TODAY—WEEKLY EXPORT INSPECTIONS—MONTHLY NOPA CRUSH—-

Overnight trade has SRW Wheat up roughly 12 cents, HRW up 15; HRS Wheat up 10, Corn is up 6 cents; Soybeans up 14; Soymeal up $2.50, and Soyoil up 85 points.

For the week, SRW Wheat prices were down roughly 4 cents; HRW down 8; HRS down 10; Corn was down 11 cents; Soybeans up 9 cents; Soymeal down $2.00, and; Soyoil up 115 points. Crushing margins were down $0.02 $0.64 (July); Oil share up 1% at 34%.

Chinese Ag futures on holiday from Feb. 11 to 17 (Thursday to Wednesday) for the celebration of Chinese Spring Festival. Resumes on Feb. 18 (Thursday).

Malaysian palm oil prices were up 9 ringgit at 3,533 (basis May)—-up 162, (basis April), on Monday at 3,720—-on higher exports, higher soyoil prices.

Brazil weather will be mixed over the next ten days to two weeks. Southern parts of the nation will experience good drying conditions favoring soybean maturation and harvesting as well as Safrinha crop planting.

Argentina weather is becoming more tenuous with restricted rainfall over the next ten days to two weeks. Scattered showers and thunderstorms in the coming week will be sporadic and light leaving some areas quite dry while others get enough rain to slow drying rates to buy more time for crops.

The player sheet had funds net buyers of 3,000 SRW Wheat; sold 5,000 Corn; net bought 4,000 Soybeans; sold 2,000 lots of Soymeal, and; net bought 4,000 Soyoil.

We estimate Managed Money net long 8,000 contracts of SRW Wheat; long 321,000 Corn; net long 157,000 Soybeans; net long 61,000 lots of Soymeal, and; long 107,000 Soyoil.

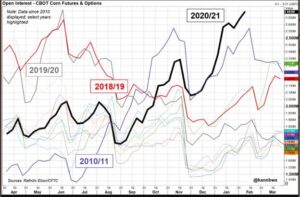

Preliminary Open Interest saw SRW Wheat futures down roughly 10,000 contracts; HRW Wheat up 1,800; Corn up 840; Soybeans down 2,700 contracts; Soymeal down 1,100 lots, and; Soyoil up 5,500.

There were no changes in registrations—Registrations total 49 contracts for SRW Wheat; ZERO Oats; Corn ZERO; Soybeans 169; Soyoil 1,286 lots; Soymeal 175; Rice 732; HRW Wheat 91, and; HRS 1,023.

Tender Activity—Japan seeks 82,393t optional-origin wheat—Algeria seeks optional-origin wheat—Syria seeks 200,000t optional-origin wheat—Egypt seeks 30,000t optional-origin soyoil, 10,000t sunoil—

NOPA January U.S. soy crush seen at 183.087 million bushels

U.S. soybean processing plants likely turned in their third-largest monthly crush on record on January and the largest-ever crush for the first month of the year, according to analysts polled ahead of a National Oilseed Processors Association (NOPA) report due on Tuesday.

NOPA members were estimated to have crushed 183.087 million bushels of soybeans last month, it would be little changed from a 183.159 million-bushel crush in December and up 3.5% from January 2020, when NOPA members processed 176.940 million bushels.

U.S. soybean supplies, however, are forecast to shrink dramatically ahead of the next harvest. The U.S. Department of Agriculture is projecting the tightest end-of-season stocks in seven years and the tightest stocks-to-use ratio on record.

January crush estimates ranged from 180.000 million to 186.300 million bushels.

The monthly NOPA report is scheduled for release at 11 a.m. CST.

Soyoil supplies among NOPA members at the end of January were seen rising to 1.763 billion pounds compared with 1.699 billion pounds at the end of December and 2.013 billion pounds at the end of January 2020. Estimates ranged from 1.710 billion to 1.850 billion pounds

Despite some volatile trading days, speculators have not largely altered their unusually bullish views in Chicago corn over the last month, though they had turned a little friendlier toward beans in the latest week. Optimism faded in recent sessions, however, as the U.S. government projection of domestic corn supply was heavier than predicted. In the near term, investors are focused on the required record export pace, but next year’s supplies are also on the radar as the upcoming marketing year is just around the corner.

Harvesting delays in Brazil are prompting buyers led by China to rely on rival exporter the United States for longer than usual in 2021, according to government data and traders. Sustained demand for U.S. soybeans is accelerating an historic drawdown of U.S. supplies of the oilseed and could further drive up soybean prices at a time of rising food inflation as countries hoard staples during the pandemic. Concerns over tight global soybean supplies after China dramatically increased purchases in recent months ignited a 4.5% U.S. soybean futures rally last month to a 6-1/2-year high. Brazil usually harvests its soybeans in the first three months of the year, marking an end to the dominance of U.S. exports. However, that process has been delayed by a drought last year that slowed plantings, and rainfall at harvest time. The country’s shipments of soybeans in January were 28 times lower than a year before at 49,500 tonnes, an amount insufficient to fill up a single vessel, Brazilian trade data showed.

The start of the tariff quota on Russian grain exports as well as duties on the export of wheat from Russia should ensure the required volume of grain on the domestic market as well as maintain a stable situation. Specifically, the measure should prevent a spike in prices for a large number of basic foodstuffs for the population, including flour, cereals, bakery goods, meat, dairy products, and eggs, the Agriculture Ministry said in the statement that is timed to the entry into force as of February 15 of the export quota of 17.5 million tonnes on grain and the export duty of 25 euros per tonne on wheat.

