 546.25 euros a tonne, before turned slightly lower, as low global oilseed stocks and poor crop weather in Europe and Canada continued to underpin prices. ($1 = 0.8228 euros)

- MALAYSIA’S END-APRIL PALM OIL STOCKS UP 7.07% TO 1.55 MLN T FROM MARCH – MPOB

- MALAYSIA’S APRIL PALM OIL EXPORTS UP 12.62% TO 1.34 MLN T FROM MARCH -MPOB

- MALAYSIA’S APRIL CRUDE PALM OIL PRODUCTION UP 6.98% TO 1.52 MLN T FROM MARCH -MPOB

A Reuters survey had pegged inventories to fall 0.27% to 1.44 million tonnes. Production was seen rising 8.9% to a six-month high of 1.55 million tonnes. Exports were forecast to jump 10% to 1.3 million tonnes.

Malaysian palm oil product exports for May 1-10 rose 29.63% to 447,225 tonnes from 345,010 tonnes shipped during the previous month, cargo surveyor Intertek Testing Services said.

Malaysia’s palm oil exports during the May 1-10 period are estimated to have risen 37% from a month earlier to 469,875 metric tons, cargo surveyor AmSpec Agri Malaysia said.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.