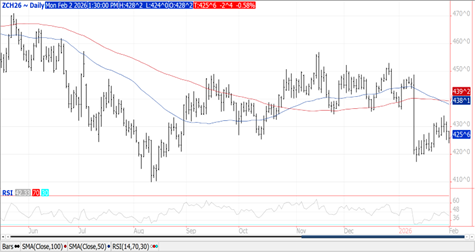

CORN

Prices were $.01 ½ – $.02 ½ lower with spreads little changed. Mch-26 fell below last week’s low while remaining rangebound between $4.15-$4.40. AgRural estimates that as of Thurs. Jan. 29th Brazilian farmers have planted 13% of their 2nd corn crop while harvest for the 1st crop has reached 10%. US cattle inventories as of Jan. 1st fell .4% YOY to 86.2 million, the lowest since 1951. Export inspections at 45 mil. bu. were in line with expectations however were a MY low and below the 61 mil. needed per week to reach the USDA forecast. YTD inspections at 1.284 bil. are up 50% from YA vs. the USDA forecast of up 12%. Japan took 17.5 mil. bu. while Mexico to 10 mil. Last week MM’s bought just over 9k contracts reducing their net short position to 72k contracts. There was just over 488 mil. bu. of corn used for the production of ethanol in Dec-25, above the average trade guess of 475 mil. and at the top end of the range of estimates. Usage was up 1.8% YOY and brought cumulative usage in the first 4 months of the 25/26 MY to 1.871 bil. bu., up less than 1% from YA vs. the USDA est. of up 3%.

SOYBEANS

Prices were mostly lower across the complex with beans down $.04-$.05, meal was up less than $1 while oil down 30-40 points. Spreads firmed across the complex. Mch-26 beans closed well off session lows at $10.51 ¾. Next support is at the January low at $10.37 ¾. Major MA support for Mch-26 oil is near 51.30. Support for Mch-26 meal is at the January low at $288.40. Spot board crush margins improved $.02 ½ to $1.73 with bean oil PV slipping to 47.5%. AgRural estimates soybean harvest in Brazil has reached 10% as of last Thursday with record yields being reported. Celeres raised their production forecast 3.8 mmt to 181.3 mmt, well above the USDA record forecast of 178 mmt. Monthly data from the EIA on biodiesel and RD production, capacity and feedstock usage data is coming out on Friday. MM’s were net buyers of just over 7k contracts of soybeans, nearly 39k contracts of bean oil and 6.4k contracts of meal. They flipped their net position in bean oil to long 13k contracts while extending their soybean long position to just over 17k contracts. Their short position in meal is down to 32k contracts. Export inspections at 48 mil. bu. were at the high end of the range of expectations and well above the 25 mil. bu. needed per week to reach the USDA forecast. YTD inspections at 808 mil. are down 36% from YA vs. the USDA forecast of down 16%. China took 27 mil. while Mexico took 5 mil. Census crush in Dec-25 at just under 230 mil. bu. was in line with expectations and the 2nd highest ever, just below the 236 mil. from Oct-25. Cumulative crush in the first 4 months of the 25/26 MY at 892 mil. bu. are up 7.4% from YA vs. the current USDA forecast of up 5%. Crush will need to reach 1.678 bil. bu. Jan thru Aug. to reach the current USDA forecast vs. 1.615 bil. YA

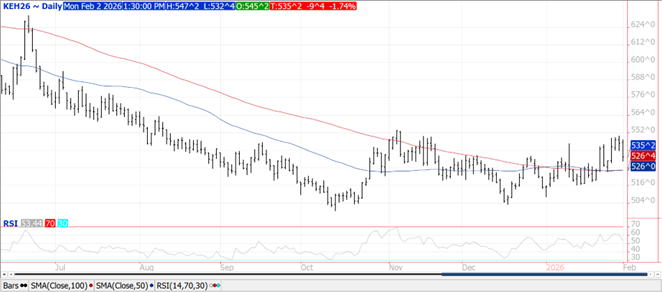

WHEAT

Prices fell sharply closing $.06-$.10 lower across the 3 classes. CGO Mch-26 fell back below its 100 day MA while holding just above the 50 day near $5.24. Support for KC Mch-26 is near its 50/100 day MA’s that converged near $5.26. Spreads also weakened. MM’s bought 16k contracts of CGO wheat, cutting their net short position to 95k contracts. They also bought nearly 3k KC cutting that short position to 10k contracts. Little to no moisture for the plain states this week however week 2 of the outlook calls for above normal precipitation. Taiwan reportedly purchased just over 106k mt of US milling wheat for spring shipment. Export inspections at 12 mil. bu. were in line with expectations however below the 16 mil. bu. needed per week to reach the USDA forecast. YTD inspections at 613 mil. bu. are up 19% from YA, vs. the USDA at up 9%. IKAR reports Russia’s export price for wheat ended LW at $231/mt FOB, up $2 from the previous week.

Charts provided by CQG

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 02547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2026 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.

Latest News & Market Commentary

ADM & Industry News

The Ghost in the Machine Q4 2025

December 22, 2025

ADM Reports Third Quarter 2025 Results

November 4, 2025