TODAY—COMMITMENT OF TRADERS—

Overnight trade has SRW Wheat up roughly 6 cents, HRW up 1; HRS Wheat up 4, Corn is up 2 cents; Soybeans up 10; Soymeal up $1.50, and Soyoil down 5 points.

For the week, SRW Wheat prices are up roughly 8 cents; HRW down 3; HRS up 7; Corn is up 11 cents; Soybeans up 52 cents; Soymeal up $4.00, and; Soyoil up 130 points. Crushing margins were down $0.29 at $0.71 (March); Oil share unchanged at 33%.

Chinese Ag futures (May) settled up 30 yuan in soybeans, up 19 in Corn, up 8 in Soymeal, up 92 in Soyoil, and up 140 in Palm Oil.

Malaysian palm oil prices were up 3 ringgit at 3,820 (basis March).

In Brazil, conditions will still be favorable for crops in most of the nation. There will still be some pockets that are drier than preferred from Rio Grande do Sul into Parana and greater rain will be needed in this area later in the month to prevent crop stress from becoming serious.

A notable rain event will still occur in Argentina due to a frontal boundary Sunday into Tuesday. Rain from this will likely be greatest in west-central and northern Argentina. Last evening’s GFS model was still aggressive with rainfall in east-central Argentina, such as Entre Rios and southern Santa Fe, which differs from the European Model that has been showing much less in this particular area.

The player sheet had funds net sellers of 5,000 SRW Wheat; sold 5,000 Corn; net sold 12,000 Soybeans; sold 5,000 lots of Soymeal, and; sold 2,000 lots of Soyoil.

We estimate Managed Money net long 37,000 contracts of SRW Wheat; long 389,000 Corn; net long 252,000 Soybeans; net long 99,000 lots of Soymeal, and; long 129,000 Soyoil.

Preliminary Open Interest saw SRW Wheat futures down roughly 3,200 contracts; HRW Wheat up 1,400; Corn up 24,300; Soybeans down 945 contracts; Soymeal down 1,000 lots, and; Soyoil down 200.

Deliveries were ZERO Soymeal; ZERO Soyoil; Rice 202; and 80 Soybean.

There were changes in registrations (Soybeans up 55; Rice up 200)—Registrations total 49 contracts for SRW Wheat; ZERO Oats; Corn ZERO; Soybeans 131; Soyoil 1,313 lots; Soymeal 175; Rice 658; HRW Wheat 91, and; HRS 1,023.

Tender Activity—Japan bought 120,000t US/Canadian /Australian wheat—Syria seeks 25,000t Black Sea wheat—

All Wheat sales are running up 10% versus a year ago, shipments down 1%, with the USDA currently forecasting a2% increase

By class, HRW sales up 3%, shipments up 3% with the USDA at a5% increase

SRW down 25%, shipments down 31% (down 18%)

HRS up 13%, shipments up 3% (up 1%)

Corn is up 137%, shipments up 72% (USDA up 49%)

Soybeans up 84%, shipments up 78% (USDA up 31%)

Soymeal up 6%, shipments up 17% (USDA unchanged)

Soyoil up 15%, shipments down 33% (USDA down 3%)

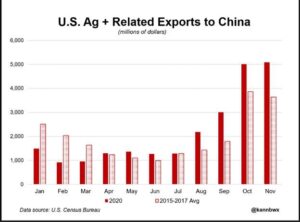

Wire story reported the U.S. government has maintained record export forecasts for domestic corn and soybeans in 2020-21, and while the progress lies at opposite ends of the spectrum, the underlying assumptions remain reasonable for now. China continues to be a prominent customer, as U.S. corn shipments to the Asian buyer in November were record-high for any month at 1.28 million tonnes. That is according to data published by the U.S. Census Bureau on Thursday. That data also confirmed that U.S. agricultural and related exports to China in November hit $5.09 billion, record-high for any month and up 40% from the 2015-2017 average. Soybeans accounted for 65% and corn 5%, and the larger dollar values were supported by higher commodity prices. U.S. soybean shipments to all destinations in the first quarter of the 2020-21 marketing year that began on Sept. 1 totaled a record 29.8 million tonnes. That is 18% more than the previous high set in 2016.

