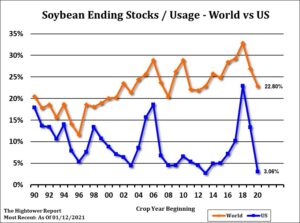

SOYBEANS

Soybean traded higher. Word of lower China corn supplies helped rally corn futures to new highs. Soybeans complex followed. For the remainder of 2021 each monthly USDA report will be critical to price discovery. USDA actual numbers versus trade guess will also have volatile price reaction. SK has long-term support near 13.00 and resistance near 15.00. Weekly US soybean exports were near 66 mil bu versus 70 last week and 22 last year. Season to date exports are near 1,806 mil bu versus 1,001 last year. USDA goal is 2,230 versus 1,682 last year. Some feel final exports could be 50 mil bu higher. Trade estimates US 2020/21 soybean carryout near 123 mil bu versus USDA 140. Trade estimates Argentina soybean crop near 47.6 mmt versus USDA 48.0. Brazil crop is estimated near 132.4 versus USDA 133.0. Forecast of drier Argentina weather could stress crops there. Brazil rains could slow harvest there.

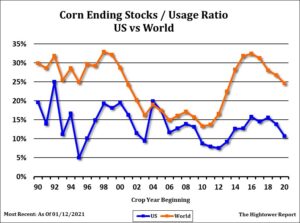

CORN

Corn futures traded higher and made new highs. Fact UN FAO lowered their estimate of China corn stocks is helping rally prices. FAO estimated China corn stocks near 139 mmt , down 54 mmt from their December estimate. They raised World corn demand 17 mmt to 1.179 billion tonnes. USDA estimated China corn stocks near 191.7 mmt. Most doubt USDA will drop their guess on tomorrows report but current futures are trading a lower World corn stocks to use ratio than current USDA guess. Weekly US corn exports were near 62 mil bu versus 40 last week and 31 last year. Season to date exports are near 844 mil bu versus 456 last year. USDA goal is 2,550 versus 1,778 last year. Some feel final exports could be 250-300 mil bu higher. Trade estimates US 2020/21 corn carryout near 1,392 mil bu versus USDA 1,552. Trade estimates Argentina corn crop near 47.0 mmt versus USDA 47.5. Brazil crop is estimated near 108.4 versus USDA 109.0. Forecast of drier Argentina weather could stress crops there. Brazil rains could slow corn plantings there.

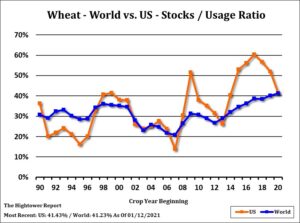

WHEAT

Wheat futures traded higher. Wheat futures continue to follow higher traded in corn. Uncertainty over Russia and Argentina export policies offers support. Fact Russia farmers and exporters are selling wheat before their export policy takes effect has been offering resistance. WK is near 6.58. KWK is near 6.42. MWK is near 6.44. Weekly US wheat exports were near 16 mil bu versus 15 last week and 21 last year. Season to date exports are near 625 mil bu versus 632 last year. USDA goal is 985 versus 965 last year. There were reports that today, China bought 1 mmt Canada wheat and 500 mt Australia wheat. Trade estimates US 2020/21 wheat carryout near 834 mil bu versus USDA 836. Trade also estimates World wheat carryout near 312.8 mmt versus USDA 313.1.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.