Soyoil traded higher. Soybeans, soymeal, corn and wheat traded lower. US stocks were marginally lower. US Dollar was lower. US Crude was unchanged. Gold was higher today.

SOYBEANS

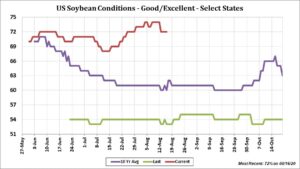

Soybean market continues to trade with news both positive and negative. Fact USDA dropped weekly US soybean crop rating plus another day in which USDA announced another US soybean sale to China offered support. Fact weekly US soybean exports were lower than expected and Pro Farmer SD and OH soybean pod count was higher than last year and average weighed on prices. Key will be US weather next week. Overnight American and Canadian weather models hinted of increases chances for rains next week across a broad area of the US Midwest. Europe model was drier. Noon American model is not as wet. Higher Malaysian palmoil prices helped soyoil gain on soymeal. Price Bears still feel soybean and soymeal futures will trend lower into the fall US harvest. Managed funds were small net sellers of soybean and soymeal and buyers of soyoil. This week funds have added to their net soybean and soyoil long and reduced their soymeal short. Some also felt lower soybean traded today could be due to an overbought technical position.

CORN

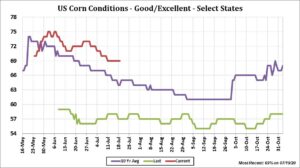

Corn futures traded lower. Corn found support recently due to talk of lower US 2020 crop. Damaging Wind storm with straight line winds in excess of 100 mph knocked down portions of the Iowa record corn crop. Farmers and agronomist are all trying to figure just how many bushels Iowa loss due to the storm. Most estimate 200-300 mil bu. Pro Farmer crop tour will survey West Iowa on Wednesday and the rest of Iowa on Thursday. USDA said they will resurvey Iowa farmers 2020 acres for the September report. USDA dropped Iowa corn crop rating this week 10 pct to 59 pct good/ex. Pro Farmer tour participant estimated SD 2020 corn yield near a record 179.2 versus their estimate last year of 142.0 and USDA August guess of 167.0. Pro Farmer tour participant estimated OH 2020 corn yield near 167.7 versus their estimate last year of 140.8 and USDA August guess of 175.0. OH is the lowest key Midwest rated corn state. Tour will survey IN and NE today. One crop watcher estimated US corn yield still near 180.0. This was below USDA August guess but still above trend. They did drop corn acres 500 thousand from USDA. USDA announced 195 mt US 2020/21 corn sold to China and 130 mt US 2020/21 corn sold to unknown. This should bring China US total to 6 mmt.

WHEAT

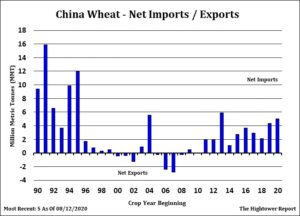

Chicago and KC wheat futures traded lower. Both markets have been supported by higher French wheat futures. That market may have been supported by talk of Increase Russia buying of French wheat. Paris wheat futures were lower overnight. Still, talk of higher Russia, Canada and Australia crop and fact USDA increased this week’s US spring wheat crop ratings offered resistance. Dryness in Argentina may be the only area of concern for 2021 World wheat supplies. Weekly US wheat exports were less than expected. There is concern that Covid could reduce World wheat trade. Covid also could keep US/World economies from growing and reduce demand. This could offset the lower US Dollar. Normally a lower US Dollar tends to help US exports. There is some concern that the lower US Dollar and higher Gold trade may be an indicator of lower US economy. US flour users continue to buy hand to mouth given the uncertainty of future demand especially in the restaurant industry.

Risk Warning: Investments in Equities, Contracts for Difference (CFDs) in any instrument, Futures, Options, Derivatives and Foreign Exchange can fluctuate in value. Investors should therefore be aware that they may not realise the initial amount invested and may incur additional liabilities. These investments may be subject to above average financial risk of loss. Investors should consider their financial circumstances, investment experience and if it is appropriate to invest. If necessary, seek independent financial advice.

ADM Investor Services International Limited, registered in England No. 2547805, is authorised and regulated by the Financial Conduct Authority [FRN 148474] and is a member of the London Stock Exchange. Registered office: 3rd Floor, The Minster Building, 21 Mincing Lane, London EC3R 7AG.

A subsidiary of Archer Daniels Midland Company.

© 2024 ADM Investor Services International Limited.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.