China’s live hog futures tumbled in their debut on the Dalian Commodity Exchange, with analysts attributing the sell-off to the contract’s high listing price and as expectations of increasing supply weigh on prices. The front-month September contract was last down 10% at 27,610 yuan ($4,271.28) per tonne on Friday versus its listing price of 30,680 yuan. Open interest and trading volume stood at 15,720 and 61,923 lots, respectively, at midday. In comparison, Dalian’s most active contract for soymeal, a key pig feed ingredient, registered open interest and trading volumes of 2.45 million and 1.7 million lots.

Argentina’s 2020/21 wheat crop is expected at 17 million tonnes versus a previous 16.8 million-tonne estimate, the Buenos Aires Grains Exchange said on Thursday, citing better than expected yields in some areas as the reason for increasing its forecast.

Argentina´s corn producers and the country’s agriculture minister held a crunch meeting on Thursday in which the government was asked to review a decision to temporarily suspend corn exports; officials had ended without resolution nor a timeline for a response; we had the meeting, we talked and we are waiting

The union representing Argentine port-side grain inspectors said on Thursday it had ended a month-long wage strike after reaching a contract deal with export companies that will allow international soy, corn and wheat shipments to return to normal.

French soft wheat shipments outside the European Union in December fell from a season’s high the previous month as exports to China eased, an initial estimate based on Refinitiv data showed.

Soft wheat exports to destinations outside the EU totalled 797,000 tonnes in December, the sixth month of the 2020/21 season, the Refinitiv loading data showed. That was below the 877,000 tonnes recorded in November, although December’s total was still the second-largest so far this season. China was the largest importer of French soft wheat outside the EU for a third straight month in December, accounting for 271,300 tonnes.

Euronext wheat fell for a second day on Thursday in step with Chicago futures as wheat markets eased from multi-year highs fuelled by South American supply risks. March milling wheat settled down 1.50 euros, or 0.7%, at 214.50 euros ($263.04) a tonne. On Wednesday it had climbed to 219.00 euros, a life-of- contract peak and highest front-month price since August 2018, before closing lower.

Export prices of rice in India rose this week on strong rupee and higher demand from rival nations, while increasing prices in Thailand raised worries about losing out to other Asian competitors. Top exporter India’s 5% broken parboiled variety was quoted at $383-$390 per tonne this week, up from last week’s $381-$387. “We are raising prices considering the appreciation in rupee,

The Indonesian Palm Oil Association (GAPKI) said on Thursday it would ask the government to reformulate its biodiesel blending rates or revise the export levy if palm oil prices maintain their meteoric rise. Malaysia’s benchmark crude palm oil prices started the year at near 10-year highs, trading at around 3,800 ringgit a tonne ($950.81) and further widening its premium over crude oil, making it a less sustainable option for biodiesel feedstock.

Palm oil prices are likely to remain high in the first quarter but “fall dramatically” during the second half of the year as palm and oilseed plantings pick up, two leading industry analysts said in a webinar on Thursday. Prices would be propelled by the soyoil market, with crop-stressing drought in South America squeezing global soybean supplies and China continuing its stockbuilding of commodities, they said. Malaysia’s benchmark crude palm oil price jumped 6% during the first week of the year, trading at 3,817 ringgit ($945.27) a tonne on Thursday, its highest in nearly a decade.

Malaysia will delay the nationwide rollout of its B20 palm oil biodiesel mandate to early 2022 to prioritise an economy that has been battered by the COVID-19 pandemic. The mandate to manufacture biofuel with a 20% palm oil component – known as B20 – for the transport sector was first rolled out in January last year, and was set to be fully implemented across the country by mid-June 2021.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.