TODAY—DELIVERABLE STOCKS—MONTHLY OILSEED/GRAIN CRUSHING REPORTS—

Overnight trade has SRW Wheat up roughly 2 cents, HRW up 3; HRS Wheat up 2, Corn is up 2 cents; Soybeans up 5; Soymeal up $1.50, and Soyoil up 45 points.

The player sheet had funds net sellers of 13,000 contracts of SRW Wheat; sold 27,000 Corn; sold 17,000 Soybeans; net sold 5,000 lots of Soymeal, and; net sold 7,000 lots of Soyoil.

We estimate Managed Money net short 4,000 contracts of SRW Wheat; long 261,000 Corn; net long 187,000 Soybeans; net long 65,000 lots of Soymeal, and; long 104,000 Soyoil.

There were changes in registrations—Registrations total 209 contracts for SRW Wheat; 240 Oats; Corn 1; Soybeans 175; Soyoil 1,658 lots; Soymeal 193; Rice 313; HRW Wheat 113, and; HRS 1,195.

The U.S. Department of Agriculture, in its last weekly crop progress report for 2020, on Monday rated 46% of U.S. winter wheat in good to excellent condition, up from 43% a week earlier, despite trade expectations for no change.

Ten analysts surveyed by Reuters on average had expected the government to rate 43% of the crop as good to excellent, steady with the previous week. Estimates ranged from 42% to 45%.

The USDA’s report showed improvement in drought-hit states in the southern Plains where farmers grow hard red winter wheat, the largest U.S. wheat class, used for bread.

In Kansas, the top U.S. winter wheat producer, the USDA rated 33% of the state’s crop as good to excellent, up from 29% last week. Good-to-excellent ratings rose by 3 to 8 percentage points in Colorado, Oklahoma and Texas.

The USDA said 92% of the U.S. winter wheat crop had emerged from the ground as of Sunday, roughly on par with the five-year average of 91% for this time of year.

Over the winter the USDA’s National Agricultural Statistics Service releases monthly reports for select states. The government will resume weekly U.S. crop progress reports in April.

U.S. soybean crushings in October likely reached a record-high 5.899 million short tons, or 196.6 million bushels, according to the average forecast of nine analysts surveyed by Reuters ahead of a monthly U.S. Department of Agriculture (USDA) report.

Estimates ranged from 195.0 million bushels to 197.5 million bushels, with a median of 196.7 million bushels.

The USDA is scheduled to release its monthly fats and oils report at 2 p.m. CST (2000 GMT) on Tuesday.

U.S. soyoil stocks at the end of October were seen rising to 1.912 billion lbs, based on estimates from six analysts, up from 1.849 billion lbs at the end of September and above stocks of 1.820 billion lbs at the end of October last year.

Soyoil stocks estimates ranged from 1.887 billion to 1.950 billion lbs, with a median of 1.903 billion lbs.

The National Oilseed Processors Association (NOPA), whose members account for 95% of all soybeans processed in the United States, said its members crushed 185.245 million bushels in October, the most ever for a single month. End-of-month oil stocks among NOPA members rose to 1.487 billion lbs.

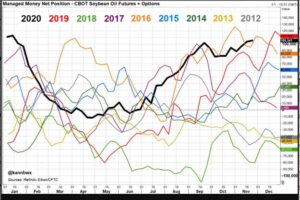

In the week ended Nov. 24, money managers cut their net long position in CBOT soybean futures and options by nearly 5,000 contracts to 203,810 contracts, based on data published on Monday by the U.S. Commodity Futures Trading Commission.

Most-active soybean futures on Monday topped out at $11.99 per bushel after briefly touching $12 a week ago. But the contract finished the day 2% lower, its largest daily drop in a month, as beneficial rains fell over portions of South America.

Brazil’s presumably record-large soybean harvest is not expected to be available as early as in past years. But top-buyer China has notably slowed purchases in recent weeks, and there are signs the soybean rally has cooled Chinese interest in the U.S. oilseed for now.

In CBOT soybean meal, money managers reduced their net long to 71,135 futures and options contracts through Nov. 24 from 78,486 a week earlier after futures hit another 2-1/2-year high during the period.

Money managers boosted their net long in CBOT corn futures and options to 287,599 contracts through Nov. 24 from 278,889 a week earlier. Outright longs reached a 2-1/2-year high, though funds also added gross shorts for a third consecutive week.

Reduced fuel usage and the impact on ethanol continue to be a dark spot for U.S. corn. But demand is otherwise strong, especially for exports, and the idea that China could drastically boost corn imports has become a semi-permanent market fixture for bulls.

Most-active corn futures hit a 16-month high on Monday of $4.39-1/2 per bushel before closing lower. Futures have fallen 1.5% over the last three sessions, and funds are predicted to have sold 27,000 corn contracts.

Money managers expanded their bullish views in Chicago wheat futures and options by just 885 contracts through Nov. 24, resulting in a net long of 15,299. But trade estimates suggest funds flipped to a slightly bearish stance following Monday’s trade, which would be their first net short since mid-August.

Most-active Chicago wheat plunged 3.5% on Monday, its worst day in over two months. Top supplier Russia said its upcoming grain export quota might increase by 2.5 million tonnes, and Australia boosted its bumper crop expectations by more than 2 million tonnes

Through Nov. 24, funds increased their net long in Kansas City wheat futures and options by 454 contracts to 48,421, though they reduced their Minneapolis long by 207 to 5,854 futures and options contracts. That is the third consecutive week in which speculators did very little with those contracts.

Two major unions in Argentina’s agro-export industry, one of the world’s top grains exporters, said on Monday that they would launch an indefinite strike starting Tuesday morning, ramping up a standoff that has been simmering for months.

Oilseed workers and grains inspectors are demanding a wage increase amid high inflation that has roiled Argentina for years. Argentina is the main global exporter of soybean oil and meal, which is the country’s top cash crop.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.