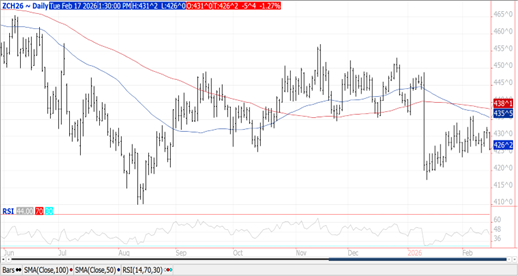

CORN

Prices were $.04-$.06 lower as nearby spreads firmed. Mch-26 held support above LW’s low of $4.25 ¼. Spot prices remain rangebound between $4.15-$4.40. AgRural reports Brazil’s 1st crop harvest has reached 22%, lagging the YA pace of 29%. 2nd crop plantings at 31% also trail YA pace of 36%. Friday’s CFTC data showed MM’s bought just over 20k contracts reducing their net short position to 48k contracts. Index funds were net buyers of just over 12k contracts. Export inspections at 59 mil. bu. were above expectations however below the 65 mil. needed to reach the revised USDA forecast. Last week’s inspections were revised up nearly 12 mil. bringing YTD inspections to 1.406 bil. up 44% from YA vs. the USDA forecast of up 16%. Noted buyers were Mexico – 20 mil. and Japan – 12 mil. EU imports for the 25/26 MY as of Feb. 15th at 10.9 mmt are down 17.5% YOY.

SOYBEANS

Prices were mixed across the complex with beans steady to $.04 higher, meal was steady to $3 lower while oil ranged from 20-40 points higher in choppy trade. Spreads weakened across the complex. Mch-26 beans hovered just below LW’s high at $11.41 ½. Mch-26 meal held support above its 100 day MA at $304.10. Mch-26 oil hovered just below last week’s contract high at 57.96. Inside trade for both beans and meal. Widespread rains brought temporary relief to central and southern growing areas of Argentina. Rains in Brazil were most heavily concentrated from Southern MGDS thru Parana and into northern RGDS. Scattered rains in northern MGDS and western Mato Grosso. Spot board crush margins fell $.06 to $1.69 bu. with bean oil PV rebounding to 48.4%. NOPA crush from Jan-26 at 221.6 mil. bu. was down from 225 mil. in Dec-25 however just above the Ave. est. of 218 mil. bu. and well above the 200 mil. bu. from Jan-25. NOPA data would suggest census crush at 226 mil. bu. vs. 230 mil. in Dec-25. YTD crush thru the first 5 months of the 25/26 MY would reach 1.118 bil. bu., up 7.2% from YA, vs. the USDA forecast of up 5%. Oil stocks however surged 15.7% from Dec-25 to 1.90 bil. lbs., well above the Ave. est. of 1.668 bil. lbs. and above the range of estimates. AgRural reports Brazilian harvest advanced only 5% LW to 21%, and now below the YA pace of 24%. Harvest in Mato Gross, their largest producing state, saw process hold at 51% still above their long term average of 43%. The 94k contracts of soybeans bought by MM’s in the week ended Tues. Feb. 10th was the largest 1 week total since May-24. Export inspections at 44 mil. bu. were at the high end of expectations and well above the 24 mil. bu. needed per week to reach the USDA forecast. YTD inspections at 895 mil. are down 32% from YA vs. the USDA forecast of down 16%. China took 25 mil. while Egypt took 8 mil. EU soybean imports at 7.94 mmt as of Feb. 15th are down 11% YOY. Meal imports at 11.8 mmt are down 2%.

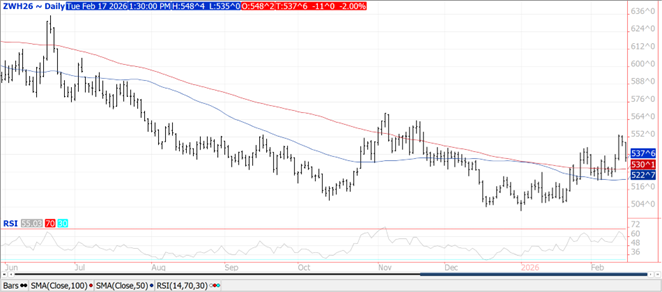

WHEAT

Prices ranged from $.03-$.11 lower with CGO futures the downside leader. CGO Mch-26 was down $.11 at $5.37 ¾. Next support is the 100 day MA at $5.30. KC Mch-26 has MA support is near $5.27. The CGO Mch/May spread gave back nearly all of Friday’s surge. There were no changes in delivery registrations holding at 34 contracts for SRW and only 17 for HRW. Given the spot spread in CGO is averaging less than 50% of full-carry, we’ll likely see a reduction in the VSR next month. MM’s were net sellers of 12.7k contracts across the 3 classes of wheat extending their combined short position to 124k contracts, still only a fraction of the record short of 235k in May-2025. IKAR reports Russia export price for wheat ended LW at $233/mt, up $2 from the previous week. Jordan passed on making any purchase in their recent 120k mt tender. Rains across US winter wheat areas appear to be more than offsetting Russian drone strikes across Ukraine’s Odesa region that inflicted serious damage to their power infrastructure. SovEcon raised their 2026 Russian production forecast 2.1 mmt to 85.9 mmt, vs. the USDA’s 89.5 mmt est. Export inspections at 14 mil. bu. were in line with expectations however below the 16 mil. bu. needed per week to reach the USDA forecast. YTD inspections at 651 mil. bu. are up 19% from YA, vs. the USDA at up 9%.

Charts provided by CQG

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 02547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2026 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.

Latest News & Market Commentary

ADM & Industry News

ADM Named to FORTUNE’s Most Admired Company List

January 23, 2026

The Ghost in the Machine Q4 2025

December 22, 2025