TOP HEADLINES

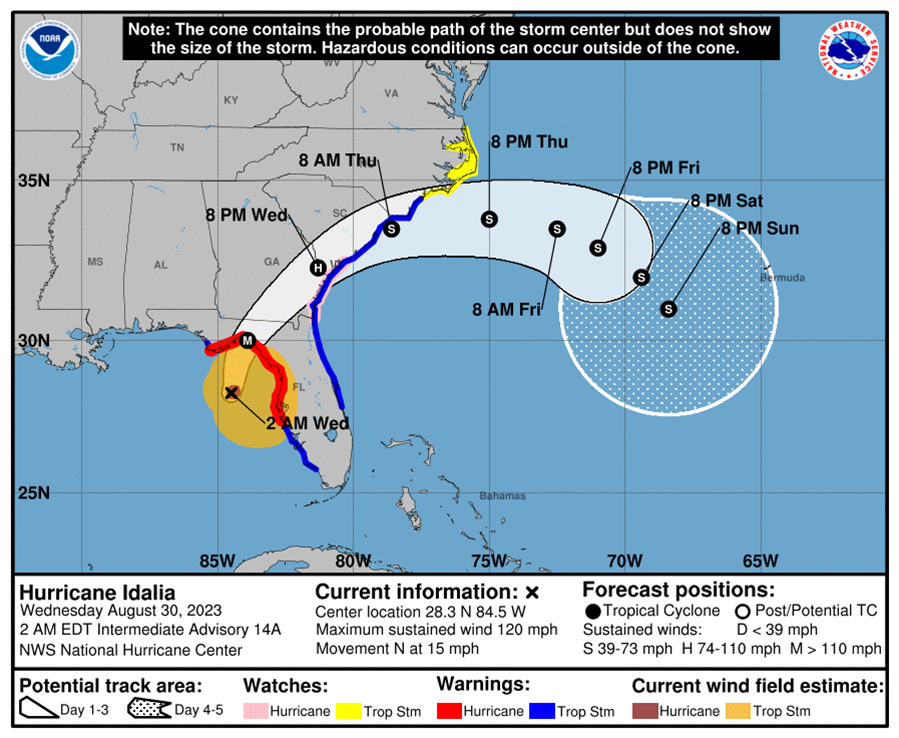

Idalia Strengthens to Category 4 Hurricane Nearing Florida

- Storm set to make landfall Wednesday morning local time

- State may see up to $15 billion in losses depending on track

Hurricane Idalia strengthened into a Category 4 storm as it heads toward landfall Wednesday on Florida’s west coast, threatening to unleash floods and trigger blackouts.

Idalia’s maximum sustained winds reached 130 miles (215 kilometers) per hour, with “catastrophic storm surge” nearing the state’s Big Bend region, the US National Hurricane Center said in an update at 5 a.m. Eastern time.

The eye of the hurricane is now located about 90 miles south of Tallahassee, as the storm crawls north-northeast. It’s expected to make landfall later this morning local time, then move along the coast of the Southeast US.

As much as 16 feet (4.9 meters) of sea water could be pushed onshore north of Tampa and 6 feet could slosh across Tampa Bay. The storm will likely strike north of heavily populated areas near Tampa and Clearwater, although changes to its path are possible.

The storm is currently moving over the extremely warm Loop Current, which will allow it to grow in strength. Tampa International Airport closed Tuesday. According to data from FlightAware, with hundreds of flights in and out of Tampa and Atlanta canceled for Wednesday.

chart from NOAA

FUTURES & WEATHER

Wheat prices overnight are up 5 in SRW, up 1 1/4 in HRW, down 2 1/2 in HRS; Corn is up 3 3/4; Soybeans up 6; Soymeal up $1.90; Soyoil up 0.37.

For the week so far wheat prices are down 18 in SRW, down 35 1/4 in HRW, down 18 3/4 in HRS; Corn is up 1; Soybeans up 3 1/2; Soymeal down $3.00; Soyoil up 0.07.

For the month to date wheat prices are down 86 1/4 in SRW, down 99 in HRW, down 86 1/4 in HRS; Corn is down 22 1/2; Soybeans up 67 1/2; Soymeal up $17.90; Soyoil up 3.65.

Year-To-Date nearby futures are down 27.6% in SRW, down 19.4% in HRW, down 19.9% in HRS; Corn is down 30.3%; Soybeans down 9.0%; Soymeal down 12.2%; Soyoil up 4.7%.

Chinese Ag futures (NOV 23) Soybeans down 24 yuan; Soymeal down 14; Soyoil up 30; Palm oil up 50; Corn down 2 — Malaysian palm oil prices overnight were up 71 ringgit (+1.81%) at 4001.

