Soybeans, soymeal and wheat traded lower. Soyoil traded higher. Corn was unchanged. US stocks were higher. US Dollar was lower.

SOYBEANS

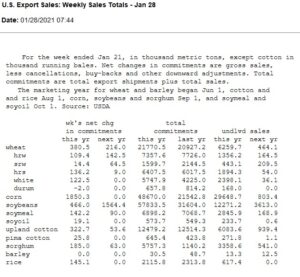

Soybean futures traded lower. Soymeal loss to soyoil. Some feel profit taking came in after US old crop soybean export sales were less than expected. Large new crop sales were reported. Market volatility is expected to increase given uncertainty over final South America crops, export supplies and final US soybean exports and carryout. USDA announced 466 mt US soybean export sales versus 800-1,400 expected. 620 mt was cancelled from unknown. Total commit is near 57.8 mmt versus 31.6 last year. USDA goal is 60.7 mmt versus 45.7 last year. China commit is near 34.7 mmt with 4.0 in unknown. Some feel China could take 38 mmt of soybean imports from US. Brazil soybean harvest is slowed due to rains. Brazil truckers still talking about a strike Monday for higher wages. Argentina rains is helping crops in the north but south remain dry. Argentina truckers strike is slowing grains to ports.

CORN

Corn futures ended unchanged. CH range was 5.29-5.50. CH made new highs before there was some profit taking. USDA announced 1,700 mt US corn sold to China and 213 mt US corn sold to unknown. USDA announced 1,850 mt US corn export sales versus 900-1,600 expected. Total commit is near 48.6 mmt versus 21.5 last year. USDA goal is 64.7 mmt versus 45.1 last year. China commit is near 11.8 mmt with 7.8 in unknown. Some feel China could take 25.0 mmt of corn imports; 5.0 from Ukraine, 3.0 from Brazil and 17.0 from US. USDA current China import guess is near 17.5. Some could see China taking 20 mmt from US. In Jan, USDA dropped World corn trade from 186.0 mmt to 183.6. This due to lower US exports. Still global stocks dropped 5.0 mmt to 283.8. Most of this due to lower US and Brazil. USDA still estimates China crop near 260.6 mmt with most crop watchers closer to 235.0. USDA est China corn stocks near 191.6 versus some estimates below 100 mmt. US sorghum export commit is near 5.7 mmt versus 1.1 ly. China commit is near 4.7.

WHEAT

Wheat futures traded lower. WH closed near 6.47. Range was 6.43-6.64. Lower soybean and fact corn traded off its highs weighed on wheat futures. KWH traded near 6.26. Range was 6.24-6.45. Concern that vaccine rollout was slower than hoped raised concern about delay in US economic recovery. US Fed comments that US economy was moderating also raised concern that restrictions on travel could slow consumer spending. US wheat export sales were 380 mt versus 250-600 expected. Total commit is near 15.5 mmt versus 15.7 last year. USDA goal is 26.8 mmt versus 26.2 last year. Key could be Russia exports. There is talk that Russia, EU and Argentina is looking at options to secure domestic wheat supplies short of export quotas. Argentina could soon increase wheat and corn export tax from 12 pct to 20 pct.

Monthly nearby Chicago wheat futures chart

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.