Soybeans, soymeal, soyoil, corn and wheat traded higher after opening lower. Talk of good Weekly US corn and soybean export sales and new concerns about Argentina weather may have triggered the rebound. Deep US freeze next week may have helped wheat. US stocks were higher. Crude was higher. Metals were higher.

SOYBEANS

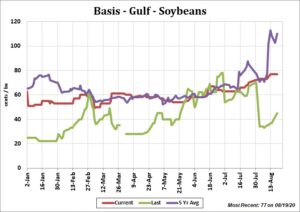

Soybeans traded higher. Demand for US domestic soymeal increased. US soybean export basis continues to firm on talk of increase China demand and tight summer supplies. Talk that truckers were blocking roads into Argentina ports and that Argentina weather could soon turn drier is offering support to soybeans. Weekly US old crop soybean export sales are estimated near 300-750 mt versus 466 last week. New crop soybean export sales are estimated near 250-500 versus 1,564 last week. Weekly US soymeal sales are estimated near 100-350 mt versus 142 last week. US soymeal commit is the 2nd highest on record. There is talk that ASF is back in the China hog herd. Some say the virus is not as strong as the previous strain but is spreading faster. So far China domestic hog prices are dropping which does not suggest a problem with hog production. China soybean crush margins are improving from last week.

CORN

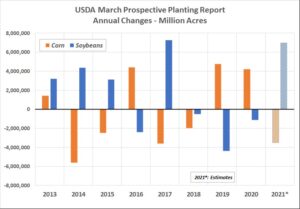

Corn futures traded higher. CH almost had a reversal from Mondays range. Commercials were active spreaders of March shorts rolling to May. Corn prices have rebounded. Some feel USDA China corn imports are too low, USDA estimate of South America corn crops is too high, USDA estimate of US corn exports are too low and USDA estimate of US 2020/21 corn carryout is too high. Weekly US corn export sales are estimated at a record 6,000 to7,500 mt versus 1,850 last week. Weekly US ethanol production was up from last week but still down from last year. Ethanol stocks were up from last week and last year. Margins remain negative. The current ethanol production pace is tracking just above the level needed to reach USDA projection of 4,950 mil bu. Key is when US consumers can get back traveling again. Last year was when ethanol and gas consumption started to drop dramatically due to the virus. USDA should raise US 2020/21 corn demand on Feb 9 and lower carryout. Price reaction could be actual USDA number versus average trade guess and range. Acreage competition between corn and soybeans is expected to keep Dec corn well supported and need to see increase in US planted corn acreage in 2021.

WHEAT

Wheat futures ended higher. Lack of new US wheat export demand and lower World wheat prices had offered resistance to wheat futures. Talk of lower Russia, EU and Argentina exports offers equal support. Managed funds liquidated small net longs as WH traded below key support. Prices found support on higher corn and soybean prices plus forecast a frigid US temps next week. Some weather forecasts indicates that a winterkill threat for US wheat from next week’s cold weather could include 10% of the HRW area and 5% of the SRW area. Increase in snowfall next week could help limit winterkill. WH is near 6.44. Range was 6.25-6.49. KWH is near 6.24. Range was 6.04-6.28. MWH is near 6.23. Range was 6.09-6.28. Weekly US wheat export sales are estimated near 250-700 mt versus 380 last week. Key to price direction in 2021 may depend upon US planted acres, weather and yield and final demand. Weather watchers still trying to figure out 2021 north hemisphere weather. Some could see normal spring US rains but dry summer.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.