There were no changes in registrations. Registration total: 1,398 SRW Wheat contracts; 448 Oats; 0 Corn; 0 Soybeans; 67 Soyoil; 0 Soymeal; 147 HRW Wheat.

Preliminary changes in futures Open Interest as of August 29 were: SRW Wheat down 431 contracts, HRW Wheat up 1,191, Corn down 30,262, Soybeans down 3,037, Soymeal down 1,472, Soyoil down 5,148.

Northern Plains: Above-normal temperatures will be more common than not in the Northern Plains through the weekend. Some disturbances will be moving from the Pacific Northwest into the Canadian Prairies which may produce some isolated showers, but most of the region will be dry. That will favor the remaining wheat harvest, but not filling corn and soybeans. A front will set up in the region early next week that could bring more widespread showers.

Central/Southern Plains: A front moved through the Central and Southern Plains over the weekend with scattered showers and some areas of heavy rain this weekend, along with cooler temperatures. The cooler readings will be brief with heat returning by the weekend and significant heat possible again in early September. Any rainfall will be limited or nonexistent — not a good way to end the season for filling corn and soybeans.

Midwest: A front passing through the Midwest on Tuesday may bring a few showers and another burst of milder air before temperatures start to rise again this weekend. Significant heat could be possible again for early September with little precipitation, a poor way to end this year’s corn and soybean crops. Early harvest should find some good conditions, however.

Canadian Prairies: Disturbances will be more likely to run through the Canadian Prairies from the middle of this week through early September with scattered showers, which may disrupt the wheat and canola harvests. It would be more favorable for forages, and possibly start the process for rebuilding soil moisture, however.

Delta: A front slowly pushed south through the Delta this weekend, and gradually pushed the heat out. But hotter temperatures will return this weekend into next week, which could be extremely hot again. Conditions will be mostly dry, though some isolated showers may fall in a few spots at times this weekend into early next week. Early harvest will find good conditions, but immature crops will not.

Brazil: A front has stalled in central Brazil over the past weekend and is forecast to produce showers throughout the week. The projected rain is well in advance of the start to the normal wet season, which typically sets in late September or early October. Rains ahead of planting are useful for conditioning soils after a long dry season, but planting is restricted until mid-September for most areas outside of Mato Grosso, which received a waiver to begin Sept. 1. Planting may start early due to the better soil conditions, a favorable situation for both the coming soybean and safrinha corn crops. Filling wheat in the south also has favorable conditions, though the remaining safrinha corn harvest will see more delays. A front moving into southern areas this weekend is likely to bring more rounds of rain, some of which may be heavy.

The player sheet for Aug. 29 had funds: net sellers of 8,500 contracts of SRW wheat, sellers of 4,000 corn, sellers of 6,500 soybeans, sellers of 4,000 soymeal, and sellers of 1,500 soyoil.

TENDERS

- SOYBEAN SALES: The USDA confirmed private sales of 246,100 metric tons of U.S. soybeans for shipment to unknown destinations in the 2023/24 marketing year.

- SOYMEAL SALES: The USDA confirmed private sales of 105,000 metric tons of U.S. soybean meal for shipment to unknown destinations in the 2023/24 marketing year.

- FEED WHEAT SALE: South Korea’s Major Feedmill Group (MFG) has purchased about 55,000 metric tons of animal feed wheat expected to be sourced from the Black Sea region in a private deal without issuing an international tender.

- WHEAT TENDER: Egypt’s state grains buyer, the General Authority for Supply Commodities, is seeking wheat in an international tender for shipment Oct. 5-20 and/or Oct. 25 – Nov. 10 and/or Nov. 15-30. GASC said the deadline for submitting offers was Aug. 30.

- DURUM TENDER: Algeria’s state grains agency OAIC has issued an international tender to purchase a nominal 50,000 metric tonnes of durum wheat.

PENDING TENDERS

- RICE TENDER: South Korea’s state-backed Agro-Fisheries & Food Trade Corp issued an international tender to purchase an estimated 130,200 metric tons of rice all to be sourced from China

- WHEAT TENDER: A Syrian state grains agency issued an international tender to purchase and import 200,000 metric tons of soft milling wheat.

- FEED BARLEY TENDER: Jordan’s state grains buyer issued an international tender to purchase up to 120,000 metric tons of animal feed barley.

TODAY

ETHANOL: US Weekly Production Survey Before EIA Report

Output and stockpile projections for the week ending Aug. 25 are based on seven analyst estimates compiled by Bloomberg.

