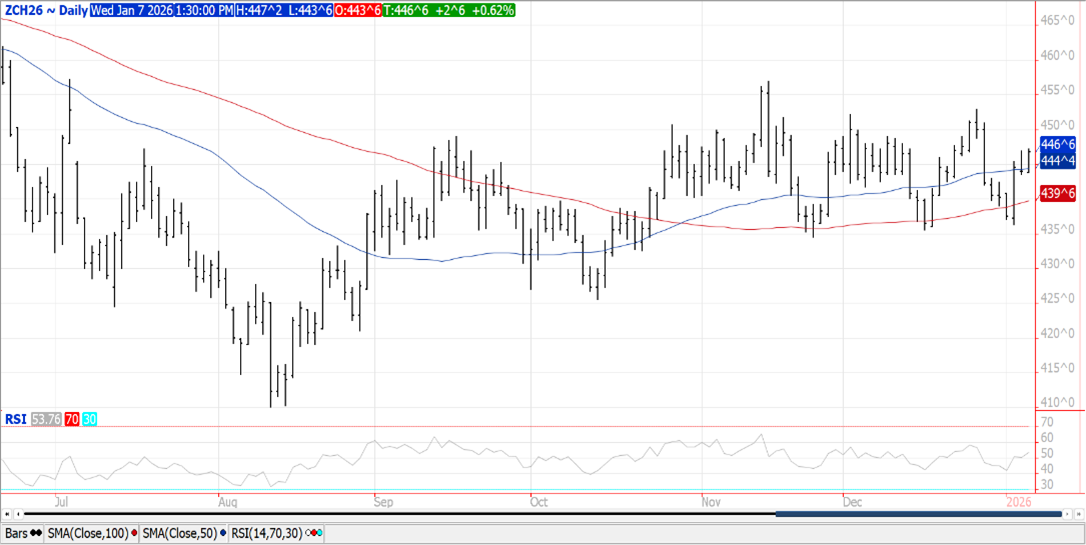

CORN

Prices were up $.02-$.03 closing near session highs. Spreads were little changed. Mch-26 is back above its 50 MA while holding near the midpoint of its 2 ½ month range of $4.35-$4.55. Brazil’s Ag. Ministry reports corn exports reached 6.13 mmt in Dec-25, up 44% YOY. Exports in 2025 totaled 41.7 mmt, up 10.6%. ANEC is forecasting exports in 2026 will rise to 44 mmt vs. USDA forecast at 43 mmt. Ethanol production slipped to 1,098 tbd, or 323 mil. gallons in the week ended Fri. Jan. 2nd down from 329 mil. There was 109 mil. bu. used in the production process, or 15.55 mil. bu. per day, above the 15.35 mbd needed to reach the USDA forecast. Ethanol stocks jumped to 23.7 mil. barrels, a 5 month high however just below the 24.1 mb from YA. Tomorrow’s export sales are expected to land between 28-60 mil. bu.

SOYBEANS

Prices were mostly higher with beans up $.08-$.11, meal surged $5-$7 while oil is down 10-15 points. Spreads have firmed across the complex. Mch-26 beans seemed to run out of steam above yesterday’s high, however hadn’t back up much either. Next resistance at the 100 day MA at $10.85. Mch-26 meal surged back above its 100 day MA. Once again buying in Mch-26 oil seemed to dry up above $.50 lb. Weakness in energy markets also weighed on bean oil. Spot board crush margins firmed about a penny to $1.47 ½ with bean oil PV slipping back to 44.7%. China may be looking to shore up a vast majority of the 12 mmt of US soybeans ahead of next Monday’s USDA updates.

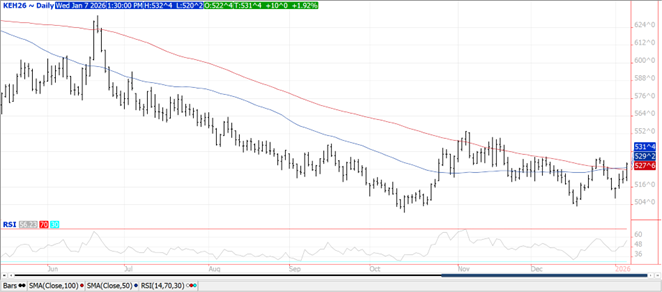

WHEAT

Prices finished with gains ranging from $.03-$.10 with KC the upside leader. Next resistance for Mch-26 CGO is $5.25. Mch-26 KC surged thru both its 50 and 100 day MA with next resistance at last month’s high of $5.36 ½. Since last reporting in late Nov-25, winter wheat ratings fell 2% in KS to 60% G/E, still well above the 47% G/E from YA. Ratings fell in CO, NE, OK and TX, while increasing in MT and ND. Markets benefited from expectations for expanded drought conditions in US winter wheat areas along with speculative short covering.

Charts provided by CQG

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 02547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2026 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.

Latest News & Market Commentary

ADM & Industry News

ADM Reports Third Quarter 2025 Results

November 4, 2025

The Ghost in the Machine Q3 2025

October 6, 2025