Soybeans and soymeal traded sharply higher. Soyoil, corn and KC wheat traded higher. Chicago Dec wheat traded slightly lower. US stocks were higher. US Dollar was lower. Crude was higher. Blue wave could help chances for a new stimulus deal. Red Senate could limit other changes.

SOYBEANS

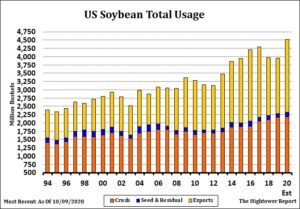

Soybeans jumped on South America weather concerns. Managed funds were net buyers of 7,000 soybeans, 2,000 soyoil and 3,000 soymeal. We estimate Managed funds are net long 222,000 soybeans, 83,000 soymeal and 92, 000 soyoil. Jan Soybeans is back over the 20 day moving average near 10.61 and Tuesdays high. There were no new US soybean sales announced to China again today. Dalian soymeal futures traded higher. Malaysian palmoil prices also traded higher. Concern about South America soybean supplies is helping soymeal. There is also talk that due to higher domestic corn prices China hog producers are adding more soymeal to their feed rations. USDA estimates US 2020 soybean crop near 4,268 mil bu and exports near 2,200. This suggest a carryout near 290. This week one group estimated US crop near 4,183 mil bu. Some commercials feel US final exports could be up 150 mil bu from USDA guess. This could drop US carryout below 100 mil bu.

CORN

Corn futures traded mixed. CZ was 1 cent lower while CZ21 was 1 cent higher. The big gains in soybean and soymeal futures failed to attract new buying in Dec corn. Dry weather in south Brazil could reduce intended soybean acres and farmer could switch to corn. Talk that Ukraine meat producers asked for reduced corn exports to conserve corn supplies for domestic use may have offered some support. Weekly US corn export sales are estimated near 1,800-2,500 mt versus 2,243 last week. US corn export prices are the lowest for export in the World. Managed funds were net even in corn. We estimate Managed funds are net long 225,000 corn. US Midwest 2 week forecast calls for normal to above temps and below normal rains. There continues to be signs that over the next 2 weeks, rainfall in Russia, South Brazil and Argentina will be less than normal. Dec corn is trading back below the 20 day moving average near 4.03. Many still feel CZ could be in a 3.80-4.20 range. Weekly US ethanol production was up 2 pct from last week and down 5 pct from ly. Stocks were up slightly from last week and down 10 pct from last year. USDA estimates US 2020 corn crop near 14,722 mil bu and exports near 2,325. This suggest a carryout near 2,167. This week one group estimated US crop near 14,502 mil bu. Some commercials feel US final exports could be up 235 mil bu from USDA guess. This could drop US carryout below 1,800 mil bu.

WHEAT

Wheat futures traded mixed. Dry weather patterns in parts of Russia. Argentina and US south plains has helped WZ traded close to 6.40. Concern that US wheat export prices are too high to get new export demand offers resistance Best support could be closer to 5.80 WZ. KW bounced off the 20 day moving average and helped negate the potential negative chart formation. MWZ dropped from recent high near 5.90 to a low near 5.50. Support is near 5.44 with resistance near 5.58. Wheat market remains a weather market. Increase cases of Covid could reduce US/World feed demand which could also limits price gains. Weekly US wheat export sales are estimated near 200-700 mt versus 743 last week. Trade suggest US farmers add to 2021 sales above 6.20 WZ. End users add to 2021coverage below 5.80. USDA estimates US 2020/21 HRW end stocks near 334 mil bu versus 522 last year. 2021/22 end stocks are estimated near 216. USDA estimates US 2020/21 SRW end stocks near 102 mil bu versus 109 last year. 2021/22 end stocks are estimated near 140. USDA estimates US 2020/21 HRS end stocks near 288 mil bu versus 252 last year. 2021/22 end stocks are estimated near 337.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.