- Production seen lower than last week at 1.02m b/d

- Stockpile avg est. 22.599m bbl vs 22.79m a week ago

Canada 2023 Wheat Crop Est. 29.5M Tons, Canola 17.6M: StatsCan

Wheat production seen 14.2% lower than last year’s crop, according to estimates released Tuesday by Statistics Canada on its website.

- In a Bloomberg survey, analysts were expecting 30.3m tons of wheat production

- Durum wheat production seen falling 26.4% y/y to 4.3m tons; survey avg 3.8m tons

- Canola production seen falling 6.1% y/y to 17.6m tons; survey avg 18.2m tons

Farm Futures survey sees fewer U.S. corn acres, more soybeans in 2024

A Farm Futures magazine survey of U.S. planting intentions for 2024 found that growers expect to reduce their plantings of corn in the coming crop year while increasing soybean and wheat acres.

- Corn plantings for 2024 were forecast at 93.100 million acres, down 1.1% from the U.S. Department of Agriculture’s 2023 estimate of 94.096 million

- Soybean plantings were seen at 85.402 million acres, up 2.3% from the USDA’s 2023 estimate of 83.505 million

- All-wheat seedings were seen at 52.679 million acres, up 5.8%

- Winter wheat seedings were seen at 38.665 million acres, up 5.0%

- Spring wheat plantings were seen at 14.014 million acres, up 7.8%

- Farm Futures surveyed 985 producers from July 15 to Aug. 1 via an email questionnaire

Cheap EU Black Sea Wheat Starts to Undercut Russian Competition

Wheat from European Union nations bordering the Black Sea is trading cheaper than rival origins like Russia, raising its relative attractiveness for buyers.

Russia — the world’s top wheat exporter — has tried to maintain an unofficial price floor while tightening its hold on the world’s wheat supplies following its invasion of Ukraine, but bumper stocks elsewhere have lowered costs. As a result, countries that previously bought wheat mainly from Russia are starting to turn to cheaper competitors.

“Russian wheat has lost its competitive edge because of the price floor and the competition with Romania and Bulgaria,” said Andrey Sizov, managing director at research firm SovEcon. Those countries have a big crop and high carryover stocks, he said. Crops in Romania and Bulgaria make up about a fifth of EU production.

EU Soft-Wheat Exports Fall 29% in Season Through Aug. 27

The European Union’s soft-wheat exports in the season that began July 1 reached 4.49m tons as of Aug. 27, compared with 6.31m tons in a similar period a year earlier, the European Commission said on its website.

- Leading destinations include Morocco (915k tons), Algeria (457k tons) and South Korea (386k tons)

- Barley exports are at 1.32m tons, down 29% y/y

- Corn imports are at 2.37m tons, down 39% y/y

EU soybean imports up 10% by Aug 13, rapeseed down 60%

PARIS, Aug 29 (Reuters) – European Union soybean imports in the 2023/24 season had reached 2.16 million metric tons by Aug. 27, up 10% from 1.96 million tons a year earlier, data published by the European Commission showed on Tuesday.

EU rapeseed imports in the same period totalled 373,837 tons, down 60% from the 923,460 tons imported a year earlier.

Soymeal imports totalled 2.32 million tons, close to the 2.37 million tons imported in the same period last year, while palm oil imports stood at 502,705 tons, down 16% from 596,042 tons a year earlier.

The Commission listed the following five largest supplier countries to the EU so far in 2023/24 per product, compared with a year earlier:

Brazil soy exports seen reaching 7.37 mln tns in August – Anec

- BRAZIL SOY EXPORTS SEEN REACHING 7.37 MILLION TNS IN AUGUST VERSUS 5.05 MILLION TNS IN SAME MONTH A YEAR AGO- ANEC

- BRAZIL CORN EXPORTS SEEN REACHING 9.19 MILLION TNS IN AUGUST VERSUS 6.89 TNS IN SAME MONTH A YEAR AGO- ANEC

- BRAZIL SOYMEAL EXPORTS SEEN REACHING 1.93 MILLION TNS IN AUGUST VERSUS 1.69 MILLION TNS IN SAME MONTH A YEAR AGO- ANEC

Alberta wheat production expected to fall 16% after hot, dry summer

Farmers in southern and parts of central Alberta have been hit with a double whammy of both hot and dry conditions this summer, according to new data from Statistics Canada that reveals just how hard the weather has been on crop production.

“In Alberta, provincial reports indicated that less than half (43.1 per cent) of the total crop was rated as being in good to excellent condition at the end of July, well below the five-year average of 60.2 per cent,” the agency reported Tuesday.

Wheat has been especially hard hit.

Even though the total harvested area is expected to increase slightly from last year, Statistics Canada says wheat yields are anticipated to be 18.7 per cent lower, at just 45.2 bushels per acre.

