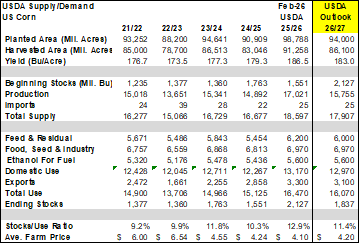

CORN

Prices were mixed while generally holding within $.01 of unchanged. Spreads weakened. Mch-26 equaled the low for the month at $4.24 while remaining in a longer term range of $4.15-$4.40. The USDA Outlook Forum showed corn acres slipping 4.8 mil. from YA to 94 mil. An average trendline yield of 183 bpa results in production at 15.755 bil. down 7.4% from YA. Total demand is forecast to fall 400 mil. bu. to 16.070 bil. Exports and feed/residual both down 200 mil. Endings stocks at 1.837 bil. would be down 290 mil. from 25/26 MY. Ethanol production rebounded to 1,118 tbd, or 329 mil. gallons for the week ended Fri. Feb. 13th, up from 326 mil. gallons the previous week. Production was in line with expectations and up 3% from YA. There was 111 mil. bu. used in the production process, or 15.84 mil. bu. per day, above the 15.33 needed to reach the USDA forecast of 5.6 bil. In the MY to date there has been 2.550 bil. bu. used, or 15.36 mbd, an annualized pace of 5.607 bil. Ethanol stocks ticked up to 25.6 mil. barrels, below YA stocks at 26.2 mb. Exports in Dec-25 at 280 mil. bu. were record high for the month and up 30% from Dec-24. YTD sales in the first 4 months of the 25/26 MY at 1.10 bil. bu. are up 51% from YA. Tomorrow’s export sales are forecast to range from 35-85 mil. bu.

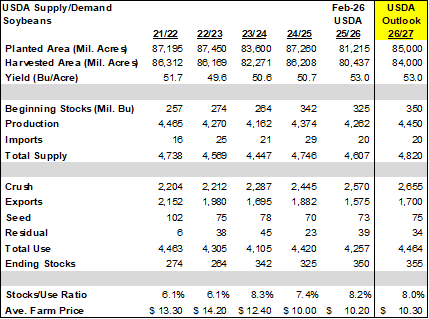

SOYBEANS

A strong close enabled prices to finish higher across most of the complex. Beans ranged from $.02-$.07 ½ higher. Meal was mixed while holding within $1 of unchanged while oil was up 85-110 points. Spreads firmed all around. Inside trade for Mch-26 beans. Mch-26 meal hovered near its 100 day MA at $304.50. Mch-26 oil carved out a fresh contract high and a new 16 month high on the weekly chart. Spot board crush margins jumped another $.06 ½ to $1.86, a 6 month high, while bean oil PV improved to a 7 month high at 49.5%. Scattered showers across S. Argentina the past 24 hours with heaviest concentration in N. LaPampa, S. Cordoba and SanteFe. Look for crop ratings to stabilize or improve in this week’s update from the BAGE. The USDA Outlook Forum showed bean acres jumping 3.8 mil. to 85 mil. The average trendline yield of 53 bpa matches last year’s record yield resulting in production at 4.450 bil. up 4.4% from YA. Total demand is forecast to jump 207 mil. bu. to 4.464 bil. Exports are forecast to rise 125 mil. to 1.70 bil. with crush up 85 mil. to 2.655 bil. Endings stocks little changed at 355 mil. bu. Bean oil demand for biofuel production is forecast to surge 17% to 17.3 bil. lbs. perhaps foreshadowing supportive policy from the EPA. Bean oil exports are expected to drop 50% to 600 mil. lbs. Meal exports are forecast at a record 20,800 short tons. Dec-25 soybean exports at 164 mil. bu. were 19 mil. above implied inspections however the lowest for the month in 7 years. In the first 4 months of the 25/26 MY cumulative sales at 624 mil. bu. are down 44% from YA. To reach the current USDA forecast of 1.575 bil. bu. sales Jan thru Aug will need to reach 951 mil. bu. well above the 774 mil. from YA. Tomorrow’s export sales are expected to range from 14-44 mil. bu. of beans, 200-400k tons of meal and 0-16k tons of oil.

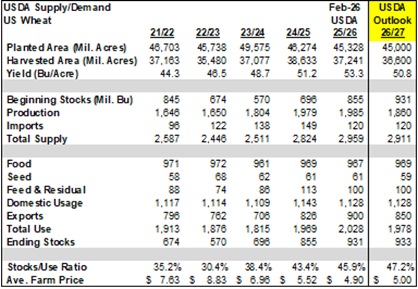

WHEAT

Prices ranged from $.09-$.15 higher surging into session highs at the close. CGO Mch-26 has reached a 3 month high with next resistance at $5.68. KC Mch-26 spiked to its highest level since Aug-25. Speculative traders continue to pare back short positions in wheat as dryness in the S. plains combined with wildfires have fueled the recent rally. Fires in the region have scorched tens of thousands of winter wheat acres with no rain in the near term forecast. It will likely be weeks before damage to this year’s crop can be quantified. The USDA Outlook Forum showed all wheat acres in 2026/27 MY slipping 300k to 45 mil. An average trendline yield of 50.8 bpa results in production at 1.860 bil. down 6% from YA. Total demand is forecast to fall 50 mil. bu. to 1.978 bil. due to lower exports resulting in endings stocks steady at 933 mil. bu. Exports in Dec-25 at 70 mil. bu. were the highest for the month in 5 years and up 15% from YA. In the first 7 months of the 25/26 MY cumulative sales at 571 mil. bu. are up 20% from YA. To reach the current USDA forecast of 900 mil. bu. sales Jan thru May will need to reach 329 mil. bu. vs. only 342 mil. from YA. US WW acres in drought rose 1% the past week to 46%, a 52 week high. Tomorrow’s export sales are expected to range from 10-20 mil. bu.

Charts provided by CQG

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 02547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2026 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.

Latest News & Market Commentary

ADM & Industry News

ADM Named to FORTUNE’s Most Admired Company List

January 23, 2026

The Ghost in the Machine Q4 2025

December 22, 2025