SOYBEANS

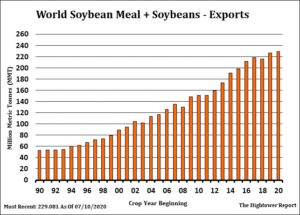

Soybean futures edged higher. There is expected to be no August soybean deliveries. Commercials expect a good US Q4 export demand. At the same time, US crops ratings suggest a higher crop than USDA July estimate. Next USDA report is August 12. Over the next 7 days, US Midwest rains will focus on the south Midwest, Ohio valley and Delta. Midwest temps have moderated and are near normal. Next week rains should be scattered across the Midwest with reduce coverage in the northern areas. Drought Index suggest W IA and parts of MI, IN and OH need rains. Weekly US soybean export sales were 257 mt. Total commit is near 46.7 mmt versus 48.7 last year. USDA goal is 44.9 mmt versus 47.6 last year. Some could see final US exports lower than USDA goal. USDA est total World soybean trade near 161 mmt versus 159 last year. Brazil exports were near 89.0 mmt versus 91.3 last year. USDA est Brazil 2020/12 export are est near 83.0 mmt. This may be low. New crop US soybean sales rose 3.3 mmt. Total unshipped sales are near 13.7 mmt. This will help buy not offset talk of a big US 2020 soybean crop.

CORN

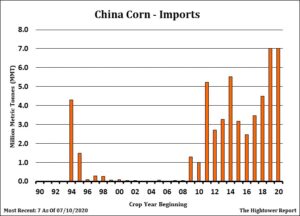

Corn futures closed unchanged. Talk of higher US new crop corn sales to China and a lower estimate of the Argentina corn crop offered support. Equal talk of a higher US 2020 corn supply versus demand offered resistance. Over the next 7 days, US Midwest rains will focus on the south Midwest, Ohio valley and Delta. Midwest temps have moderated and are near normal. Next week rains should be scattered across the Midwest with reduce coverage in the northern areas. Drought Index suggest W IA and parts of IN, MI and OH could use rains. USDA announced the overnight China bought 1.9 mmt US new crop corn. This will help buy not offset talk of a big US 2020 corn crop. Weekly US corn export sales were a negative 29 mt. Total commit is near 43.6 mmt versus 49.8 last year. USDA goal is 45.0 mmt versus 52.4 last year. Some could see final US exports lower than USDA goal. USDA est total World corn trade near 171 mmt versus 181. Some could see US 2020/21 carryin up 200 mil bu from USDA estimate, crop could be 400 mil bu higher and 2020/21 demand could end up 300 mil bu below USDA estimate. This could add 900 mil bu to USDA carryout estimate of 2,648. This should push corn futures lower.

WHEAT

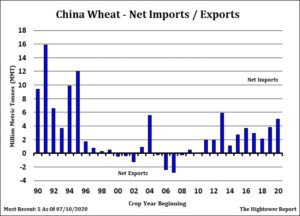

Wheat futures closed lower. French wheat futures were higher. US export prices remain above Russia which offers resistance. US stock prices were lower. US Dollar was lower. Energy prices were lower. Covid virus continues to raise concern about Global economies and food demand. Weekly US wheat export sales were 676 mt. Total commit is near 9.6 mmt versus 6.8 last year. USDA goal is 25.8 mmt versus 26.2 last year. USDA est total World wheat trade near 188 mmt versus 187 last year. Most do not look for big changes from USDA August 12 US wheat supply and demand report. US total supply should be near 3,015 mil bu, total demand should remain near2,95 mil bu. This leaves a carryout near 920 mil bu versus 1,044 last year. September Chicago wheat is expected to remain in a 4.80-5.40 trading range. Lower corn price action could also drop wheat futures.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.