Total wheat production in the province is projected at 9.5 million tonnes, down 16.2 per cent from 2022.

An animated image combining two maps showing rainfall and temperature anomalies. Southeastern Alberta saw both hot and dry weather in the summer of 2023. (Statistics Canada)

Dry conditions were seen across the Prairies this summer, with many areas receiving 90 to 120 millimetres less rain than average.

Southern and parts of central Alberta also saw above-average temperatures.

The conditions have led to an earlier-than-normal harvest for many farmers in the province.

Ethanol Maker Says US ‘Green’ Jet Fuel Fate Hinges on Tax Policy

- Green Plains CEO expects US guidance as soon as September

- Decision on how to track emissions key to IRA benefitBy Kim Chipman and Tarso Veloso

US corn farmers and biofuel producers are poised to gain from turning ethanol into sustainable jet fuel — depending on how Washington writes the tax policy.

That’s the message from ethanol maker Green Plains Inc. Chief Executive Officer Todd Becker at a conference on sustainable aviation fuel, or SAF, in Minneapolis. Makers of crop-based biofuels are pushing the Biden administration to help them take full advantage of tax credits in the landmark Inflation Reduction Act.

The hurdle lies in disagreement on how to track emissions from SAF, which can be made from a wide range of materials. The decision is seen as key as the US ethanol industry is counting on SAF to help revive demand in upcoming years, with gasoline consumption expected to decline as more electric cars take over the roadways.

Biofuel producers and farm state lawmakers are pushing for a model used by the US Energy Department that would give credit for carbon sequestered in soil even after crops are removed. Environmentalists seek what they consider a more rigorous model that factors in changes in land use driven by biofuel production. The latter could prevent some ethanol-based sustainable aviation fuel production from qualifying for the tax credit.

Becker’s comments come as he attempts to show investors his goal of expanding Green Plains beyond a traditional ethanol maker and into new markets including SAF will pay off. The CEO is already facing scathing criticism from activist shareholder Ancora Holdings Group LLC over performance as well as recent stock sales.

Guidance from the Treasury Department on the climate law’s potentially lucrative provisions is expected as early as September, Becker said.

Brazil fertilizer demand to recover in 2023/2024, industry consultant says

Brazilian farmers of staples like soybeans and corn are expected to order more fertilizers in the 2023/2024 cycle driven by a fall in prices of crop nutrients, an industry consultant said during a conference on Tuesday.

MB Agro forecasts deliveries of up to 42.8 million metric tons of fertilizers like potash and urea in the grain season that begins in September. If confirmed, it would mark a 4% increase from 41.1 million tons in the previous marketing year, according to MB Agro data.

Aside from the incentive to buy at lower prices, there is demand in Brazil to rebalance soil nutrients after farmers applied less fertilizer in the 2022/2023 season, MB Agro partner Alexandre Barros said.

For the fertilizer lobby Anda, there are signs that Brazil will have “a year very similar to 2022,” said Ricardo Tortorella, the head of the group.

He preferred not to make projections, but cited consultants’ estimates that forecast fertilizer deliveries between 42 million and 43 million tons for the 2023/2024 cycle.

Brazil imports about 85% of its fertilizer demand.

Rice Resumes Gain as India Implements More Export Restrictions

- Asian benchmark Thai white 5% broken advances to $646 a ton

- India imposes 20% tariff on shipments of the parboiled variety

Rice prices in Asia rebounded on escalating concerns around supply as top exporter India implemented more restrictions on its shipments.

Thai white rice 5% broken, an Asian benchmark, advanced to $646 a ton on Wednesday, according to the Thai Rice Exporters Association. Prices dipped on Aug. 16 after rallying to the highest in almost 15 years the previous week.

Rice is vital to the diets of billions of people across Asia and Africa, and the jump in prices is likely to stretch the budgets for many. India’s mounting curbs have prompted Guinea to send its trade minister to the South Asian nation to seek an exemption and allow shipments to the West African country.

India recently imposed a 20% tax on shipments of the parboiled variety and a minimum export price on basmati, meaning every grain the nation ships is now subject to curbs. The country accounts for almost 40% of global rice trade.

“There are limited risks that other major rice exporting countries will follow suit with export restrictions,” said Oscar Tjakra, a senior commodities analyst at Rabobank in Singapore. However, that could change if weather disruptions significantly reduce domestic output, he added.

There are concerns about lower rainfall affecting production in Thailand, particularly with the onset of El Niño. The world’s second-biggest rice exporter has asked farmers to grow one crop this year instead of two, although higher shipments from Vietnam could potentially help offset any supply shortage.

Interested in more futures markets? Explore our Market Dashboards here.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.