Russian wheat export prices fell for the fourth consecutive week last week amid a decline in prices in Chicago and Paris and rising supply in the domestic market. Russian wheat with 12.5% protein loading from Black Sea ports for supply in March was at $277.5 a tonne free on board (FOB) at the end of last week, down $8.5 from the previous week. Sovecon, another Moscow consultancy, said wheat prices fell by $4 to $281, while barley was unchanged at $248.

Russian agriculture consultancy IKAR said on Monday it had raised its estimate for Russia’s 2021 wheat crop by 1 million tonnes to 78 million tonnes as weather conditions improved.

Russia’s February exports of wheat, barley and maize (corn) are estimated at 3.1 million tonnes, down from 3.2 million tonnes in January, the SovEcon agriculture consultancy said.

Export of soybeans from Russia during the week of January 25 to 31 – the last week before the entry into effect of the export duty – amounted to 603,800 tons, the Agriculture Ministry’s Center for Agricultural Analysis said. This is a record weekly volume. Almost all of this was shipped to China (601,000 tons, or 99.5% of exports for the week). Since the beginning of the season (from September 1, 2020 to January 31, 2021) Russian soybean exports amounted to 1.4 million tons (that is, more than 40% of all exports took place during the last week before the introduction of the export duty). This is a 2.9-fold increase over last season (480,800 tons).

Soft wheat exports from the European Union in the 2020/21 season that started last July had reached 16.25 million tonnes by Feb. 14, data published by the European Commission showed. That was down from 19.53 million tonnes cleared by the same week last season

European Union soybean imports in the 2020/21 season that started last July had reached 9.17 million tonnes by Feb. 14, data published by the European Commission showed. That compared with 8.85 million tonnes cleared by the same week last season

Britain’s wheat imports rose in December and are running at more than double last season’s pace, customs data showed on Friday. Wheat imports for the month totalled 332,458 tonnes, up from 208,948 tonnes in November. Cumulative imports since the start of the 2020/21 season, which started last July 1, totalled 1.43 million tonnes, up from 551,807 tonnes in the same period a year earlier.

Euronext European wheat futures rose to their highest price in about two weeks on Monday, buoyed by an Algerian tender expected to bring fresh exports sales for French wheat. Front-month March milling wheat ended up 6 euros, or 2.7%, at 229.75 euros ($278.71) a tonne. The settlement price was slightly lower at 228.50 euros.

Australian farmers will harvest a record amount of wheat during the 2020/21 season, the country’s chief commodity forecaster said on Tuesday, after heavy rains in the country’s key producing regions boosted yields. With harvesting nearly complete, output will total a record 33.34 million tonnes in the season ending in July 2021, the Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) said, surpassing the previous all-time high of 31.8 million tonnes in the 2016/17 season. ABARES said in December it expected wheat this year to total 31.17 million tonnes.

Egypt maintains strong soybean imports. As previously forecasted by Refinitiv trade flow models, Egypt imported about 613,100 tons of U.S. soybeans in January 2021, a substantial increase of 66% from the previous month. This is the second biggest monthly soybean imports into Egypt since 2017/2018 season (October/September). As a result, Egypt’s soybean imports for the first four months of the current marketing year totaled about 1.48 million tons, an 8% increase from the same period last year, and 52% above the three-year average of 973,830 tons.

India’s palm oil imports jumped 31% in January from a year earlier as lower import taxes prompted refiners to increase purchases of the tropical oil, while soyoil and sunflower oil imports fell, a trade body said. The country imported 780,741 tonnes of palm oil last month, while soyoil imports plunged 66% to 88,667 tonnes “as truckers strikes in Argentina seriously affected loading during November,” the Solvent Extractors’ Association of India (SEA) said. India in late November slashed the import tax on crude palm oil (CPO) to 27.5% from 37.5%, as New Delhi tried to bring down rising food prices. The CPO imports jumped 24% to 2.17 million tonnes in the first quarter of the 2020/21 marketing year started on Nov. 1 due to the duty reduction. The country’s sunflower oil imports fell 32% to 205,227 tonnes in January.

Australian farmers will harvest a record amount of wheat during the 2020/21 season, the country’s chief commodity forecaster said on Tuesday, after heavy rains in the country’s key producing regions boosted yields.

With harvesting nearly complete, output will total a record 33.34 million tonnes in the season ending in July 2021, the Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES) said, surpassing the previous all-time high of 31.8 million tonnes in the 2016/17 season. ABARES said in December it expected wheat this year to total 31.17 million tonnes.

India raised the base import price of crude palm oil by $32 to $1,045 per tonne, the government said in a statement on Monday.

India’s palm oil imports jumped 31% in January from a year earlier as lower import taxes prompted refiners to increase purchases of the tropical oil, while soyoil and sunflower oil imports fell, a trade body said. The country imported 780,741 tonnes of palm oil last month, while soyoil imports plunged 66% to 88,667 tonnes “as truckers strikes in Argentina seriously affected loading during November. India in late November slashed the import tax on crude palm oil (CPO) to 27.5% from 37.5%, as New Delhi tried to bring down rising food prices. The CPO imports jumped 24% to 2.17 million tonnes in the first quarter of the 2020/21 marketing year started on Nov. 1 due to the duty reduction, the SEA said. The country’s sunflower oil imports fell 32% to 205,227 tonnes in January.

Malaysian palm oil product exports for February 1-15 rose 27.4% to 530,545 tonnes from 416,565 tonnes shipped during January 1-15, cargo surveyor Intertek Testing Services said.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.