Soybeans, soymeal, soyoil traded higher but finished off session highs. Corn traded higher. Wheat traded lower. US stocks were higher. US Dollar traded higher. Crude traded higher. Gold traded lower. Copper traded higher.

SOYBEANS

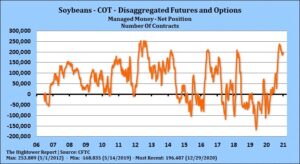

Soybean traded higher. Managed funds continued to add to a record long position. Some feel new buying could slow into weekly US export sales report and the Jan 12 USDA report. Bulls still feel potential drop in 2021 South America soybean supply and delay in Brazil harvest could add to demands for US soybeans. Drop in Argentina crop could also increase demand for US soymeal and soyoil. Weather maps hint of rain next week for parts of Argentina. Dalian soybean and soymeal contact made new highs. Malaysian palmoil futures also made new highs. A test of the 2008 high near 4,300 could result in higher soyoil prices. In 2008. Soyoil futures tested 70 cents. SH range has been 13.54 to 13.78. Trade estimates US 2020/21 soybean carryout near 100 mil bu vs USDA 175. Trade also looks for US final 2020 soybean crop near 4,150 versus USDA 4,170. Dec 1 US soybean stocks could be near 2,800 mil bu vs 3,252 last year. Some estimate Brazil+Argentina soybean crop near 174 mmt versus USDA 183. Trade estimates US soybean export sales near 600 mt versus 695 last week.

CORN

Corn futures traded higher. Managed funds are adding to their already record long position. Some feel new buying may slow in front of weekly export sales and USDA Jan 12 report. Weekly US corn sales are expected to be near 800-1,200 mt versus 964 last week. USDA announced 102.6 mt new US corn sales to unknown. Some feel that China 2020 corn crop could be down 30 mmt from USDA guess and that could trigger new China buying both in 2021 and than expected. US ethanol stocks decreased from last week, slightly below expectations. Sept-Nov corn used for ethanol totals 1704 mil bu vs 1780 mil bu last year. The pace could gain relative to last year during March-June, when ethanol production collapsed last year due to COVID. USDA may need to eventually raise their estimate for corn for ethanol by 100 mil bu to 5150 mil bu. Trade estimates US 2020/21 corn carryout near 1,380 mil bu vs USDA 1,702. Trade also looks for US final 2020 corn crop near 14,450 versus USDA 14,507. Dec 1 US corn stocks could be near 12,000 mil bu vs 11,327 last year. Some estimate Brazil+Argentina corn crop near 147 mmt versus USDA 159.

WHEAT

Wheat futures ended lower. Higher US Dollar and higher US equities may have weighed on prices. Wheat continues to be weakest link in the grain room. Large global stocks offers resistance. Fact that corn and soybean prices are expected to continue to trend higher offers support. World Wheat values continue to trade higher. After mid Feb, there are no Russia wheat export prices. Some feel final Russia wheat exports could drop below USDA estimate. Some feel EU will also have to slow their export pace to preserve old crop supplies for domestic use. Some feel the 2021 direction of wheat prices may depend upon weather. A weaker La Nina could offer increase chances for rain in east US south plains and Russia. If La Nina weakens in Feb then returns in May, US south plains, US Midwest and Russia could see a drier than normal summer. Trade estimates US Dec 1 wheat stocks near 1,685 mil bu vs 1,841 last year. Trade estimates US 2021 winter wheat acres near 31.9 mil vs 30.4 ly, HRW 22.4 vs 21.3, SRW 6.2 vs 5.5 and white winter 3.4 vs 3.5 ly.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.