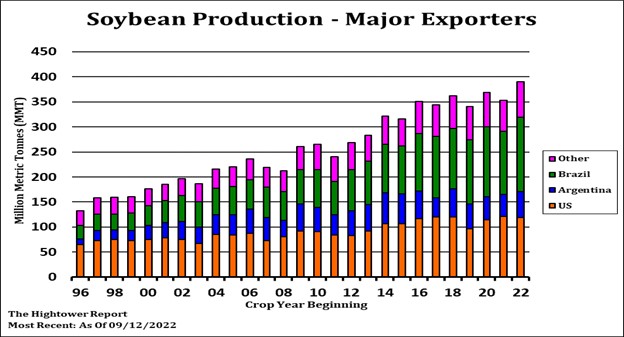

SOYBEANS

Soybeans ended higher following higher Crude and US equities. Lower US Dollar also offered support. Stocks and commodities continue to rally on feelings that bad US/World economic data could reduce the amount Central Banks raise interest rates. Key is will US Fed continue its stance that they will raise rates until US inflation is down to 2 pct. Feelings that USDA could increase US 2022 crop 35 MIL BU and reduce exports 50-100 mil bu on Oct 12 offers strong overhead resistance. Over 14.00 US farmers should increase cash sales. Bulls still have to contend with talk that Brazil could plant record high acres and produce a crop over 150 mmt. South Brazil is wet. Central and north Brazil has turned dry. Soybean plantings are near 5 pct versus 4 last year. Argentina remains dry. China is on holiday. Malaysian palmoil prices are higher.

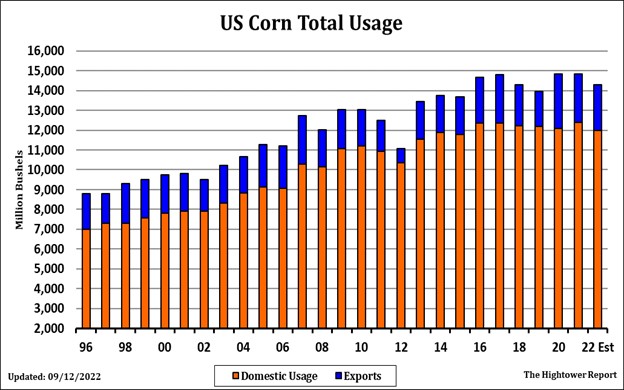

CORN

Corn futures ended higher. Crude also is up on continued talk OPEC will reduce production. Crude is near 85.58 with next resistance near 86.71. Gold continues its largest 2 day rally since March. Talk of lower US crop and slow farmer selling offers support. Low demand for US corn exports offers resistance. Uncertainty over Ukraine exports also offers support. Ukraine continues to advance into Ukraine territories that Russia recently annexed. This raises concern that Russia may retaliate. There is already talk that Russia may not extend Ukraine export corridor when it expires in November. USDA estimates World corn trade near 183 mmt vs 203 ly. US 57 vs 63, Brazil 47 vs 44, Argentina 41 vs 39 and Ukraine13 vs 26. Some fear US export could drop to 50 mmt. USDA est US corn harvest near 20 pct vs 27 ly. Crop is slow in drying down. US topsoil dropped to 58 short to very short vs 54 last week and 46 ly. NE is 81. SD is 80. Low US navigation water levels continues to weigh on basis levels.

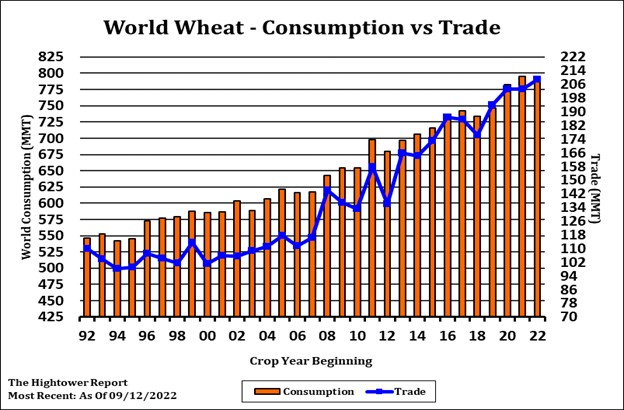

WHEAT

Wheat futures ended mixed. Chicago and MLS ended lower. KC ended higher but off session high. Last week, wheat futures rallied after USDA lowered US 2022 crop. The crop was lowered 128 mil bu from the average trade guess. Winter wheat was down 87 mil bu. HRW was down 42, SRW 42 and white down 2. HRS was down 32 and durum 10. On Monday. Futures took profits on new month and quarter trade. There was also a chance for rain next week across dry areas of KS, OK and W TX. Today’s maps reduced this rain event. US topsoil dropped to 58 pct short and very short from 54 last week and 46 ly. KS is 86, OK 92, AR 86 and NE 81. USDA estimates World wheat exports near 208 mmt vs 202 ly. Russia is 42 vs 33. EU 33 vs 32. Canada 26 vs 15. Australia 25 vs 27. Argentina 13 vs 16. US 22 vs 22. 30 mmt goes to N Africa. 26 SE Asia, 23 to Middle East.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.