Soybeans, soymeal, soyoil, corn and wheat traded higher. New buying pushed futures higher. Late profit taking erased some of the days gains. US stocks were higher. US Dollar was lower. Crude was higher. Cattle futures reversed Mondays losses.

SOYBEANS

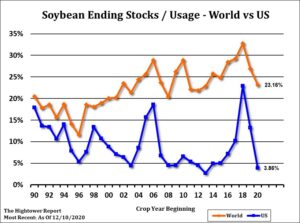

To many surprise, soybean futures traded sharply higher. Trade estimates US 2020/21 soybean carryout near 100 mil bu vs USDA 175. Doubt USDA will drop South America soybean crop, increase China soybean imports or increase US exports/crush as much as the trade. Trade also looks for US final 2020 soybean crop near 4,150 versus USDA 4,170. Dec 1 US soybean stocks could be near 2,800 mil bu vs 3,252 last year. Some estimate Brazil+Argentina soybean crop near 174 mmt versus USDA 183. Informa dropped Argentina crop 1.5 mmt to 50. US census soybean crush for Nov at 191 mil bu vs 174.6 mil bu last year was in line with expectations. Sept-Nov crush totals 558.7 mil bu vs 524.4 mil bu last year, up 34.6 mil bu. US domestic soybean meal use during Oct-Nov is up 9.8 pct from last year, while USDA is only forecasting a 1.5 pct increase in 2020-21 US domestic soybean meal use.

CORN

Corn futures traded higher with CH near 5.00. Open interest is increasing with signs of new fresh longs. Lack of new farmer selling above the market offers little resistance. Trade still concerned that lower South America 2021 corn supplies could increase demands for US exports and lower carryout. This could push prices even higher. US corn used for ethanol during November was 432 mil bu (vs 457 mil bu last year). The Sep-Nov corn grind for ethanol totals 1267 mil bu vs 1301 mil bu last year, down 34.1 mil bu. USDA is projecting a 198 mil bu increase in 2020-21 corn for ethanol, which could be low, assuming a rebound in US gasoline consumption during the summer months. Weekly EIA ethanol production is expected to down slightly from last week with another increase in stocks expected from last week. Trade estimates US 2020/21 corn carryout near 1,380 mil bu vs USDA 1,702. Doubt USDA will drop South America corn crop, China corn crop or increase US exports as much as the trade. Trade also looks for US final 2020 corn crop near 14,450 versus USDA 14,507. Dec 1 US corn stocks could be near 12,000 mil bu vs 11,327 last year. Some estimate Brazil+Argentina corn crop near 147 mmt versus USDA 159. Informa dropped Argentina corn crop 1.6 mmt to 47.

WHEAT

Wheat traded higher. Lower Dollar and increase flow on new money buying commodities offered support to wheat. Higher trend in EU and Black Seas wheat prices also offered support. Concern about US and Russia 2020 crops and Russia and EU old crop exports pace is also helping prices. USDA rated 2021 KS wheat crop 46 pct good/ex vs 33 in Nov and 40 last year. CO was 19 vs 20 in Nov and 57 last year. IL was 50 versus 79 in Nov and 48 last year. SD was 37 vs 57 in Nov and 73 ly. Trade estimates US Dec 1 wheat stocks near 1,685 mil bu vs 1,841 last year. Trade estimates US 2021 winter wheat acres near 31.9 mil vs 30.4 ly, HRW 22.4 vs 21.3, SRW 6.2 vs 5.5 and white winter 3.4 vs 3.5 ly. There was even talk that US spring wheat farmers could switch intended 2021 acres to corn or soybeans. Informa raised India wheat crop 8 mmt to 110.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.