SOYBEANS

Prices finished mixed with beans $.02 – $.04 higher, meal was up $2, while oil down 10 – 20. May-24 beans traded to its highest level since Feb 1st overnight, before pulling back. Prices held above $12 during the AM selloff. May-24 meal traded above its recent range of $325 – $345 before pulling back and closing right at its 50 day MA of $344.30. May-24 oil failed to trade thru the $.50 resistance level overnight however held support above the $.48 level. Uncertainty over how heavy rain and flooding across EC areas of Argentina and Southern Brazil will impact soybean and corn production triggered the speculative buying and higher prices. While these excessively wet areas are expected to dry out over the next week, much of the cropland has seen 2 to 4 times their normal rainfall over the past 30 days. Spot board crush margins slipped $.01 today to $.82 bu. with meal PV improving to 41.5%. Export sales at 18 mil. bu. was in line with expectations. YTD commitments at 1.476 bil. are down 19% from YA, vs. the USDA forecast of down 14%. Commitments represent 86% of the USDA forecast, below the historical average of 91%. There were combined sales to China/unknown of just over 9 mil. bu. Soybean meal sales at 243k tons were in line with expectations. YTD commitments are up 20% from YA, vs. the USDA forecast of up 8%. The US drought monitor showed 30% of soybean acres in drought, down 3% from week ago.

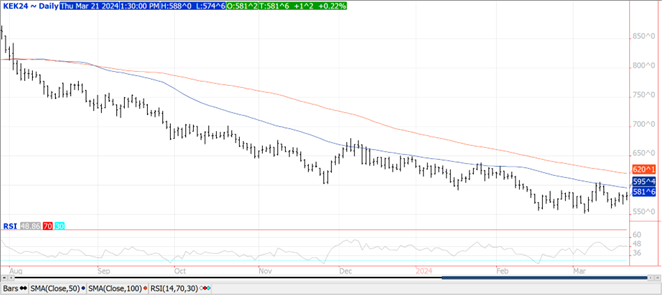

CORN

Prices were $.01 – $.02 higher today. May-24 reached a 5 week high overnight before backing off. Next resistance is at $4.63. Dec-24 corn had its highest close in 6 weeks at $4.76 ¾. Rains are still expected to fill in over central and northern growing regions of Brazil thru month-end helping build subsoil moisture for the 2nd corn crop. A mix of heavy snow and rain across the NC Midwest over the next 5 days should further ease drought conditions. Heavy rain across the southern Midwest and Delta region will delay early season planting efforts. Export sales at 47 mil. bu. were in line with expectations. YTD commitments at 1.642 bil. are up 19% from YA, vs. the USDA forecast of up 26%. Commitments represent 78% of the USDA forecast, just below the historical average of 80%. The US drought monitor showed 34% of corn acres in drought, down 2% from week ago. This afternoon the BAGE reduced their Argentine production forecast 2.5 mmt to 54 mmt, below the USDA est. of 56 mmt.

WHEAT

Prices managed to scratch out gains of $.01 – $.02 across all 3 classes. Chicago May-24 continued to chop sideways between $5.25 – $5.55. Similar story for KC May-24 between $5.50 – $6.05. May-24 MGEX continues to bounce off lows just above $6.40. Export sales at 7 mil. bu. (-4 mil. – 23/24 MY, 11 – 24/25 MY) were in line with expectations. Old crop commitments slipped to 676 mil. still up 3% from YA, vs. the USDA forecast of down 6.5%. Commitments represent 95% of the USDA forecast, above the historical average of 92%. Shipments however are still down 9%. SRW exports –9 mil. due to the Chinese cancellations. Total outstanding SRW sales to China is down to 29 mil. SovEcon raised their Russian production forecast 1.2 mmt to 94 mmt vs. the USDA forecast of 91.5 mmt. Winter wheat areas in drought fell 2% LW to only 12%, vs. 51% YA.

All charts provided by QST

>>See more market commentary here.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.