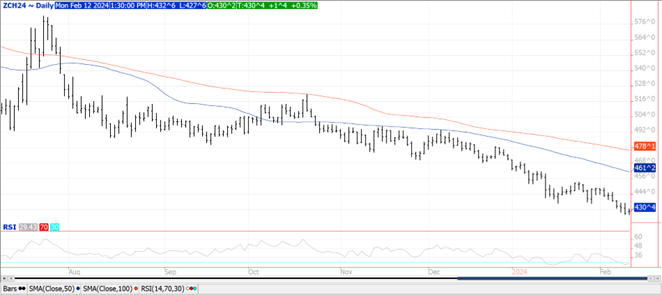

CORN

After making a new contract lows in early trade, prices rebounded trading $.04 higher before closing $.01 – $.02 better. Trade is expected to be quiet this week with Lunar New Year celebration in China, Carnival in Brazil, with the USDA Outlook Forum this Thursday and Friday. AgRural raised their 2nd crop production forecast for Brazil by nearly 5 mmt to 91.2 mmt, pretty much the exact opposite of Conab’s updated forecast last Thursday. AgRural cited higher than expected plantings drove their larger production forecast. US export inspections at 35 mil. bu. were at the high end of expectations however below the 46 mil. bu. needed per week to reach the USDA export forecast of 2.10 bil. bu. YTD inspections at 677 mil. are up 31% from YA vs. the USDA forecast of up 26%. Last week Money managers were net sellers of 17,593 contracts extending their short position to nearly 298k, their largest short position since May-2019.

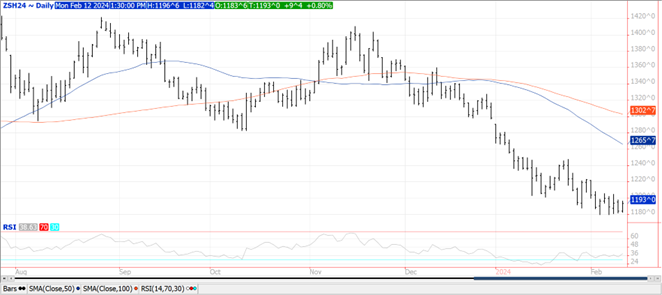

SOYBEANS

The soybean complex was mixed with beans $.06 – $.10 higher, meal was up $2 – $3, while oil was 20 – 35 lower. An inside day for Mch-24 beans with support at last week’s low of $11.79 ¼ and resistance at $12.05 ½. Spot board crush margins fell $.09 today to $.90 ½ per bu. with soybean meal PV increasing to 59.5%. South American weather remains mostly favorable. Good rains across much of central and northern growing regions of Brazil in the past week are expected to slide south this week supporting crop development. Rainfall late last week thru the weekend also brought significant relief to key growing areas of Argentina. Brazilian harvest has reached 24% complete, vs. 17% YA. Export inspections at 49 mil. were at the high end of expectations and well above the 19 mil. bu. needed per week to reach the revised USDA export forecast of 1.720 bil. YTD inspections at 1.155 bil. are still down 23% from YA, vs. the USDA forecast of down 14%. Last week MM’s were net sellers of just over 22k contracts. That marked the 12th consecutive week MM’s have been net sellers of soybeans. Their short position has swelled to just over 130k contracts, the largest since May-2019. MM’s were net buyers of both products with 10.2k contracts of oil and 7.5k contracts of meal. Ahead of tomorrow’s Malaysian Palm Oil Board data, production in Jan-24 is expected to have reached 1.367 mmt, exports at 1.219 mmt, with stocks at 2.139 mmt.

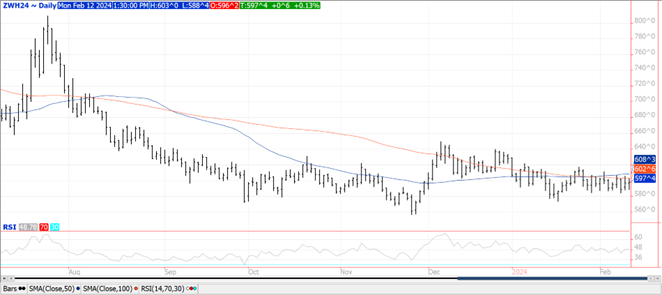

WHEAT

Prices were mostly lower as Chicago was mixed with all contracts closing with $.01 of unchanged, KC was $.03 – $.05 lower while MGEX was down $.01 – $.02. Early rally efforts in Mch-24 Chicago stalled out at its 100 day MA at $6.02 ¾. Mch-24 contracts in all three classes experienced an inside trading session. Export inspections at 15 mil. bu. were in line with expectations and just above the weekly total needed to reach the USDA export forecast of 725 mil. bu. YTD inspections are down 18% from YA, vs. the USDA forecast of down 4.5%. SovEcon estimates Russian grain exports last week at 860k mt, down from 1.290 mmt the previous week. Wheat accounted for 720k mt of last week’s grain exports. IKAR is reporting that Russian 12.5% protein wheat export price closed last week at $224/mt, down $4 from the previous week. Over the weekend, Russian media claims they were able to fend off a Ukrainian drone attack on a civilian transport ship in the a SW region of the Black Sea. Independent media outlets were not able to verify the Russian claims. Last week MM’s were light sellers in Chicago and KC wheat while being modest buyers in MGEX. Their combined net short position continues to hover around 125k contracts.

All charts provided by QST

>>See more market commentary here.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.