Soybeans, soymeal, soyoil, corn and wheat traded higher. US stocks, Crude, gold and copper were lower. US Dollar was higher.

SOYBEANS

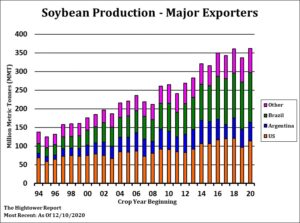

Soybean ended higher Talk of some China interest in US old crop and new crop soybeans and reduced South America exports offered support. La Nina could also reduce S Brazil and Argentina 2021 crops which could also increase demand for US soybean and soymeal. Bulls feel that in January, soybean futures could trend higher in front of USDA Jan 12 report. USDA will revise final US 2020 crops. Some feel final US soybean crop could be down 20-25 mil bu. Dec 1 US soybean stocks are estimated near 2,800 mil bu versus 3,252 last year. Some could also see USDA lowering South America 2021 soybean crops 6 mmt from USDA current guess. China announced that Nov yoy increase in hog herd was up 30 pct. Sow herd was up 31 pct. Some feel increase production could slow new pork imports but increase soybean import demand. China Dalian soymeal futures were up $11 to near $502 and new contract highs. There are 100 vessels delayed in Argentina due to strikes. The amount includes 1.5 mmt soymeal and 500 mt soyoil.

CORN

Corn futures traded higher. Talk of lower South America 2021 corn crops could add to demand for US export demand offered support. US cash domestic and export corn basis remain strong as commercials try to add to coverage before 2021 export starts. Some feel US Jan-May corn exports could be record high. The US Congress finally approved a stimulus aid package of around $900 billion. US agriculture will benefit with new aid of $13 Bil while the US ethanol and biodiesel industries will enjoy tax benefits and extenders to maintain production. The rescue package could add 1.5-1.8% to next year’s US GDP rate. Some have lowered their estimate of South America corn crop 9 mmt from USDA Dec guess. This suggest USDA Jan 12 report will be key to price discovery. The Brazil weather forecast suggest more normal rains in the C/E crop areas. Southern areas could see less than normal rains. Argentina main areas could also see less than normal rains. China Dalian corn futures were higher overnight and near $10.53 and new contract highs. There are 100 vessels delayed in Argentina due to strikes. The amount includes 900 mt corn.

WHEAT

Wheat futures traded higher. WH had a wide range from 6.03-6.19. Since 2016 nearby Chicago wheat futures has been in a range of 4.00-6.00. Since June the range has been 5.25-6.25. Large World wheat supplies and talk of lower Covid related demand limits the upside. Big crops in Australia and Canada also offset a lower EU crop. Weather concerns in US plains and Russia offers support. Some talk of a lower Russia 2021 wheat crop could reduce their exports. Their Feb 15 export tax already has prices above competitors. There could be strong pinned up demand for raw material including grains post Covid. There could also be a hint of inflation if the demand exceeds supply. US Dollar is forecasted to continue to trend lower on increase US debt. This could also help the demand for US Ag exports.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.